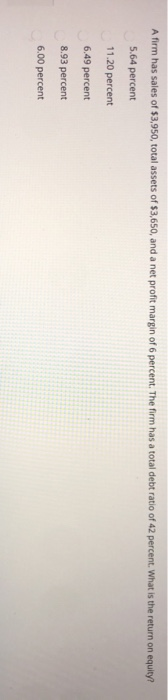

Question: PLEASE ANSWER ALL 4 MULTIPLE CHOICE QUESTIONS A firm has sales of $3,950, total assets of $3,650, and a net profit margin of 6 percent.

PLEASE ANSWER ALL 4 MULTIPLE CHOICE QUESTIONS

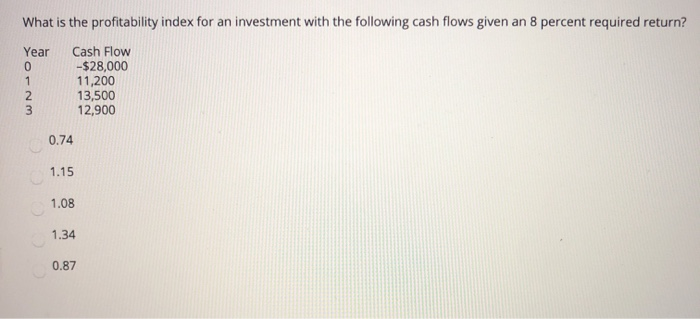

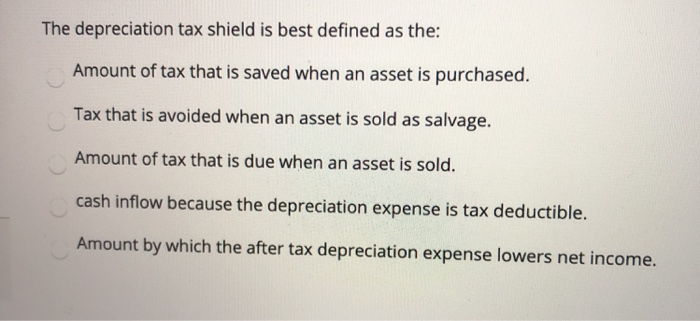

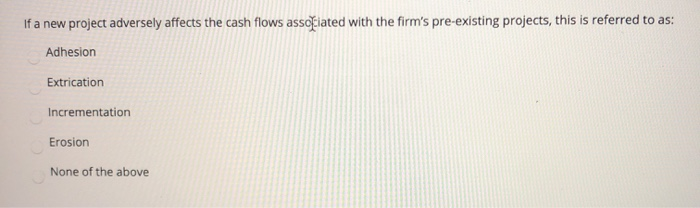

PLEASE ANSWER ALL 4 MULTIPLE CHOICE QUESTIONSA firm has sales of $3,950, total assets of $3,650, and a net profit margin of 6 percent. The firm has a total debt ratio of 42 percent. What is the return on equity? 5.64 percent 11.20 percent 6.49 percent 8.93 percent 6.00 percent What is the profitability index for an investment with the following cash flows given an 8 percent required return? Year 0 1 Cash Flow -$28,000 11,200 13,500 12,900 2 3 0.74 1.15 1.08 1.34 0.87 The depreciation tax shield is best defined as the: Amount of tax that is saved when an asset is purchased. Tax that is avoided when an asset is sold as salvage. Amount of tax that is due when an asset is sold. cash inflow because the depreciation expense is tax deductible. Amount by which the after tax depreciation expense lowers net income. If a new project adversely affects the cash flows associated with the firm's pre-existing projects, this is referred to as: Adhesion Extrication Incrementation Erosion None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts