Question: PLEASE ANSWER ALL 4 ASAP ROCKY Plzz !!! assignment due at midnight eill Piedmont Company segments its business into two regions-North and South. The company

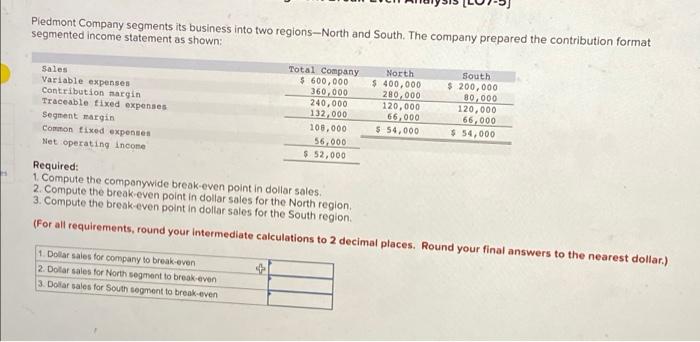

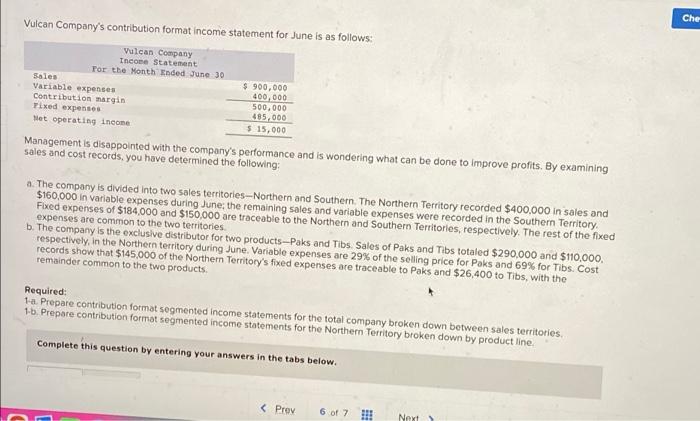

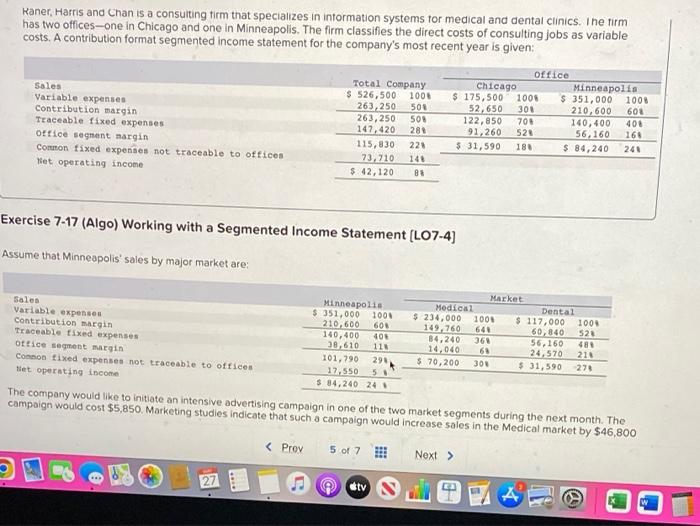

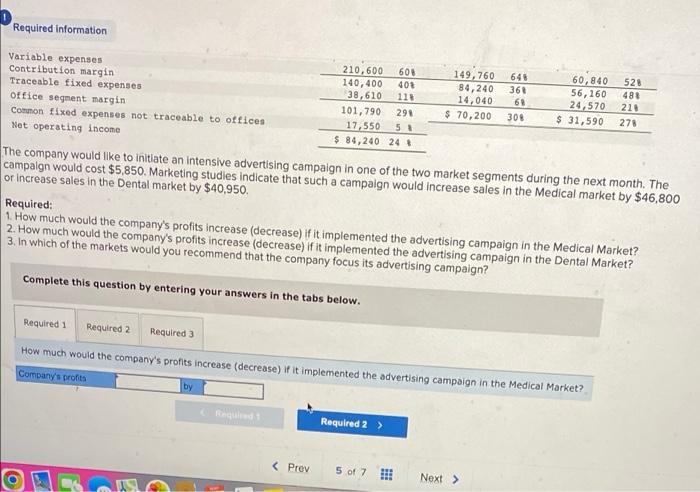

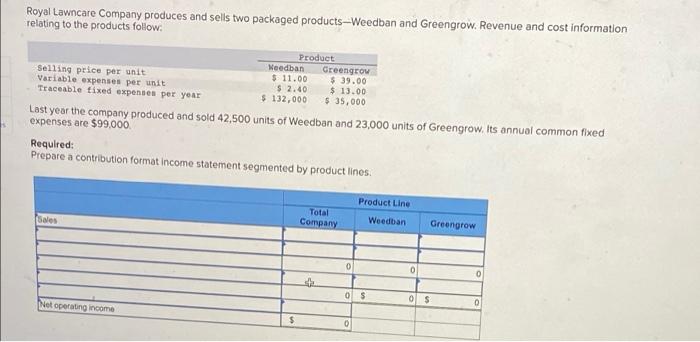

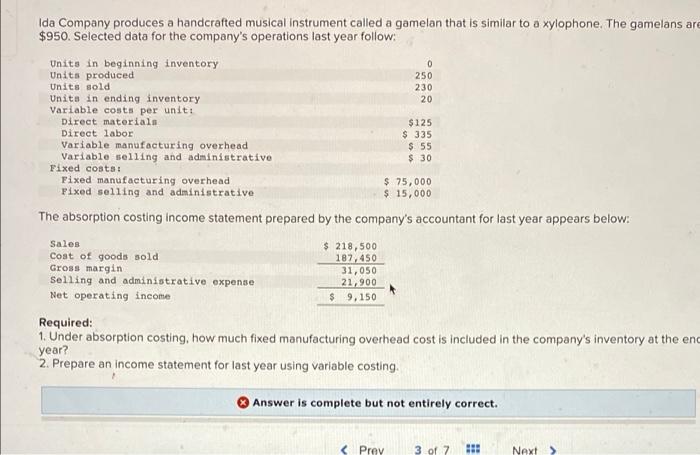

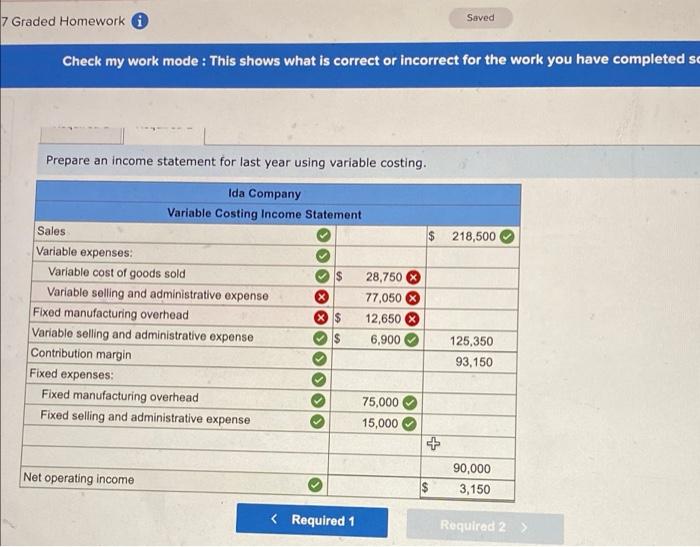

Piedmont Company segments its business into two regions-North and South. The company prepared the contribution format segmented income statement as shown: North Sales South $ 200,000 Variable expenses Contribution margin Total Company $ 600,000 360,000 240,000 132,000 $ 400,000 280,000 120,000 66,000 80,000 120,000 66,000 Traceable fixed expenses Segment margin $ 54,000 $ 54,000 Common fixed expenses 108,000 56,000 Net operating income $ 52,000 Required: 1. Compute the companywide break-even point in dollar sales. 2. Compute the break-even point in dollar sales for the North region. 3. Compute the break-even point in dollar sales for the South region. (For all requirements, round your intermediate calculations to 2 decimal places. Round your final answers to the nearest dollar.) 1. Dollar sales for company to break-even 4 2. Dollar sales for North segment to break-even 3. Dollar sales for South segment to break-even Vulcan Company's contribution format income statement for June is as follows: Vulcan Company Income Statement For the Month Ended June 30 Sales $ 900,000 400,000 Variable expenses Contribution margin Fixed expenses 500,000 495,000 Net operating income $ 15,000 Management is disappointed with the company's performance and is wondering what can be done to improve profits. By examining sales and cost records, you have determined the following: a. The company is divided into two sales territories-Northern and Southern. The Northern Territory recorded $400,000 in sales and $160,000 in variable expenses during June; the remaining sales and variable expenses were recorded in the Southern Territory. Fixed expenses of $184,000 and $150,000 are traceable to the Northern and Southern Territories, respectively. The rest of the fixed expenses are common to the two territories. b. The company is the exclusive distributor for two products-Paks and Tibs. Sales of Paks and Tibs totaled $290,000 and $110,000. respectively, in the Northern territory during June. Variable expenses are 29% of the selling price for Paks and 69% for Tibs. Cost records show that $145,000 of the Northern Territory's fixed expenses are traceable to Paks and $26,400 to Tibs, with the remainder common to the two products. Required: 1-a. Prepare contribution format segmented income statements for the total company broken down between sales territories. 1-b. Prepare contribution format segmented income statements for the Northern Territory broken down by product line. Complete this question by entering your answers in the tabs below. stv A Market Required information 210,600 149,760 Variable expenses Contribution margin 60% 40% 140,400 38,610 11W 64% 361 69 84,240 14,040 30% Traceable fixed expenses 60,840 528 56,160 48% 24,570 21% $ 31,590 278 office segment margin $ 70,200 Common fixed expenses not traceable to offices Net operating income 101,790 291 17,550 51 $ 84,240 24 % The company would like to initiate an intensive advertising campaign in one of the two market segments during the next month. The campaign would cost $5,850. Marketing studies indicate that such a campaign would increase sales in the Medical market by $46,800 or increase sales in the Dental market by $40,950. Required: 1. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? 2. How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Dental Market? 3. In which of the markets would you recommend that the company focus its advertising campaign? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Required 3 How much would the company's profits increase (decrease) if it implemented the advertising campaign in the Medical Market? Company's profits by Required 2 > O K Royal Lawncare Company produces and sells two packaged products-Weedban and Greengrow. Revenue and cost information relating to the products follow: Product Selling price per unit Needban $11.00 $ 2.40 Greengrow $39.00 $ 13.00 Variable expenses per unit Traceable fixed expenses per year $ 132,000 $ 35,000 Last year the company produced and sold 42,500 units of Weedban and 23,000 units of Greengrow. Its annual common fixed expenses are $99,000. Required: Prepare a contribution format income statement segmented by product lines. Product Line Total Weedban Company Greengrow Sales + Net operating income $ 0 0 0 $ 0 0 $ 0 0 Ida Company produces a handcrafted musical instrument called a gamelan that is similar to a xylophone. The gamelans are $950. Selected data for the company's operations last year follow: Units in beginning inventory 0 250 Units produced Units sold 230 20 Units in ending inventory Variable costs per unit: Direct materials. Direct labor $125 $ 335 $ 55 Variable manufacturing overhead Variable selling and administrative $ 30 Fixed costs: Fixed manufacturing overhead $ 75,000 Fixed selling and administrative $ 15,000 The absorption costing income statement prepared by the company's accountant for last year appears below: Sales $ 218,500 Cost of goods sold Gross margin 187,450 31,050 21,900 Selling and administrative expense Net operating income $ 9,150 Required: 1. Under absorption costing, how much fixed manufacturing overhead cost is included in the company's inventory at the enc year? 2. Prepare an income statement for last year using variable costing. Answer is complete but not entirely correct. Saved 7 Graded Homework i Check my work mode: This shows what is correct or incorrect for the work you have completed so Prepare an income statement for last year using variable costing. Ida Company Variable Costing Income Statement Sales Variable expenses: Variable cost of goods sold $ Variable selling and administrative expense. Fixed manufacturing overhead Variable selling and administrative expense Contribution margin Fixed expenses: Fixed manufacturing overhead Fixed selling and administrative expense Net operating income X X + $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts