Question: please answer all 4, question has been posted previously and has only recieved one answer Mark has decided to retire once he has $1,000,000 in

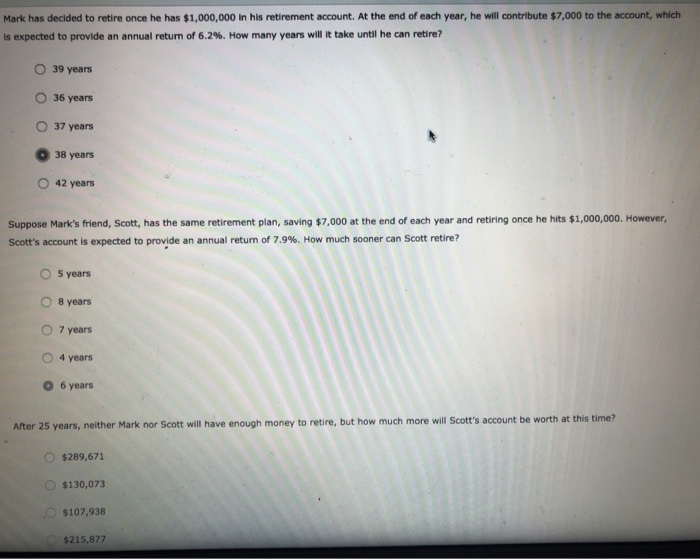

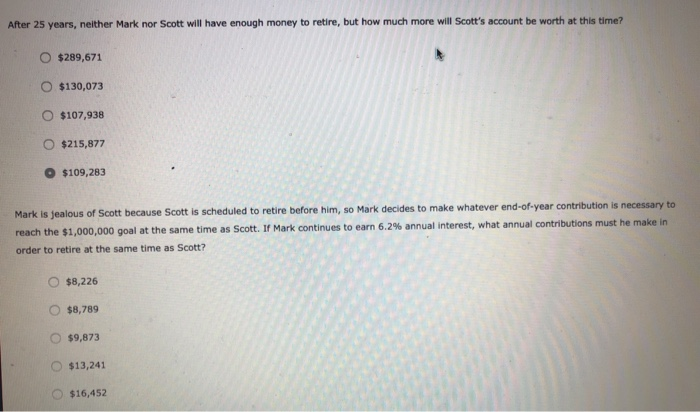

Mark has decided to retire once he has $1,000,000 in his retirement account. At the end of each year, he will contribute $7,000 to the account, which is expected to provide an annual return of 6.2%. How many years will it take until he can retire? 39 years O 36 years 37 years 38 years 42 years Suppose Mark's friend, Scott, has the same retirement plan, saving $7,000 at the end of each year and retiring once he hits $1,000,000. However, Scott's account is expected to provide an annual return of 7.9%. How much sooner can Scott retire? O 5 years O 8 years 7 years 4 years 0 6 years After 25 years, neither Mark nor Scott will have enough money to retire, but how much more will Scott's account be worth at this time? $289,671 $130,073 $107,938 $215,877 After 25 years, neither Mark nor Scott will have enough money to retire, but how much more will Scott's account be worth at this time? O $289,671 O $130,073 O $107,938 O $215,877 $109,283 Mark is jealous of Scott because Scott is scheduled to retire before him, so Mark decides to make whatever end-of-year contribution is necessary to reach the $1,000,000 goal at the same time as Scott. If Mark continues to earn 6.2% annual interest, what annual contributions must he make in order to retire at the same time as Scott? $8,226 $8,789 $9,873 $13,241 $16,452

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts