Question: please answer all 1 points The discount rate that makes the net present value of an Investment exactly equal to zero is called the O

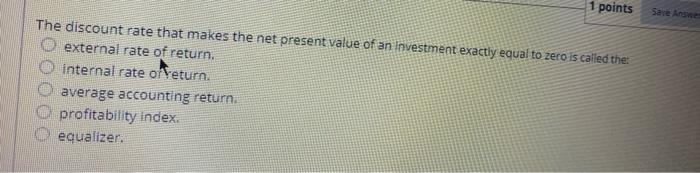

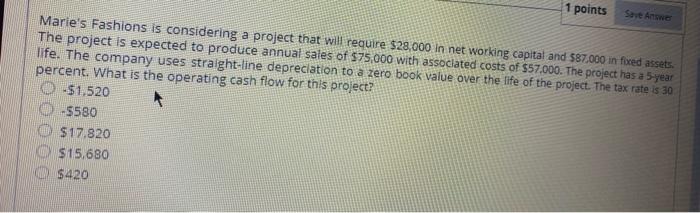

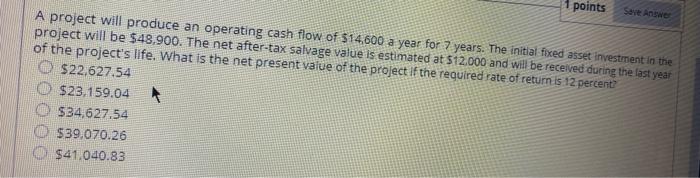

1 points The discount rate that makes the net present value of an Investment exactly equal to zero is called the O external rate of return. internal rate or return. average accounting return profitability index equalizer. 1 points Save Anne Marie's Fashions is considering a project that will require $28,000 in net working capital and 587.000 in foxed assets. The project is expected to produce annual sales of $75,000 with associated costs of $57.000. The project has a 5 year life. The company uses straight-line depreciation to a zero book value over the life of the project. The tax rate is 30 percent. What is the operating cash flow for this project? O $1,520 5580 $17.820 $15,680 $420 1 points A project will produce an operating cash flow of 514,600 a year for 7 years. The initial fixed asset investment in the project will be $48,900. The net after-tax salvage value is estimated at 512.000 and will be received during the last year of the project's life. What is the net present value of the project of the required rate of return is 12 percent $22.627.54 $23.159.04 $34,627.54 $39,070.26 $41.040.83

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts