Question: PLEASE answer all. 18 19 20 Select whether each of the following transactions increases ( + ), decreases ( - ), or has no effect

PLEASE answer all.

18

19

19

20

20

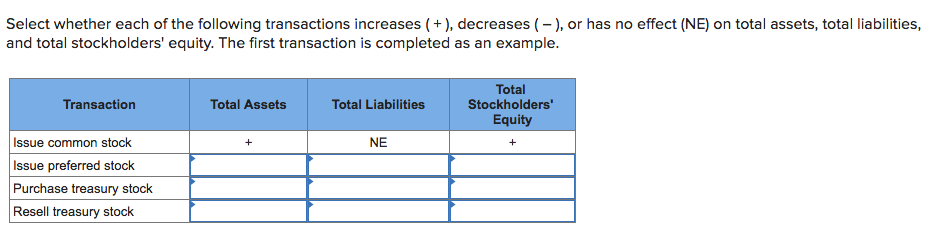

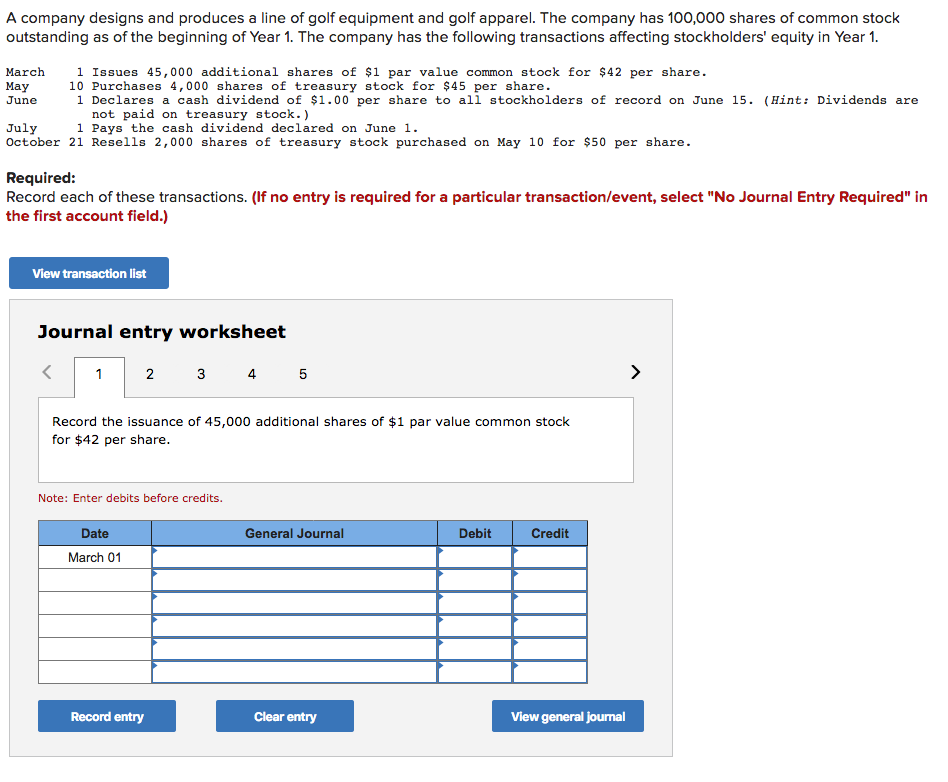

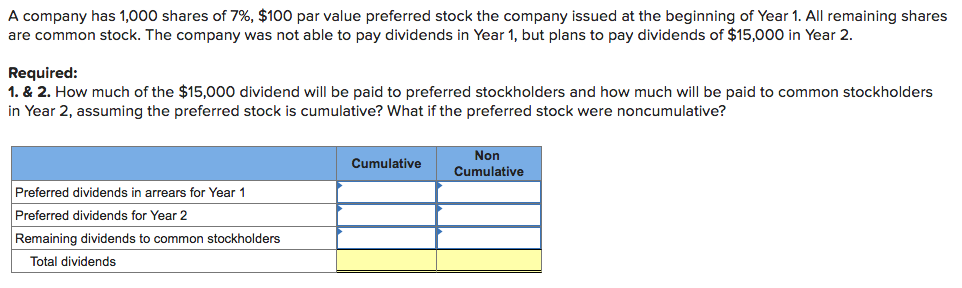

Select whether each of the following transactions increases ( + ), decreases ( - ), or has no effect (NE) on total assets, total liabilities, and total stockholders' equity. The first transaction is completed as an example. Transaction Total Assets Total Liabilities Total Stockholders' Equity + NE Issue common stock Issue preferred stock Purchase treasury stock Resell treasury stock A company designs and produces a line of golf equipment and golf apparel. The company has 100,000 shares of common stock outstanding as of the beginning of Year 1. The company has the following transactions affecting stockholders' equity in Year 1. March 1 Issues 45,000 additional shares of $1 par value common stock for $42 per share. May 10 Purchases 4,000 shares of treasury stock for $45 per share. June 1 Declares a cash dividend of $1.00 per share to all stockholders of record on June 15. (Hint: Dividends are not paid on treasury stock.) July 1 Pays the cash dividend declared on June 1. October 21 Resells 2,000 shares of treasury stock purchased on May 10 for $50 per share. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.) View transaction list Journal entry worksheet 2 3 4 5 Record the issuance of 45,000 additional shares of $1 par value common stock for $42 per share. Note: Enter debits before credits. Date General Journal Debit Credit March 01 - Record entry Clear entry View general journal A company has 1,000 shares of 7%, $100 par value preferred stock the company issued at the beginning of Year 1. All remaining shares are common stock. The company was not able to pay dividends in Year 1, but plans to pay dividends of $15,000 in Year 2. Required: 1. & 2. How much of the $15,000 dividend will be paid to preferred stockholders and how much will be paid to common stockholders in Year 2, assuming the preferred stock is cumulative? What if the preferred stock were noncumulative? Cumulative Non Cumulative Preferred dividends in arrears for Year 1 Preferred dividends for Year 2 Remaining dividends to common stockholders Total dividends

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts