Question: please answer all 3. 4 points Save Answer Question 20 Your small multinational US business has a 10.000 Euro capital expense to purchase some tools

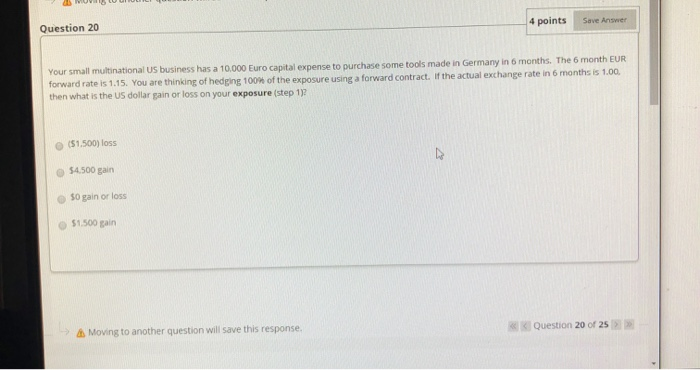

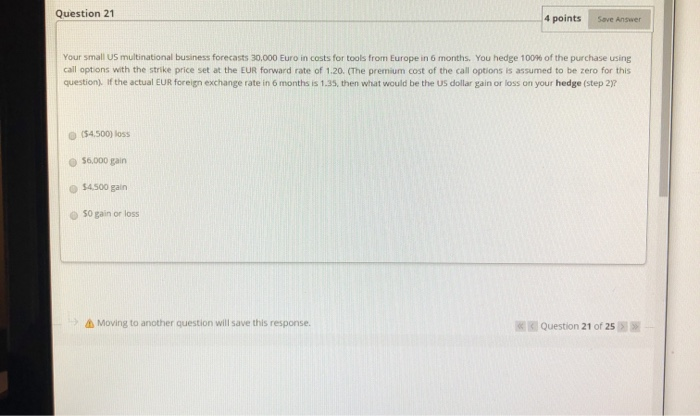

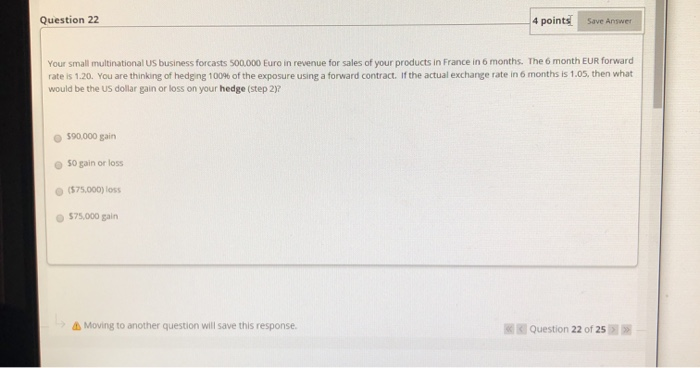

4 points Save Answer Question 20 Your small multinational US business has a 10.000 Euro capital expense to purchase some tools made in Germany in 6 months. The 6 month EUR forward rate is 1.15. You are thinking of hedging 100% of the exposure using a forward contract. If the actual exchange rate in 6 months is 1.00 then what is the US dollar gain or loss on your exposure (step 12 51.500) loss $4.500 gain 50 gain or loss 51500 gain Question 20 of 25 >>> Moving to another question will save this response. Question 21 4 points Save Answer Your small US multinational business forecasts 30.000 Euro in costs for tools from Europe in 6 months. You hedge 100% of the purchase using call options with the strike price set at the EUR forward rate of 1.20. (The premium cost of the call options is assumed to be zero for this question). If the actual EUR foreign exchange rate in 6 months is 1.35, then what would be the US dollar gain or loss on your hedge (step 277 (54,500) loss 56.000 gain 54.500 gain 50 gain or loss Moving to another question will save this response. Question 21 of 25 Question 22 4 points: Save Answer Your small multinational US business forcasts 500.000 Euro in revenue for sales of your products in France in 6 months. The 6 month EUR forward rate is 1.20. You are thinking of hedging 100% of the exposure using a forward contract. If the actual exchange rate in 6 months is 1.05, then what would be the US dollar gain or loss on your hedge (step 277 590.000 gain 50 gain or loss (575.000) loss 575.000 gain Moving to another question will save this response. Question 22 of 25

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts