Question: please answer all 17. Elmer Sporting Goods is getting ready to produce a new line of golf clubs by investing $1.85 million. The investment will

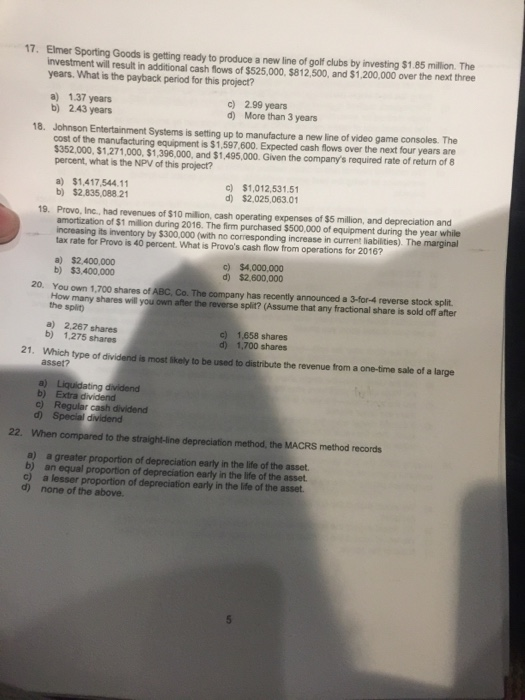

17. Elmer Sporting Goods is getting ready to produce a new line of golf clubs by investing $1.85 million. The investment will result in additional cash flows of $525,000, $812,500, and $1,200,000 over the next three years. What is the payback period for this project? a) 1.37 years b) 2.43 years Johnson Entertainment Systems is setting up to manufacture a new line of video game consoles. The c) 2.99 years d) More than 3 years 18. cost of the manufacturing equipment is $1,597,600. Expected cash flows over the next four years are 352,000, $1,271,000, $1,396,000, and $1,495,000. Given the company's required rate of return of 8 percent, what is the NPV of this project? c) $1,012,531.51 d) $2,025,063.01 a) $1,417,544.11 b) $2.835,088.21 19. Provo, Inc, had revenues of $10 million, cash operating expenses of $5 million, and depreciation and amortization of $1 milion during 2016. The firm purchased $500,000 of equipment during the year while increasing its inventory by $300,000 (with no tax rate for Provo is 40 percent. What is Provo's cash flow from operations for 2016? g increase in current liabilities). The marginal a) $2,400,000 b) $3,400,000 c) $4,000,000 d) $2,600,000 20. You own 1,700 shares of ABC, Co. The company has recently announced a 3-for-4 reverse stock split How many shares will you own after the reverse split? (Assume that any fractional share is sold off after the split) a) 2.267 shares b) 1,275 shares c) 1,658 shares d) 1,700 shares 21. Which type of dividend is most Skaly to be used to distribute the revenue from a one-tme sale of a large asset? b) Extra dividend c) Regular cash dividend d) Special dividend 22. When compared to the straight-line depreciation method, the MACRS method records a) a greater proportion of depreciation early in the life of the asset b) an equal proportion of depreciation early in the life of the asset c) a lesser proportion of depreciation early in the life of the asset. d) none of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts