Question: please answer all 3 and explain preferably writing out the steps for NPV and IRRs Use the following data to answer the next 3 questions:

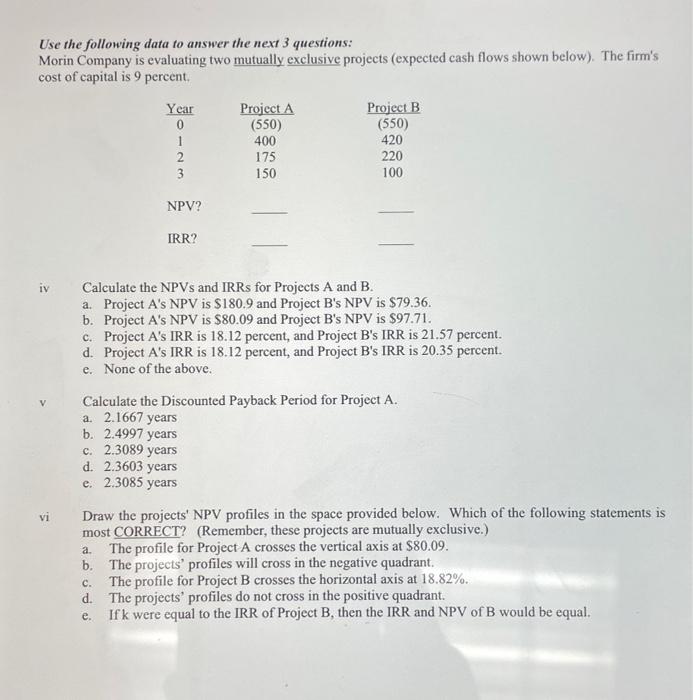

Use the following data to answer the next 3 questions: Morin Company is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 9 percent. iv Calculate the NPVs and IRRs for Projects A and B. a. Project A's NPV is $180.9 and Project B's NPV is $79.36. b. Project A's NPV is $80.09 and Project B's NPV is $97.71. c. Project A's IRR is 18.12 percent, and Project B's IRR is 21.57 percent. d. Project A's IRR is 18.12 percent, and Project B's IRR is 20.35 percent. e. None of the above. Calculate the Discounted Payback Period for Project A. a. 2.1667 years b. 2.4997 years c. 2.3089 years d. 2.3603 years e. 2.3085 years vi Draw the projects' NPV profiles in the space provided below. Which of the following statements is most CORRECT? (Remember, these projects are mutually exclusive.) a. The profile for Project A crosses the vertical axis at $80.09. b. The projects' profiles will cross in the negative quadrant. c. The profile for Project B crosses the horizontal axis at 18.82%. d. The projects' profiles do not cross in the positive quadrant. e. If k were equal to the IRR of Project B, then the IRR and NPV of B would be equal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts