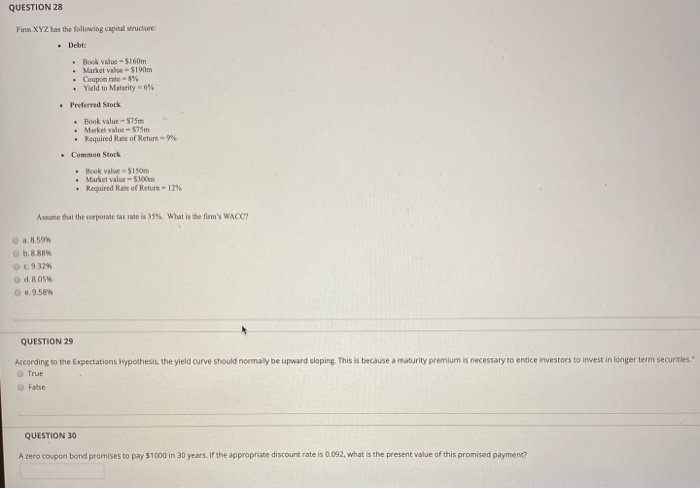

Question: please answer all 3!! QUESTION 28 Finm XYZ has the following capital structure . Det Book value $160m Market value $190m Coupon rule-8% Yield to

QUESTION 28 Finm XYZ has the following capital structure . Det Book value $160m Market value $190m Coupon rule-8% Yield to Maturity -6% . Preferred Stock Bok value - 575m Market value 575m Required Rate of Return Common Stock Book Value $150m Market value - 5300m Required Rate of Return -12% Assume that the corporate tax rate is 35%. What is the firm's WACCY a 8.59 b.8.884 9.32 d.BOS e. 9.58% QUESTION 29 According to the Expectations Hypothesis, the yield curve should normally be upward sloping. This is because a maturity premium is necessary to entice investors to invest in longer term securities." True False QUESTION 30 A zero coupon bond promises to pay $1000 in 30 years. If the appropriate discount rate is 0.092, what is the present value of this promised payment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts