Question: PLEASE answer all. 21 22 23 Fidelity Systems reports net income of $81 million. Included in that number is depreciation expense of $9 million, and

PLEASE answer all.

21

22

22

23

23

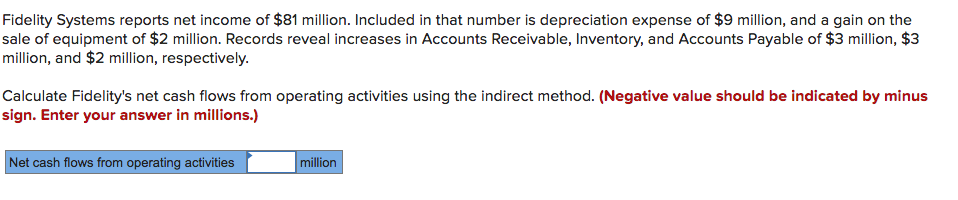

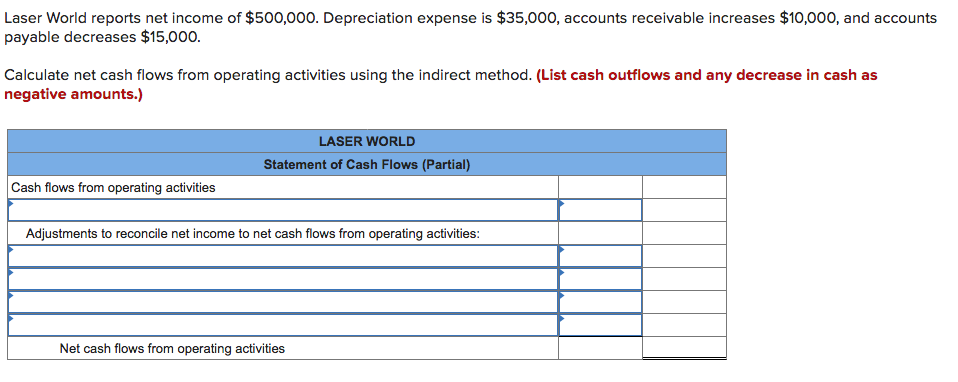

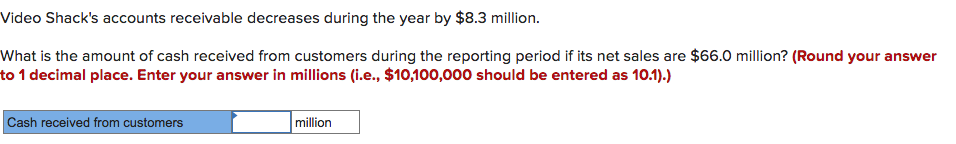

Fidelity Systems reports net income of $81 million. Included in that number is depreciation expense of $9 million, and a gain on the sale of equipment of $2 million. Records reveal increases in Accounts Receivable, Inventory, and Accounts Payable of $3 million, $3 million, and $2 million, respectively. Calculate Fidelity's net cash flows from operating activities using the indirect method. (Negative value should be indicated by minus sign. Enter your answer in millions.) Net cash flows from operating activities million Laser World reports net income of $500,000. Depreciation expense is $35,000, accounts receivable increases $10,000, and accounts payable decreases $15,000. Calculate net cash flows from operating activities using the indirect method. (List cash outflows and any decrease in cash as negative amounts.) LASER WORLD Statement of Cash Flows (Partial) flows from operating activities Adjustments to reconcile net income to net cash flows from operating activities: Net cash flows from operating activities Video Shack's accounts receivable decreases during the year by $8.3 million. What is the amount of cash received from customers during the reporting period if its net sales are $66.0 million? (Round your answer to 1 decimal place. Enter your answer in millions (i.e., $10,100,000 should be entered as 10.1).) Cash received from customers million

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts