Question: please answer Additional information for the 2024 fiscal year ($ in thousands): begin{tabular}{|c|c|c|} hline multicolumn{3}{|l|}{ Adjustments for noncash effects: } hline & &

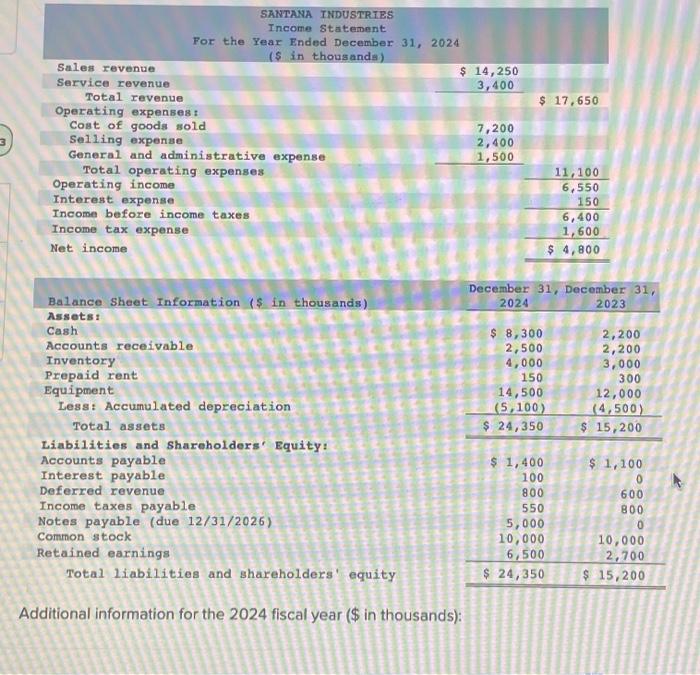

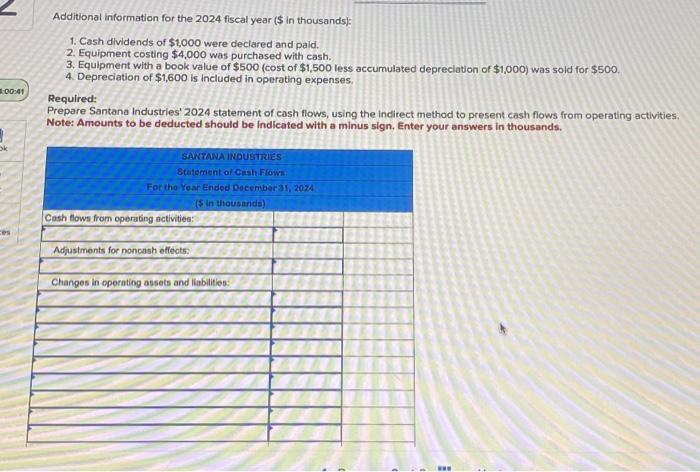

Additional information for the 2024 fiscal year (\$ in thousands): \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Adjustments for noncash effects: } \\ \hline & & \\ \hline \multicolumn{3}{|l|}{ Changes in operating assets and liabilities: } \\ \hline \\ \hline \multicolumn{3}{|c|}{40} \\ \hline & 1+ & \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \multicolumn{3}{|l|}{ Net cash flows from operating activities } \\ \hline \multicolumn{3}{|l|}{ Cash flows from investing activities: } \\ \hline \\ \hline \\ \hline \\ \hline \multicolumn{3}{|l|}{ Net cash flows from investing activities } \\ \hline \multicolumn{3}{|l|}{ Cash flows from financing activities: } \\ \hline \\ \hline \\ \hline \\ \hline \multicolumn{3}{|l|}{ Net cash flows from financing activities } \\ \hline \multicolumn{3}{|l|}{ Net increase in cash } \\ \hline \multicolumn{3}{|l|}{ Cash, January 1} \\ \hline Cash, December 31 & & \\ \hline \end{tabular} Additional information for the 2024 fiscal year (\$ in thousands): 1. Cash dividends of $1,000 were declared and paid. 2. Equipment costing $4,000 was purchased with cash. 3. Equipment with a book value of $500 (cost of $1,500 less accumulated depreciation of $1,000 ) was sold for $500. 4. Depreciation of $1,600 is included in operating expenses. Required: Prepare Santana Industries' 2024 statement of cash flows, using the indirect method to present cash flows from operating activities. Note: Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands. Additional information for the 2024 fiscal year (\$ in thousands): \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|l|}{ Adjustments for noncash effects: } \\ \hline & & \\ \hline \multicolumn{3}{|l|}{ Changes in operating assets and liabilities: } \\ \hline \\ \hline \multicolumn{3}{|c|}{40} \\ \hline & 1+ & \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \\ \hline \multicolumn{3}{|l|}{ Net cash flows from operating activities } \\ \hline \multicolumn{3}{|l|}{ Cash flows from investing activities: } \\ \hline \\ \hline \\ \hline \\ \hline \multicolumn{3}{|l|}{ Net cash flows from investing activities } \\ \hline \multicolumn{3}{|l|}{ Cash flows from financing activities: } \\ \hline \\ \hline \\ \hline \\ \hline \multicolumn{3}{|l|}{ Net cash flows from financing activities } \\ \hline \multicolumn{3}{|l|}{ Net increase in cash } \\ \hline \multicolumn{3}{|l|}{ Cash, January 1} \\ \hline Cash, December 31 & & \\ \hline \end{tabular} Additional information for the 2024 fiscal year (\$ in thousands): 1. Cash dividends of $1,000 were declared and paid. 2. Equipment costing $4,000 was purchased with cash. 3. Equipment with a book value of $500 (cost of $1,500 less accumulated depreciation of $1,000 ) was sold for $500. 4. Depreciation of $1,600 is included in operating expenses. Required: Prepare Santana Industries' 2024 statement of cash flows, using the indirect method to present cash flows from operating activities. Note: Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts