Question: Please answer a-f with explanations to help me understand. Under where it says Determine...Thank you ! TE Scenario #2 Storage Hedge A corn producer has

Please answer a-f with explanations to help me understand. Under where it says Determine...Thank you !

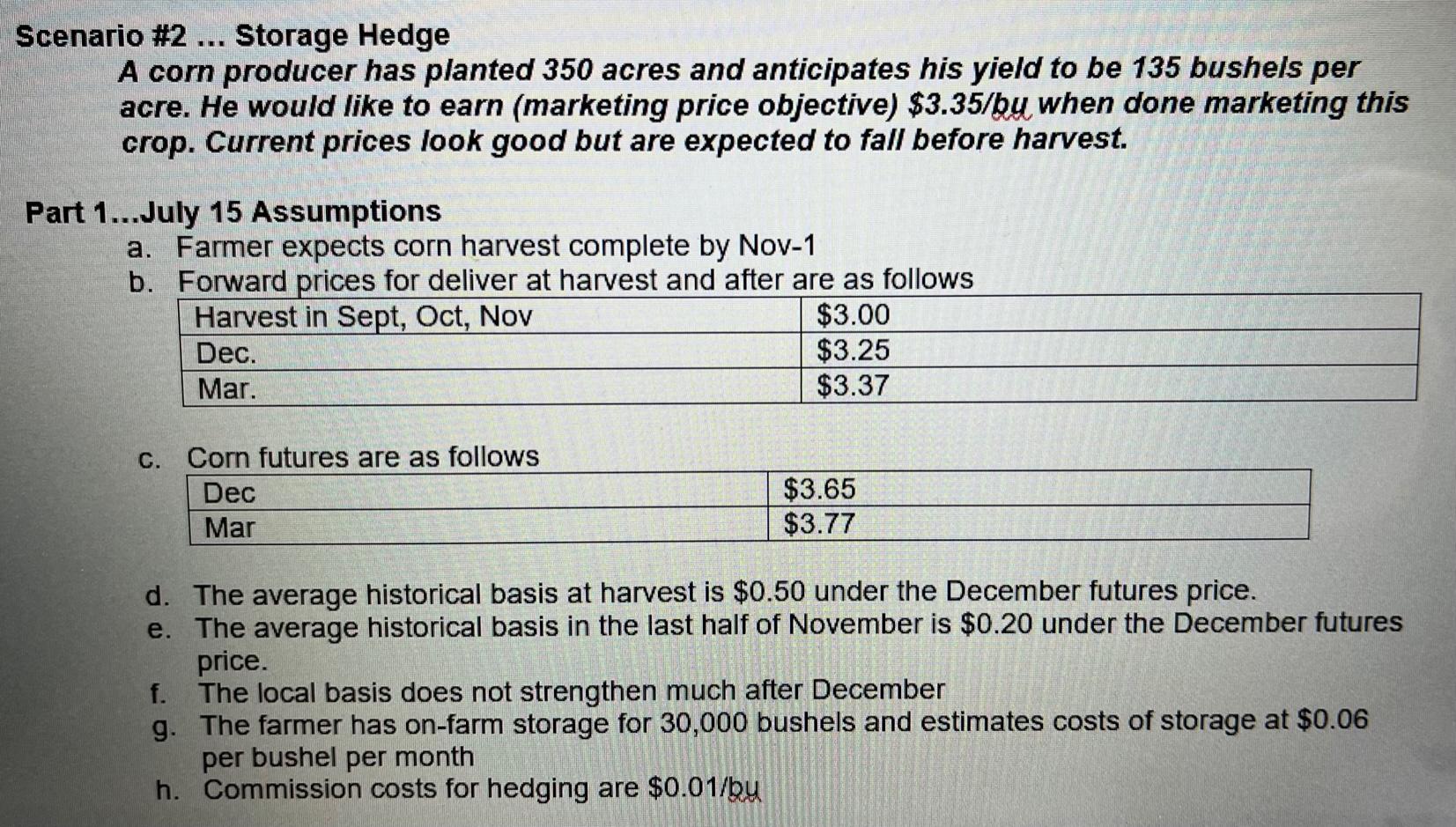

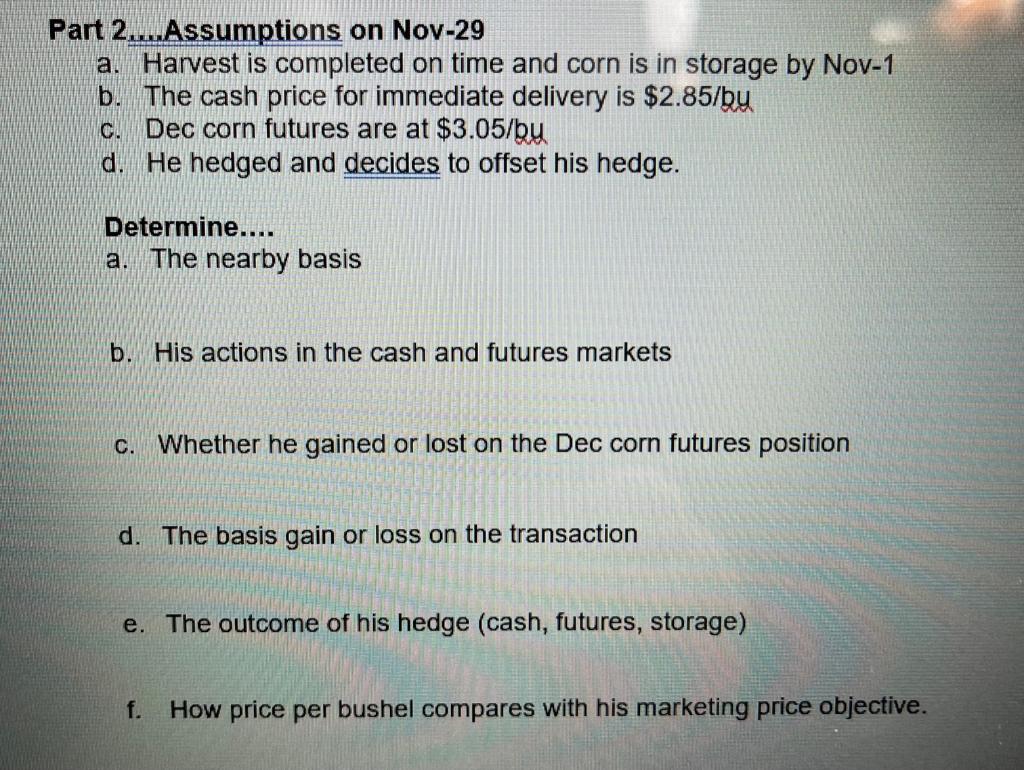

TE Scenario #2 Storage Hedge A corn producer has planted 350 acres and anticipates his yield to be 135 bushels per acre. He would like to earn (marketing price objective) $3.35/by when done marketing this crop. Current prices look good but are expected to fall before harvest. Part 1...July 15 Assumptions a. Farmer expects corn harvest complete by Nov-1 b. Forward prices for deliver at harvest and after are as follows Harvest in Sept, Oct, Nov $3.00 Dec. $3.25 Mar. $3.37 C. Corn futures are as follows Dec Mar $3.65 $3.77 d. The average historical basis at harvest is $0.50 under the December futures price. e. The average historical basis in the last half of November is $0.20 under the December futures price. f. The local basis does not strengthen much after December g. The farmer has on-farm storage for 30,000 bushels and estimates costs of storage at $0.06 per bushel per month h. Commission costs for hedging are $0.01/by Part 2....Assumptions on Nov-29 a. Harvest is completed on time and corn is in storage by Nov-1 b. The cash price for immediate delivery is $2.85/by c. Dec corn futures are at $3.05/bu d. He hedged and decides to offset his hedge. Determine.... a. The nearby basis b. His actions in the cash and futures markets C. Whether he gained or lost on the Dec corn futures position d. The basis gain or loss on the transaction e. The outcome of his hedge (cash, futures, storage) f. How price per bushel compares with his marketing price objective

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts