Question: Please answer all 3, thanks! Question 1 1 pts Walmart is considering issuing bonds. They estimate they will issue bonds similar to a recent bond

Please answer all 3, thanks!

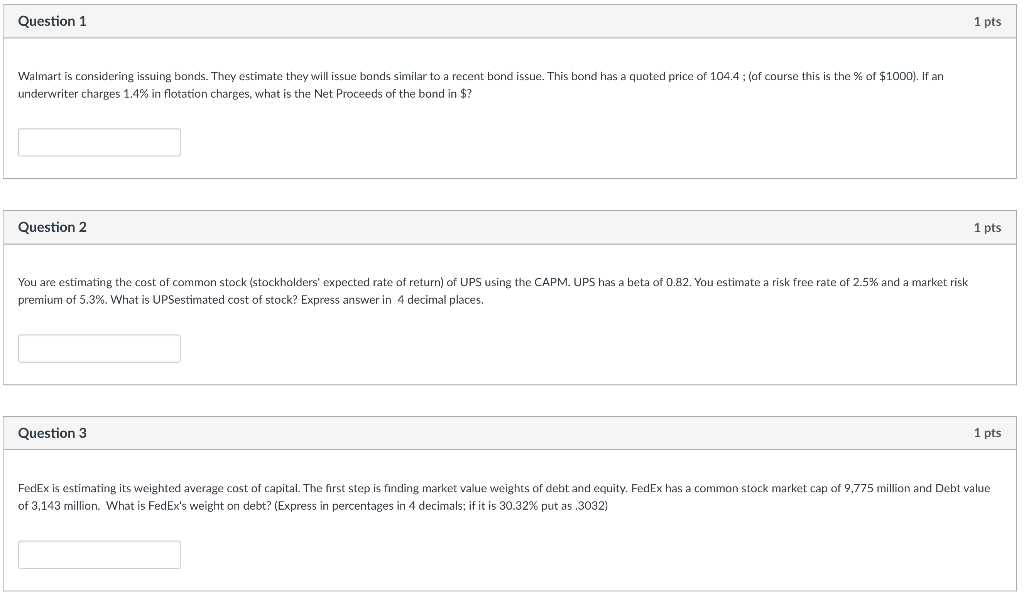

Question 1 1 pts Walmart is considering issuing bonds. They estimate they will issue bonds similar to a recent bond issue. This bond has a quoted price of 104.4 ; (of course this is the % of $1000). If an underwriter charges 1.4% in flotation charges, what is the Net Proceeds of the bond in $? Question 2 1 pts You are estimating the cost of common stock (stockholders' expected rate of return) of UPS using the CAPM. UPS has a beta of 0.82. You estimate a risk free rate of 2.5% and a market risk premium of 5.3%. What is UPSestimated cost of stock? Express answer in 4 decimal places. Question 3 1 pts FedEx is estimating its weighted average cost of capital. The first step is finding market value weights of debt and equity. FedEx has a common stock market cap of 9,775 million and Debt value of 3,143 million. What is FedEx's weight on debt? (Express in percentages in 4 decimals; if it is 30.32% put as 3032)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts