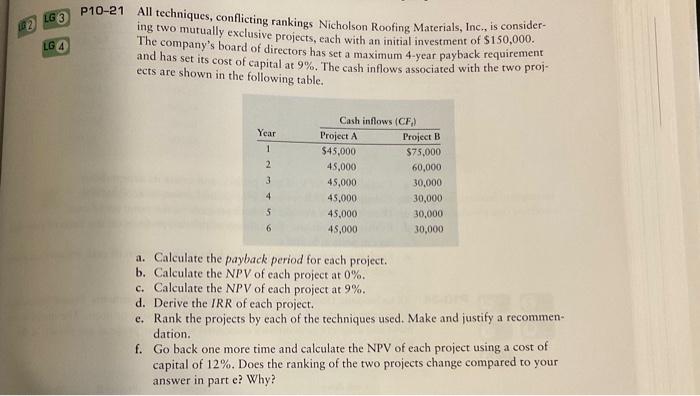

Question: Please answer A-F :) All techniques, conflicting rankings Nicholson Roofing Materials, Inc,, is considering two mutually exclusive projects, each with an initial investment of $150,000.

All techniques, conflicting rankings Nicholson Roofing Materials, Inc,, is considering two mutually exclusive projects, each with an initial investment of $150,000. The company's board of directors has set a maximum 4-year payback requirement and has set its cost of capital at 9%. The cash inflows associated with the two projects are shown in the following table. a. Calculare the payback period for each project. b. Calculate the NPV of each project at 0%. c. Calculate the NPV of each project at 9%. d. Derive the IRR of each project. e. Rank the projects by each of the techniques used. Make and justify a recommendation. f. Go back one more time and calculate the NPV of each project using a cost of capital of 12%. Does the ranking of the two projects change compared to your answer in part e? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts