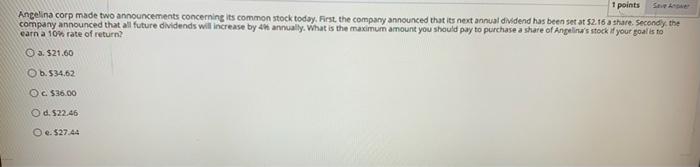

Question: please answer all 1 points Angelina corp made two announcements concerning its common stock today. First, the company announced that its next annual dividend has

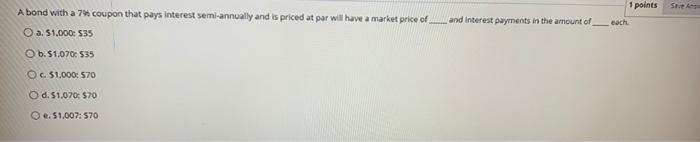

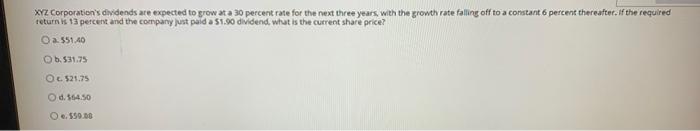

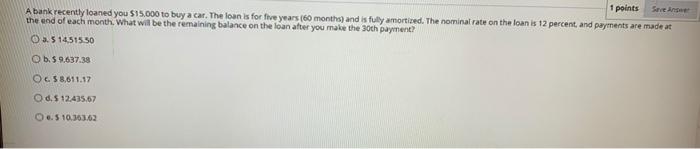

1 points Angelina corp made two announcements concerning its common stock today. First, the company announced that its next annual dividend has been set at $2.16 3 share. Second, the company announced that all future dividends will increase by 44 annually. What is the maximum amount you should pay to purchase a share of Angelina's stock if your goal is to carn a 10% rate of return? a. $21.60 Ob. 534.62 OC. $36.00 Od. 522.46 e. $27.44 1 points A bond with a 74 coupon that pays interest semi-annually and is priced at par will have a market price of O a. 51.000: 535 and interest payments in the amount of each O b.51.070: 535 Oc. 51.000: 570 O d. $1.070 $70 e. 51.007: 570 XYZ. Corporation's dividends are expected to grow at a 30 percent rate for the next three years with the growth rate falling off to a constant 6 percent thereafter. If the required return is 13 percent and the company just paid a 51.90 dividend, what is the current share price? O a. 551.40 6.531.75 OL. 521.75 Od. 564.50 O. 599.00 1 points See A bank recently loaned you $15.000 to buy a car. The loan is for five years (60 months) and is fully amortired. The nominal rate on the loan is 12 percent, and payments are made at the end of each month. What will be the remaining balance on the loan after you make the 30th payment? 3.5 14.51550 6.5 9.637.38 OC. 58,611.17 O d. 5 12.435,67 0.5 10.303.02

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts