Question: Please, answer all 1 0 journal entries ( requires will be provided below ) and, only answer if you have the CORRECT ANSWER to the

Please, answer all journal entries requires will be provided below and, only answer if you have the CORRECT ANSWER to the question. if your answer is wrong or irrelevant, I will REPORT it to Chegg and leave a thumb down. So please, check your answer before posting it

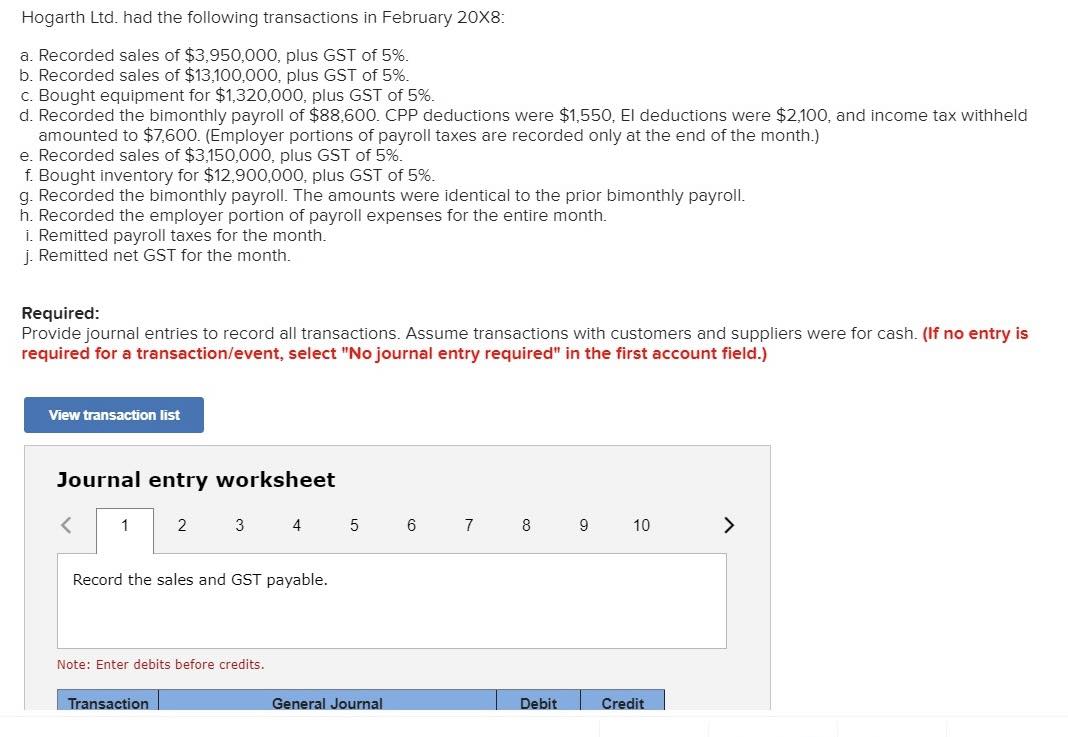

Hogarth Ltd had the following transactions in February :

a Recorded sales of $ plus GST of

b Recorded sales of $ plus GST of

c Bought equipment for $ plus GST of

d Recorded the bimonthly payroll of $ CPP deductions were $ El deductions were $ and income tax withheld

amounted to $Employer portions of payroll taxes are recorded only at the end of the month.

e Recorded sales of $ plus GST of

f Bought inventory for $ plus GST of

g Recorded the bimonthly payroll. The amounts were identical to the prior bimonthly payroll.

h Recorded the employer portion of payroll expenses for the entire month.

i Remitted payroll taxes for the month.

j Remitted net GST for the month.

Required:

Provide journal entries to record all transactions. Assume transactions with customers and suppliers were for cash. If no entry is

required for a transactionevent select No journal entry required" in the first account field.

Record the sales and GST payable.

Record the sales and GST payable.

Record the purchase of equipment.

Record the salary expense and employee's share of payroll taxes.

Record the sales and GST payable.

Record the purchase of inventory.

Record the salary expense and employee's share of payroll taxes.

Record the employer's portion of payroll taxes.

Record the remittance of payroll taxes.

Record the net GST for the month.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock