Question: PLEASE answer all. 29 30 31 Company A, reports net sales of $2,750,000, cost of goods sold of $1,550,000, and income tax expense of $141,000

PLEASE answer all.

29

30

30

31

31

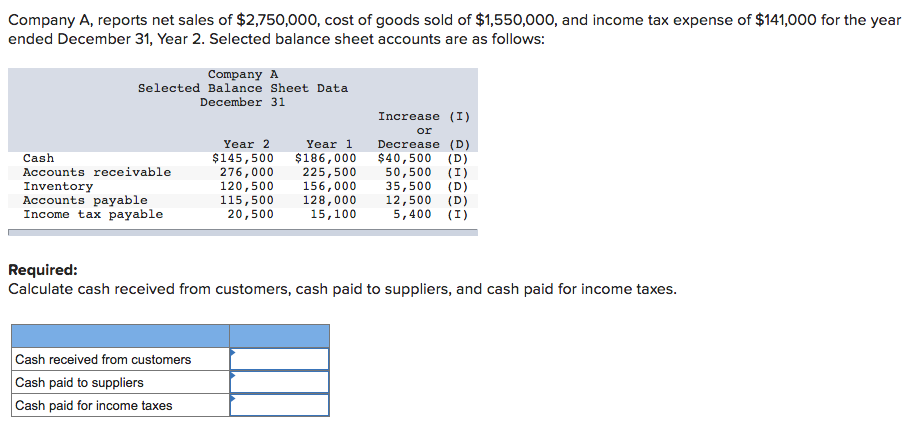

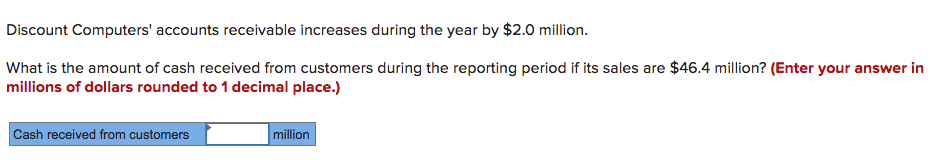

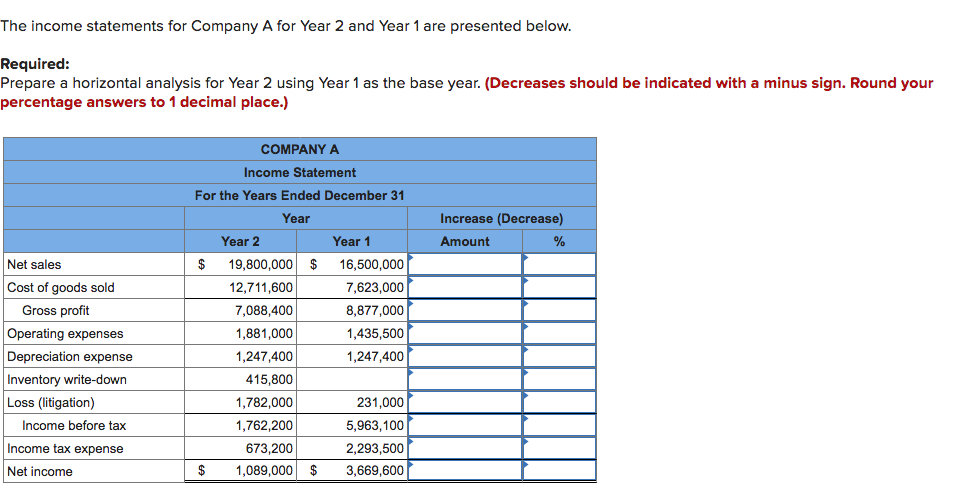

Company A, reports net sales of $2,750,000, cost of goods sold of $1,550,000, and income tax expense of $141,000 for the year ended December 31, Year 2. Selected balance sheet accounts are as follows: Company A Selected Balance Sheet Data December 31 Cash Accounts receivable Inventory Accounts payable Income tax payable Year 2 $145,500 276,000 120,500 115,500 20,500 Year 1 $186,000 225,500 156,000 128,000 15,100 Increase (I) or Decrease (D) $40,500 (D) 50,500 (I) 35,500 (D) 12,500 (D) 5,400 (I) Required: Calculate cash received from customers, cash paid to suppliers, and cash paid for income taxes. Cash received from customers Cash paid to suppliers Cash paid for income taxes Discount Computers' accounts receivable increases during the year by $2.0 million. What is the amount of cash received from customers during the reporting period if its sales are $46.4 million? (Enter your answer millions of dollars rounded to 1 decimal place.) Cash received from customers million The income statements for Company A for Year 2 and Year 1 are presented below. Required: Prepare a horizontal analysis for Year 2 using Year 1 as the base year. (Decreases should be indicated with a minus sign. Round your percentage answers to 1 decimal place.) Increase (Decrease) Amount % COMPANY A Income Statement For the Years Ended December 31 Year Year 2 Year 1 $ 19,800,000 $ 16,500,000 12,711,600 7,623,000 7,088,400 8,877,000 1,881,000 1,435,500 1,247,400 1,247,400 415,800 1,782,000 231,000 1,762,200 5,963,100 673,200 2,293,500 $ 1,089,000 $ 3,669,600 Net sales Cost of goods sold Gross profit Operating expenses Depreciation expense Inventory write-down Loss (litigation) Income before tax Income tax expense Net income 8,81

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts