Question: PLEASE ANSWER ALL 4 QUESTIONS DO NOT SOLVE/EXPLAIN JUST ANSWER ALL 4 Question 39 (1 point) Clear Ltd. uses the FIFO cost method in a

PLEASE ANSWER ALL 4 QUESTIONS

DO NOT SOLVE/EXPLAIN JUST ANSWER ALL 4

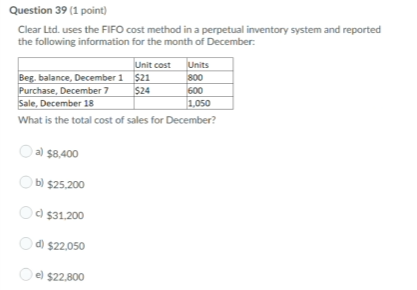

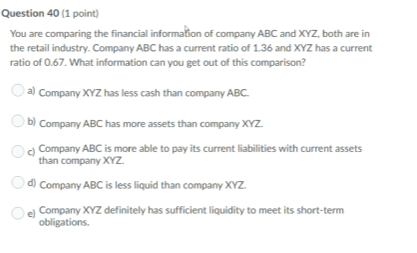

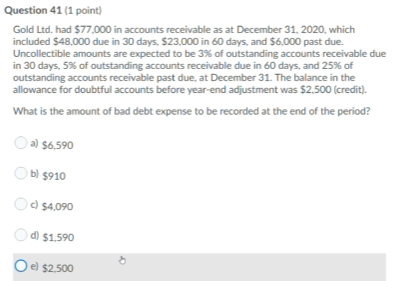

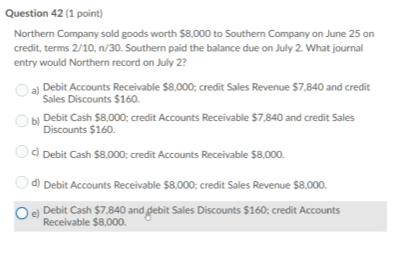

Question 39 (1 point) Clear Ltd. uses the FIFO cost method in a perpetual inventory system and reported the following information for the month of December Unit cost Units Beg. balance, December 1 $21 800 Purchase, December 7 $24 600 Sale, December 18 1,050 What is the total cost of sales for December? a) $8.400 b) $25.200 $31.200 d) $22,050 ) el $22.800 Question 40 (1 point You are comparing the financial information of company ABC and XYZ, both are in the retail industry. Company ABC has a current ratio of 1.36 and XYZ has a current ratio of 0.67. What information can you get out of this comparison? a) Company XYZ has less cash than company ABC. b) Company ABC has more assets than company XYZ. Company ABC is more able to pay its current liabilities with current assets than company XYZ d) Company ABC is less liquid than company XYZ. Company XYZ definitely has sufficient liquidity to meet its short-term obligations. Question 41 (1 point) Gold Ltd. had $77,000 in accounts receivable as at December 31, 2020, which included $48,000 due in 30 days. $23,000 in 60 days, and $6,000 past due. Uncollectible amounts are expected to be 3% of outstanding accounts receivable due in 30 days, 5% of outstanding accounts receivable due in 60 days, and 25% of outstanding accounts receivable past due, at December 31. The balance in the allowance for doubtful accounts before year-end adjustment was $2,500 (credit). What is the amount of bad debt expense to be recorded at the end of the period? a) $6,590 b) 5910 54,090 $ d) $1,590 ) Oe) $2,500 Question 42 (1 point) Northern Company sold goods worth $8,000 to Southern Company on June 25 on credit, terms 2/10, n/30. Southern paid the balance due on July 2. What journal entry would Northern record on July 2? a) Debit Accounts Receivable $8,000; credit Sales Revenue $7,840 and credit Sales Discounts $160. b) Debit Cash $8,000: credit Accounts Receivable $7.840 and credit Sales Discounts $160. c) Debit Cash $8,000; credit Accounts Receivable $8.000 d) Debit Accounts Receivable $8,000 credit Sales Revenue $8,000. OeDebit Cash $7,840 and gebit Sales Discounts $160, credit Accounts Receivable $8,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts