Question: PLEASE answer all. 32 33 Perform a horizontal analysis providing both the amount and percentage change. (Round Percentage answers to 1 decimal place. Decreases should

PLEASE answer all.

32

33

33

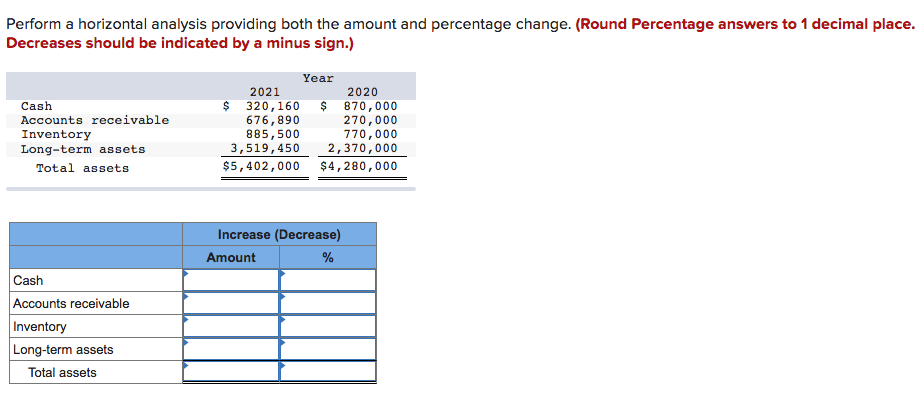

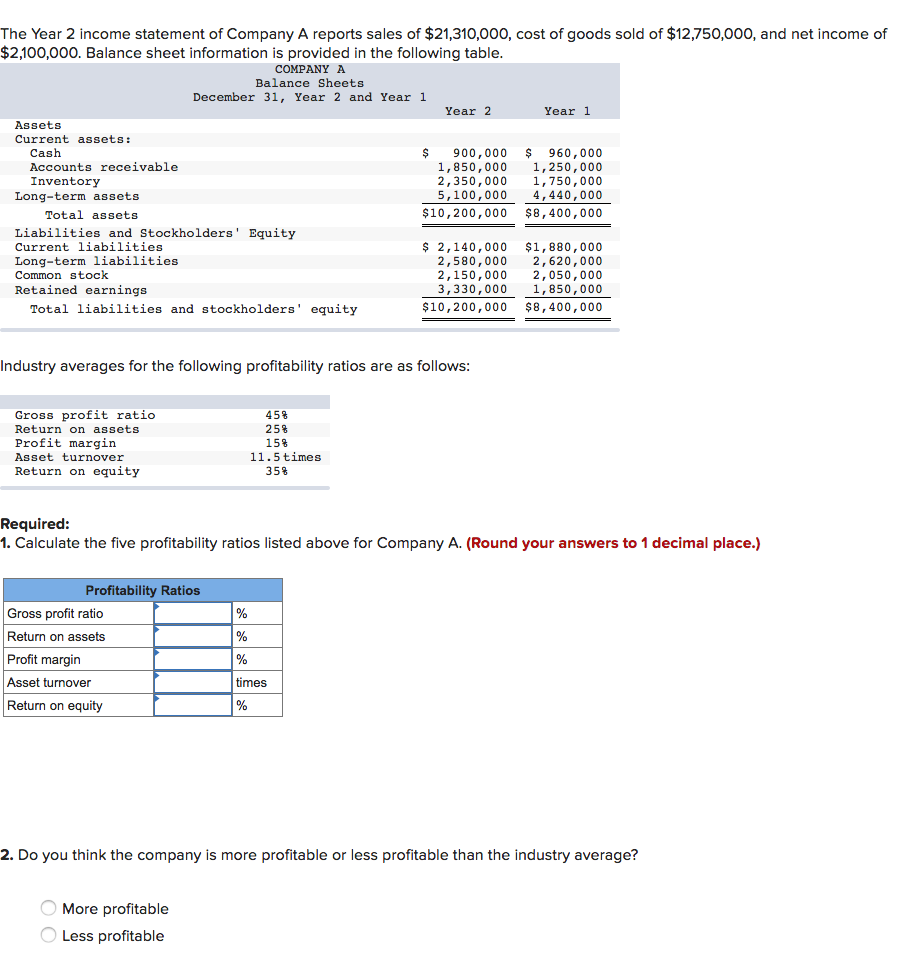

Perform a horizontal analysis providing both the amount and percentage change. (Round Percentage answers to 1 decimal place. Decreases should be indicated by a minus sign.) Cash Accounts receivable Inventory Long-term assets Total assets Year 2021 2020 $ 320,160 $ 870,000 676,890 270,000 885,500 770,000 3,519,450 2,370,000 $5,402,000 $4,280,000 Increase (Decrease) Amount % Cash Accounts receivable Inventory Long-term assets Total assets The Year 2 income statement of Company A reports sales of $21,310,000, cost of goods sold of $12,750,000, and net income of $2,100,000. Balance sheet information is provided in the following table. COMPANY A Balance Sheets December 31, Year 2 and Year 1 Year 2 Year 1 Assets Current assets: Cash $ 900,000 $ 960,000 Accounts receivable 1,850,000 1,250,000 Inventory 2,350,000 1,750,000 Long-term assets 5,100,000 4,440,000 Total assets $10,200,000 $8,400,000 Liabilities and Stockholders' Equity Current liabilities $ 2,140,000 $1,880,000 Long-term liabilities 2,580,000 2,620,000 Common stock 2,150,000 2,050,000 Retained earnings 3,330,000 1,850,000 Total liabilities and stockholders' equity $10,200,000 $8,400,000 Industry averages for the following profitability ratios are as follows: Gross profit ratio Return on assets Profit margin Asset turnover Return on equity 45% 25% 15% 11.5 times 35% Required: 1. Calculate the five profitability ratios listed above for Company A. (Round your answers to 1 decimal place.) Profitability Ratios Gross profit ratio Return on assets Profit margin Asset turnover Return on equity times 2. Do you think the company is more profitable or less profitable than the industry average? O More profitable Less profitable

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts