Question: Please answer all 4! 2. If it is possible to consistently earn abnormal profits based on fundamental analysis you can conclude that the market is

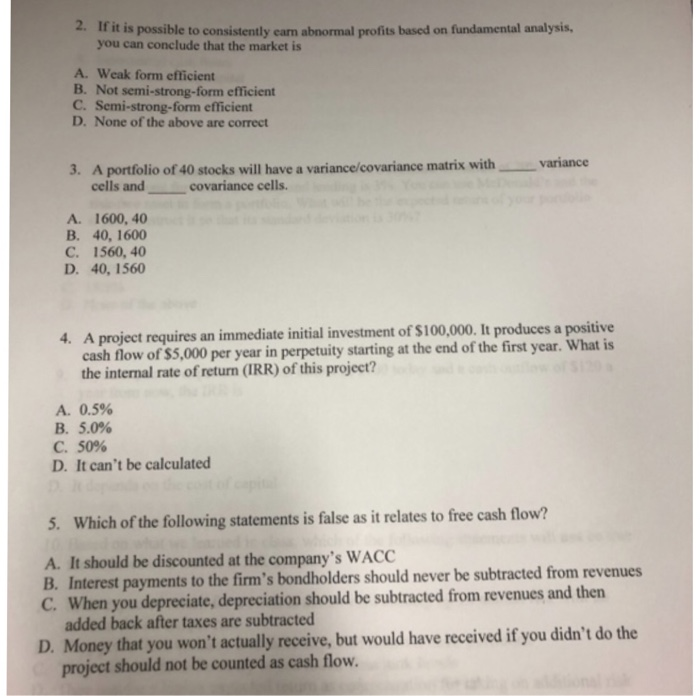

2. If it is possible to consistently earn abnormal profits based on fundamental analysis you can conclude that the market is A. Weak form efficient B. Not semi-strong-form efficient C. Semi-strong-form efficient D. None of the above are correct 3. A portfolio of 40 stocks will have a variance/covariance matrix withvariance cells and covariance cells . 1600,40 B. 40, 1600 C. 1560, 40 D. 40, 1560 4. A project requires an immediate initial investment of $100,000. It produces a positive cash flow of $5,000 per year in perpetuity starting at the end of the first year. What is the internal rate of return (IRR) of this project? A. 0.5% B. 5.0% C.50% D. It can't be calculated 5. Which of the following statements is false as it relates to free cash flow? A. It should be discounted at the company's WACC B. Interest payments to the firm's bondholders should never be subtracted from revenues C. When you depreciate, depreciation should be subtracted frorn revenues and then added back after taxes are subtracted D. Money that you won't actually receive, but would have received if you didn't do the project should not be counted as cash flow

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts