Question: please answer A-G here is the info to answer the questions: Excel Online Structured Activity: Capital budgeting criteria A company has a 13% WACC and

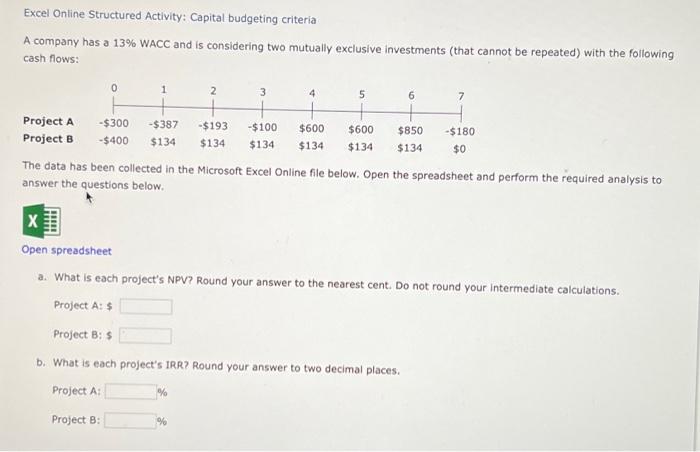

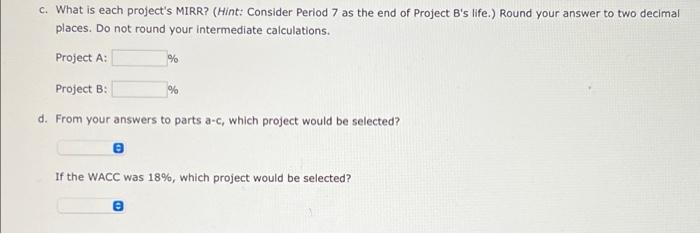

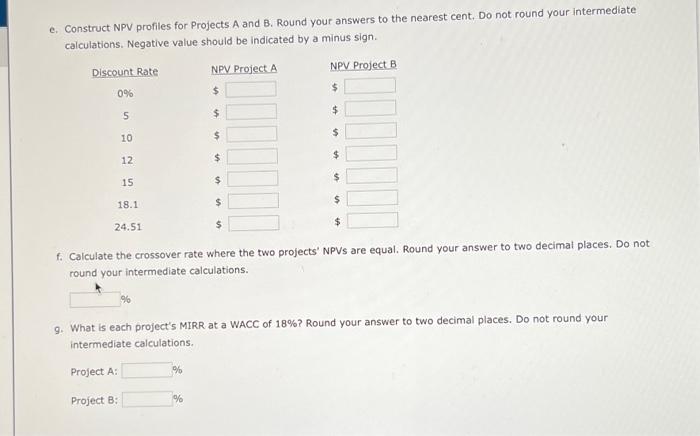

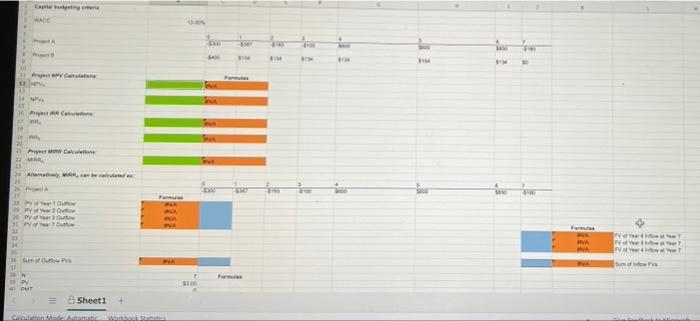

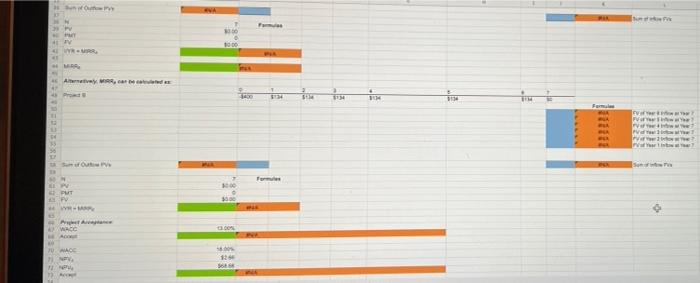

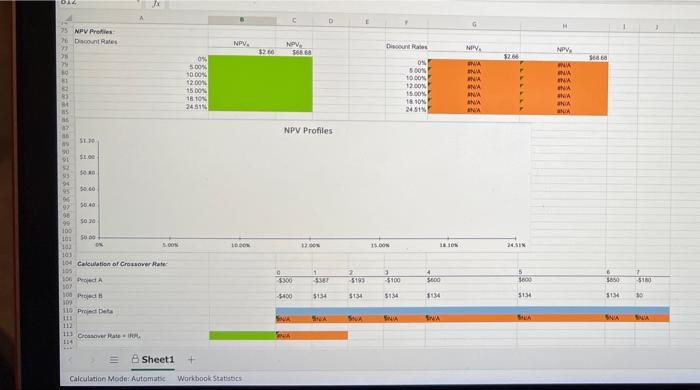

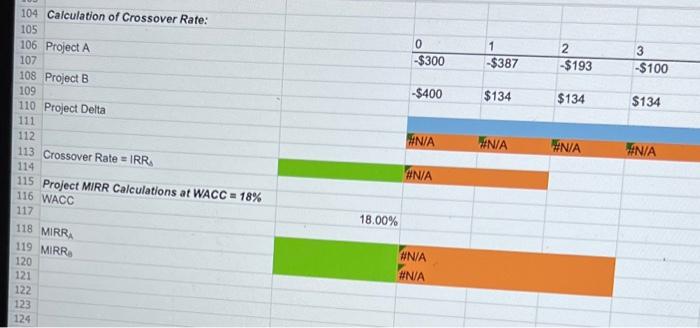

Excel Online Structured Activity: Capital budgeting criteria A company has a 13% WACC and is considering two mutually exclusive Investments (that cannot be repeated) with the following cash flows: 0 1 2 3 4 5 6 7 Project A -$300 -$387 - $ 193 -$100 $600 $600 $850 -$180 Project B -$400 $134 $134 $134 $134 $134 $134 $0 The data has been collected in the Microsoft Excel Online file below. Open the spreadsheet and perform the required analysis to answer the questions below. Open spreadsheet a. What is each project's NPV? Round your answer to the nearest cent. Do not round your intermediate calculations. Project A: $ Project B: $ b. What is each project's IRR? Round your answer to two decimal places. Project A: % Project B: % c. What is each project's MIRR? (Hint: Consider Period 7 as the end of Project B's life.) Round your answer to two decimal places. Do not round your intermediate calculations. Project A: % Project B: % d. From your answers to parts a-c, which project would be selected? If the WACC was 18%, which project would be selected? e e. Construct NPV profiles for Projects A and B. Round your answers to the nearest cent. Do not round your intermediate calculations. Negative value should be indicated by a minus sign Discount Rate NPV Project A NPV Project B 0% $ $ 5 $ $ 10 $ $ 12 $ $ 15 $ $ 18.1 $ $ 24.51 $ $ f. Calculate the crossover rate where the two projects' NPVs are equal. Round your answer to two decimal places. Do not round your intermediate calculations. g. What is each project's MIRR at a WACC of 18%? Round your answer to two decimal places. Do not round your intermediate calculations. Project A: % Project B: % Cat 11 Pro PARCE Cake PE Aber . ht wetu Wowo PV NA On Sun PV 47 UT = Sheet1 + COM are 3 41 WUR 1000 MA 46 AM mi HIE Bil PVT 11 Yrit Form 1000 PUT 38 . WC TO D G H 1 75 NPV Proties DiscountRates NPV, NPV 568.68 Dinas NIV. NPVA 3266 sa WN O 500 1000% 12.00 15.00 18101 NA INA NA ANA ON 5.00 10 00 12.00% 15.00% 18104 24.51 WINE ANA WINE VN VINE VINE WN NISTE NA NPV Profiles 19 SLO 500 95 50.00 92 5040 0 66 503 100 11 5. 183 104 Calculation of Crossover Rate tot w 2005 15. OON WOTE NISTE - 7 10 Pro 10 $300 1 3587 > 5193 5100 4 3600 5 1800 5830 ZO $100 $154 $134 5134 1134 5134 PIS o ME 100 Praha Pied Det TE 112 113 Create 114 11 VNS NA NA NA ++ Sheet1 Calculation Mode: Automate WorkbookStatis 0 -$300 $387 2 -$193 3 -$100 -$400 $134 $134 $134 104 Calculation of Crossover Rate: 105 106 Project A 107 108 Project B 109 110 Project Delta 111 112 113 Crossover Rate = IRR. 114 115 Project MIRR Calculations at WACC - 18% 117 HINA #N/A #N/A N/A #NA 116 WACC 18.00% 118 MIRRA 119 MIRR #N/A ANA 120 121 122 123 124

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts