Question: please answer all 4 parts in this question AP (this information is used for questions 16-19) A project has a cash flow of ($1,327,500) at

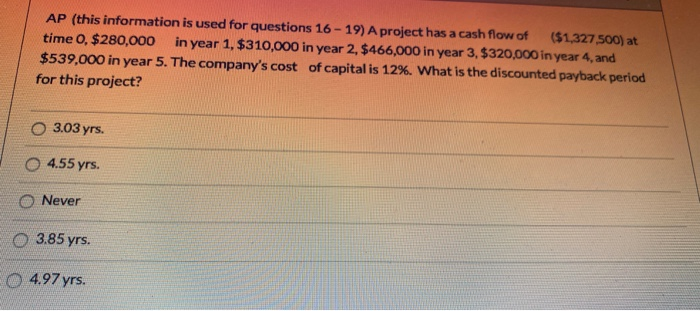

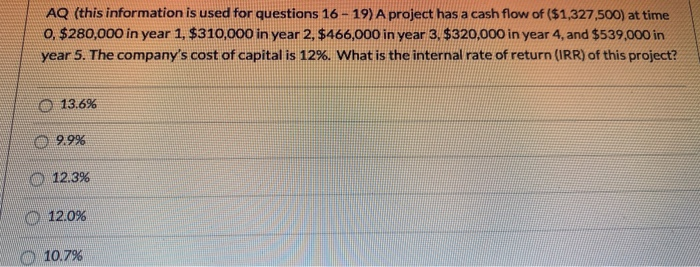

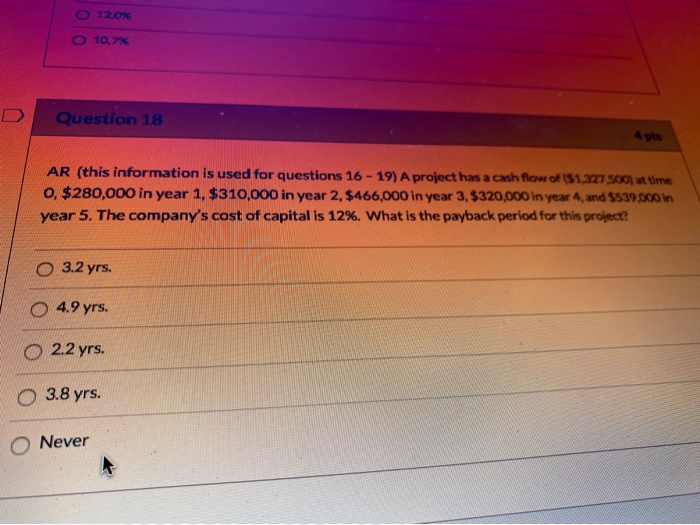

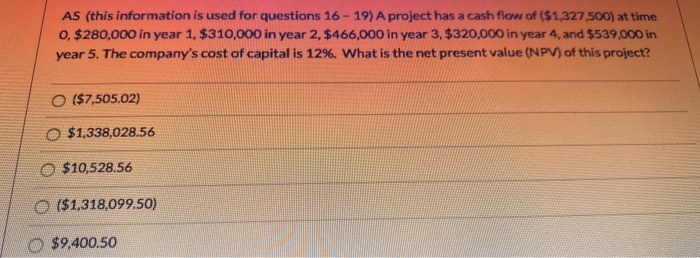

AP (this information is used for questions 16-19) A project has a cash flow of ($1,327,500) at time 0, $280,000 in year 1, $310,000 in year 2, $466,000 in year 3, $320,000 in year 4, and $539,000 in year 5. The company's cost of capital is 12%. What is the discounted payback period for this project? 3.03 yrs. 4.55 yrs. Never 3.85 yrs. 4.97 yrs. AQ (this information is used for questions 16-19) A project has a cash flow of ($1,327,500) at time 0 $280,000 in year 1, $310,000 in year 2, $466,000 in year 3. $320,000 in year 4, and $539,000 in year 5. The company's cost of capital is 12%. What is the internal rate of return (IRR) of this project? 13.6% 9.9% 12.3% 12.0% 10.7% 120x O 10,7% Question 18 AR (this information is used for questions 16 - 19) A project has a cash flow of ($1,277 500) a time 0, $280,000 in year 1, $310,000 in year 2, $466,000 in year 3, $320,000 in year 4 and 3539000 in year 5. The company's cost of capital is 12%. What is the payback period for this project O 3.2 yrs. O 4.9 yrs. O 2.2 yrs. O 3.8 yrs. Never AS (this information is used for questions 16-19) A project has a cash flow of ($1,327,500) at time 0, $280,000 in year 1, $310,000 in year 2, $466,000 in year 3, $320,000 in year 4, and $539,000 in year 5. The company's cost of capital is 12%. What is the net present value (NPV) of this project? O ($7,505.02) o $1,338,028.56 $10,528.56 O ($1,318,099.50) O $9,400.50

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts