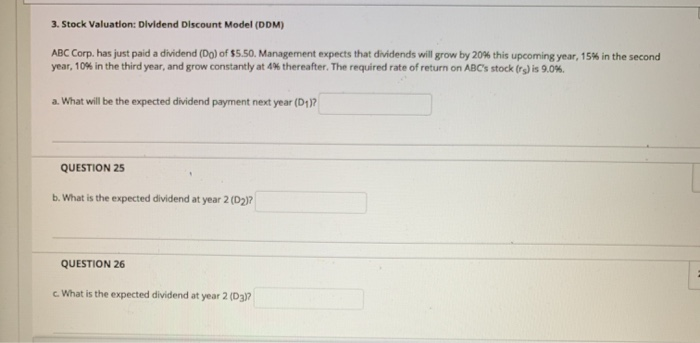

Question: please answer a-f (Stock Valuation: Dividend Discount Model) DDM 3. Stock Valuation: Dividend Discount Model (DOM) ABC Corp, has just paid a dividend (Do) of

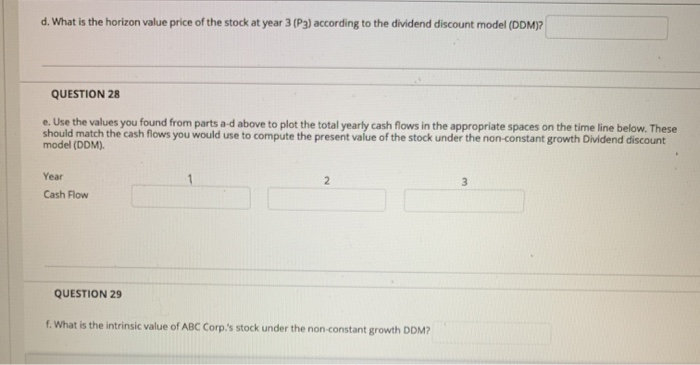

3. Stock Valuation: Dividend Discount Model (DOM) ABC Corp, has just paid a dividend (Do) of $5.50. Management expects that dividends will grow by 20% this upcoming year, 15% in the second year, 10% in the third year, and grow constantly at 4 thereafter. The required rate of return on ABC's stock Iris 9.0%. a. What will be the expected dividend payment next year (D1)? QUESTION 25 b. What is the expected dividend at year 2 (D2)? QUESTION 26 c. What is the expected dividend at year 2 (D3)? d. What is the horizon value price of the stock at year 3 (P3) according to the dividend discount model (DDM)? QUESTION 28 e. Use the values you found from parts a d above to plot the total yearly cash flows in the appropriate spaces on the time line below. These should match the cash flows you would use to compute the present value of the stock under the non-constant growth Dividend discount model (DDM). Year Cash Flow QUESTION 29 f. What is the intrinsic value of ABC Corp's stock under the non-constant growth DDM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts