Question: Please answer all 3! Thumbs up! I just need the unanswered questions answered. I have completed the previous questions. Daily Enterprises is purchasing a $14,000,000

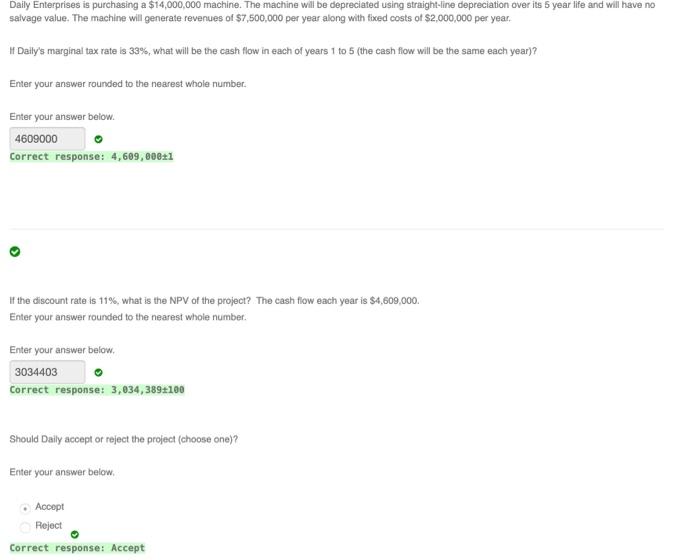

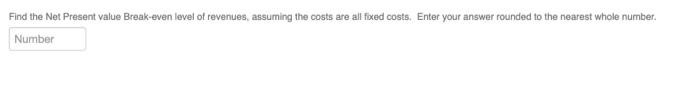

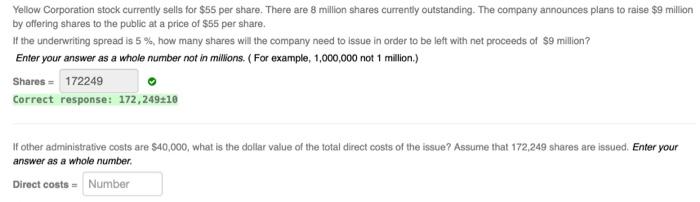

Daily Enterprises is purchasing a $14,000,000 machine. The machine will be depreciated using straight-line depreciation over its 5 year life and will have no salvage value. The machine will generate revenues of $7,500,000 per year along with fixed costs of $2,000,000 per year, # Daily's marginal tax rate is 33%, what will be the cash flow in each of years 1 to 5 (the cash flow will be the same each year)? Enter your answer rounded to the nearest whole number. Enter your answer below. 4609000 Correct response: 4,609,000:1 if the discount rate is 11%, what is the NPV of the project? The cash flow each year is $4,609,000 Enter your answer rounded to the nearest whole number. Enter your answer below 3034403 Correct response: 3,034,389+100 Should Daily accept or reject the project (choose one)? Enter your answer below Accept Reject Correct response: Accept Find the Net Present value Break-even level of revenues, assuming the costs are all fixed costs. Enter your answer rounded to the nearest whole number. Number Yellow Corporation stock currently sells for $55 per share. There are 8 million shares currently outstanding. The company announces plans to raise $9 million by offering shares to the public at a price of $55 per share. it the underwriting spread is 5 %, how many shares will the company need to issue in order to be left with net proceeds of $9 million? Enter your answer as a whole number not in millions. (For example, 1,000,000 not 1 million) Shares = 172249 Correct response: 172,249:10 If other administrative costs are $40,000, what is the dollar value of the total direct costs of the issue? Assume that 172,249 shares are issued. Enter your answer as a whole number Direct costs = Number Keira Mig. is considering a rights offer. The company has determined that the ex-rights price would be $62. The current price is $84.00 per share and there are 9 million shares outstanding. The rights offer would raise a total of $81,000,000 How many rights are required to get a new share? Round your answer to the nearest integer. Enter your answer below Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts