Question: please answer all 3 parts to this one question. be neat and organized and easy to read please and I will upvote Exercise 14-4 (Static)

![14-4 (Static) Investor; effective interest [LO14-2] The Bradford Company issued 10% bonds,](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/66fbe9bf28b41_40666fbe9be98c5b.jpg)

please answer all 3 parts to this one question. be neat and organized and easy to read please and I will upvote

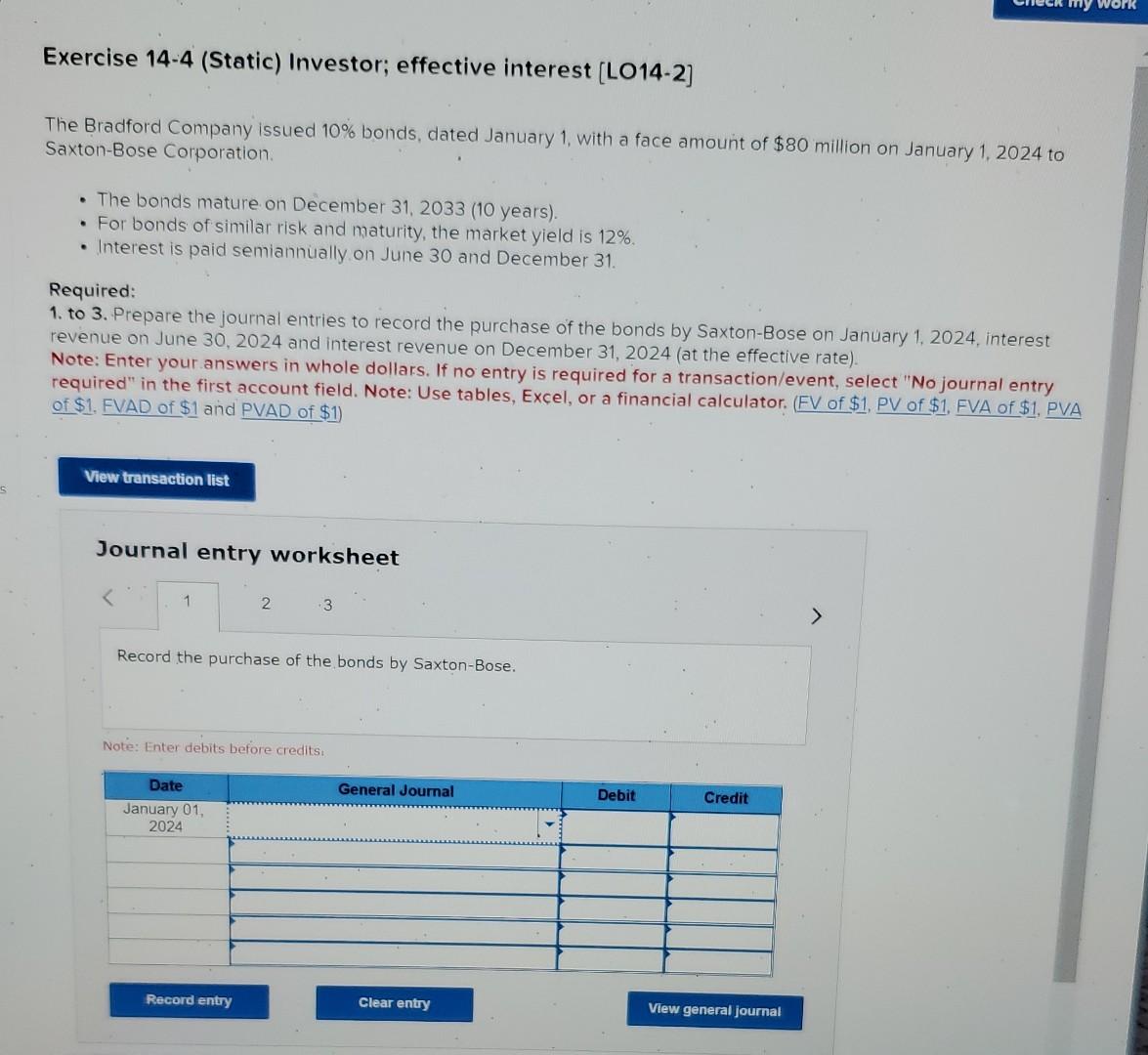

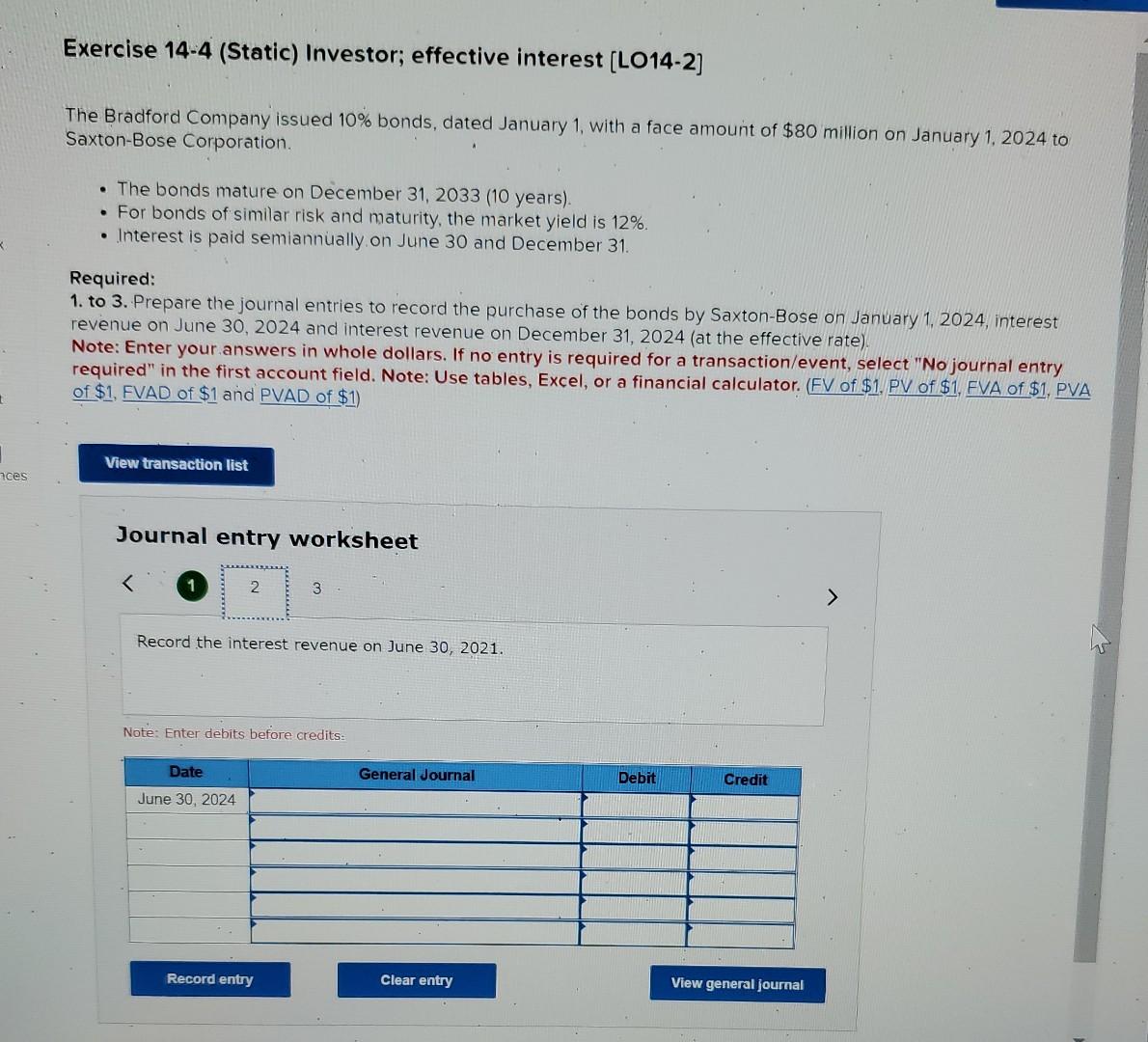

Exercise 14-4 (Static) Investor; effective interest [LO14-2] The Bradford Company issued 10% bonds, dated January 1 , with a face amount of $80 million on January 1,2024 to Saxton-Bose Corporation. - The bonds mature on December 31, 2033 (10 years). - For bonds of similar risk and maturity, the market yield is 12%. - Interest is paid semiannually on June 30 and December 31. Required: 1. to 3. Prepare the journal entries to record the purchase of the bonds by Saxton-Bose on January 1, 2024, interest revenue on June 30,2024 and interest revenue on December 31,2024 (at the effective rate). Note: Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of $1. FVAD of $1 and PVAD of $1 ) Journal entry worksheet Record the purchase of the bonds by Saxton-Bose. Note: Enter debits before credits Exercise 144 (Static) Investor; effective interest [LO14-2] The Bradford Company issued 10% bonds, dated January 1 , with a face amount of $80 million on January 1,2024 to Saxton-Bose Corporation. - The bonds mature on December 31, 2033 (10 years). - For bonds of similar risk and maturity, the market yield is 12%. - Interest is paid semiannually on June 30 and December 31. Required: 1. to 3. Prepare the journal entries to record the purchase of the bonds by Saxton-Bose on January 1,2024 , interest revenue on June 30,2024 and interest revenue on December 31, 2024 (at the effective rate). Note: Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of $1, FVAD of $1 and PVAD of $1 ) Journal entry worksheet Record the interest revenue on June 30, 2021. Note: Enter debits before credits: Exercise 14-4 (Static) Investor; effective interest [LO14-2] The Bradford Company issued 10% bonds, dated January 1 , with a face amount of $80 million on January 1,2024 to Saxton-Bose Corporation. - The bonds mature on December 31, 2033 (10 years). - For bonds of similar risk and maturity, the market yield is 12%. - Interest is paid semiannually on June 30 and December 31. Required: 1. to 3. Prepare the journal entries to record the purchase of the bonds by Saxton-Bose on January 1,2024 , interest revenue on June 30,2024 and interest revenue on December 31, 2024 (at the effective rate). Note: Enter your answers in whole dollars. If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Note: Use tables, Excel, or a financial calculator. (FV of \$1, PV of \$1, FVA of \$1, PVA of $1. FVAD of $1 and PVAD of $1 ) Journal entry worksheet Record the interest revenue on December 31, 2021. Note: Enter debits before credits

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts