Question: please answer all 4 multiple choice questions If the discount rate is 7.6%, what would you be willing to pay for receiving a payment of

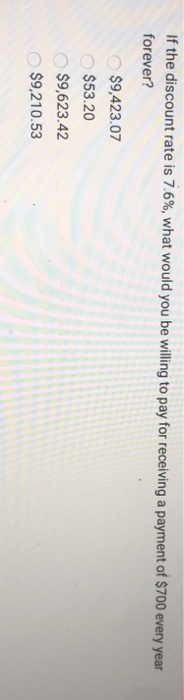

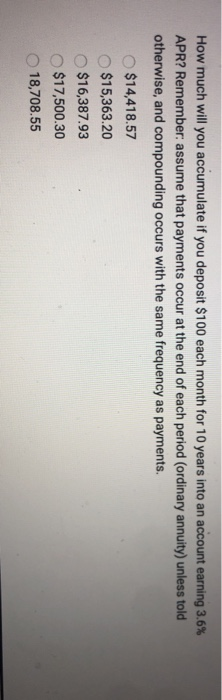

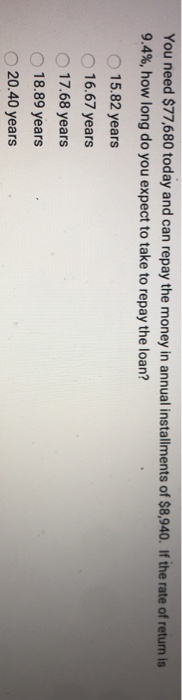

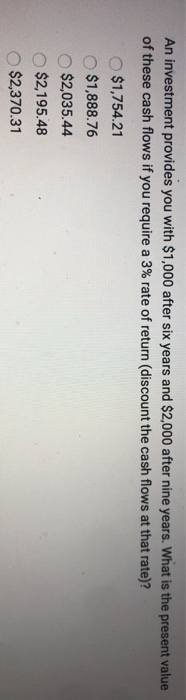

If the discount rate is 7.6%, what would you be willing to pay for receiving a payment of $700 every year forever? $9,423.07 $53.20 $9,623.42 $9,210.53 How much will you accumulate if you deposit $100 each month for 10 years into an account earning 3.6% APR? Remember: assume that payments occur at the end of each period (ordinary annuity) unless told otherwise, and compounding occurs with the same frequency as payments. $14,418.57 $15,363.20 $16,387.93 $17,500.30 18,708.55 You need $77,680 today and can repay the money in annual installments of $8,940. If the rate of return is 9.4%, how long do you expect to take to repay the loan? 15.82 years 16.67 years 17.68 years 18.89 years 20.40 years An investment provides you with $1,000 after six years and $2,000 after nine years. What is the present value of these cash flows if you require a 3% rate of return (discount the cash flows at that rate)? $1,754.21 $1,888.76 $2,035.44 $2,195.48 $2,370.31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts