Question: please answer all 4 multiple choice questions pictured , please and thank you Gina Production Company uses a standard costing system. The following information pertains

please answer all 4 multiple choice questions pictured , please and thank you

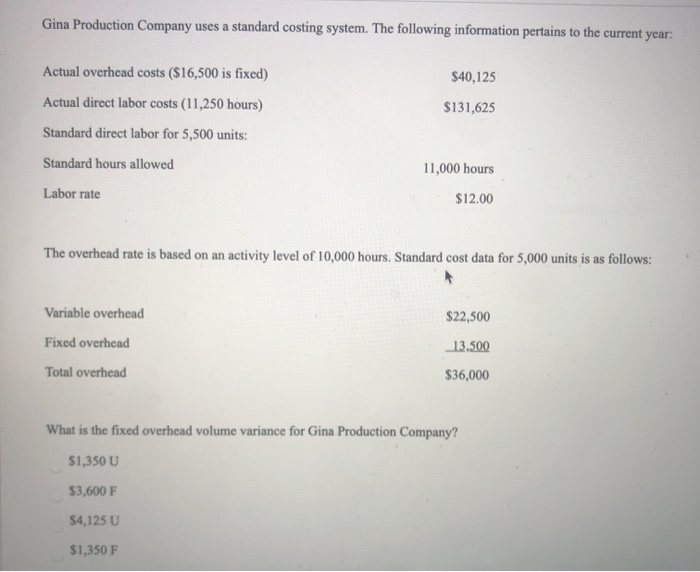

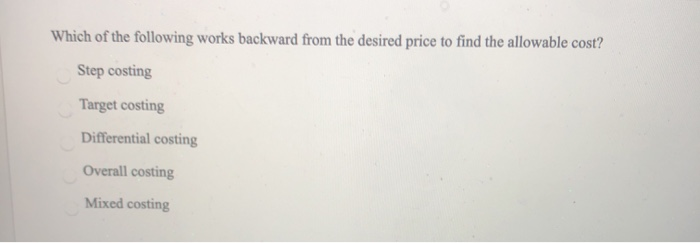

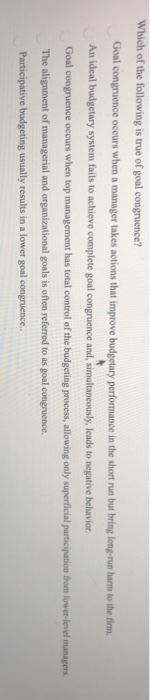

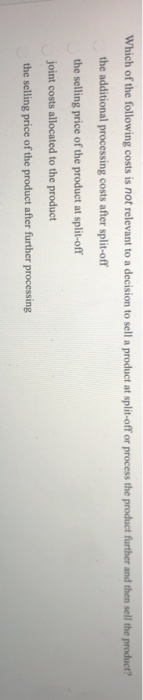

please answer all 4 multiple choice questions pictured , please and thank youGina Production Company uses a standard costing system. The following information pertains to the current year: $40,125 $131,625 Actual overhead costs ($16,500 is fixed) Actual direct labor costs (11,250 hours) Standard direct labor for 5,500 units: Standard hours allowed 11,000 hours Labor rate $12.00 The overhead rate is based on an activity level of 10,000 hours. Standard cost data for 5,000 units is as follows: Variable overhead $22,500 Fixed overhead 13,500 Total overhead $36,000 What is the fixed overhead volume variance for Gina Production Company? $1,350 U $3,600 F $4,125 U $1,350 F Which of the following works backward from the desired price to find the allowable cost? Step costing Target costing Differential costing Overall costing Mixed costing Which of the following is true of goal congruence? Goal congruence occurs when a manager takes actions that improve budgetary performance in the short run but bring long-run harm to the firm, An ideal budgetary system fails to achieve complete goal congruence and, simultaneously, leads to negative behavior Goal congruence occurs when top management has total control of the budgeting process, allowing only superficial participation from lower level managers. The alignment of managerial and organizational goals is often referred to as goal congruence. Participative budgeting usually results in a lower goal congruence.. Which of the following costs is not relevant to a decision to sell a product at split-off or process the product further and then sell the product? the additional processing costs after split-off the selling price of the product at split-off joint costs allocated to the product the selling price of the product after further processing

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts