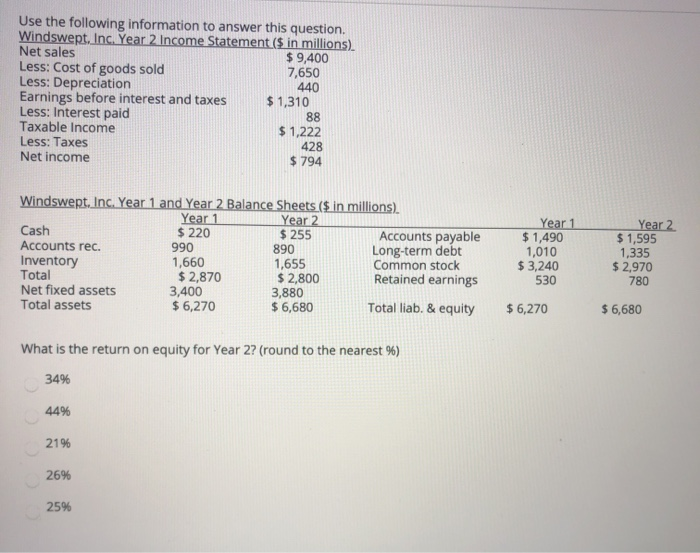

Question: PLEASE ANSWER ALL 4 MULTIPLE CHOICE QUESTIONS Use the following information to answer this question. Windswept. Inc. Year 2 Income Statement ($ in millions). Net

PLEASE ANSWER ALL 4 MULTIPLE CHOICE QUESTIONS

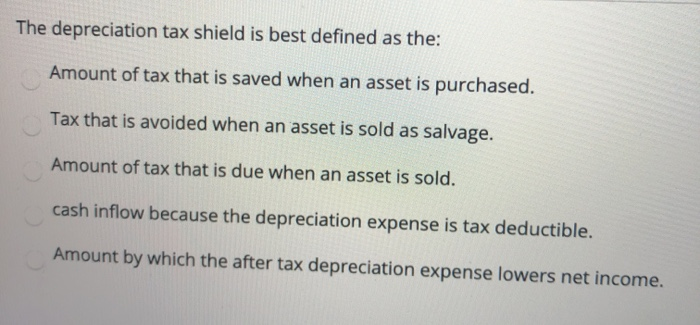

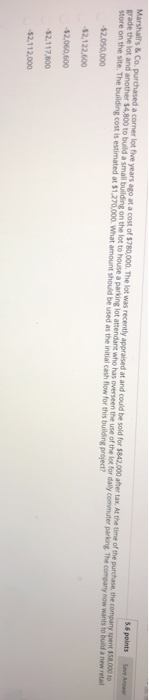

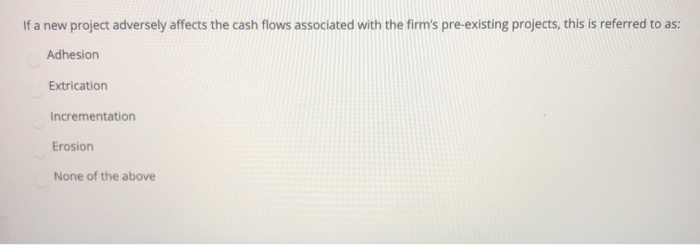

PLEASE ANSWER ALL 4 MULTIPLE CHOICE QUESTIONSUse the following information to answer this question. Windswept. Inc. Year 2 Income Statement ($ in millions). Net sales $ 9,400 Less: Cost of goods sold 7,650 Less: Depreciation 440 Earnings before interest and taxes $ 1,310 Less: Interest paid 88 Taxable income $ 1,222 Less: Taxes 428 Net income $ 794 Windswept. Inc. Year 1 and Year 2 Balance Sheets ($ in millions) Year 1 Year 2 Cash $ 220 $ 255 Accounts payable Accounts rec. 990 890 Long-term debt Inventory 1,660 1,655 Common stock Total $ 2,870 $ 2,800 Retained earnings Net fixed assets 3,400 3,880 Total assets $ 6,270 $ 6,680 Total liab. & equity Year 1 $ 1,490 1,010 $3,240 530 Year 2 $ 1,595 1,335 $ 2,970 780 $ 6,270 $ 6,680 What is the return on equity for Year 2? (round to the nearest %) 34% 44% 21% 26% 25% The depreciation tax shield is best defined as the: Amount of tax that is saved when an asset is purchased. Tax that is avoided when an asset is sold as salvage. Amount of tax that is due when an asset is sold. cash inflow because the depreciation expense is tax deductible. Amount by which the after tax depreciation expense lowers net income. 5.6 points Marshall's & Co. purchased a comer lot five years ago at a cost of $780,000. The lot was recently appraised at and could be sold for $342.000 after tax. At the time of the purchase, the company spent $58,000 to grade the lot and another 54,800 to build a small building on the lot to house a parking lot attendant who has overseen the use of the lot for daily commuter parking. The company now wants to build a new retail store on the site. The building cost is estimated at $1.270.000. What amount should be used as the initial cash flow for this building project? -32,050,000 -32.122.600 -$2.060,600 -52.117.800 -52,112.000 If a new project adversely affects the cash flows associated with the firm's pre-existing projects, this is referred to as: Adhesion Extrication Incrementation Erosion None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts