Question: Please Answer All 4 Questions In a sell-or-process-further decision, joint production costs: Multiple Choice Are irrelevant to the decision. Should be allocated to outputs based

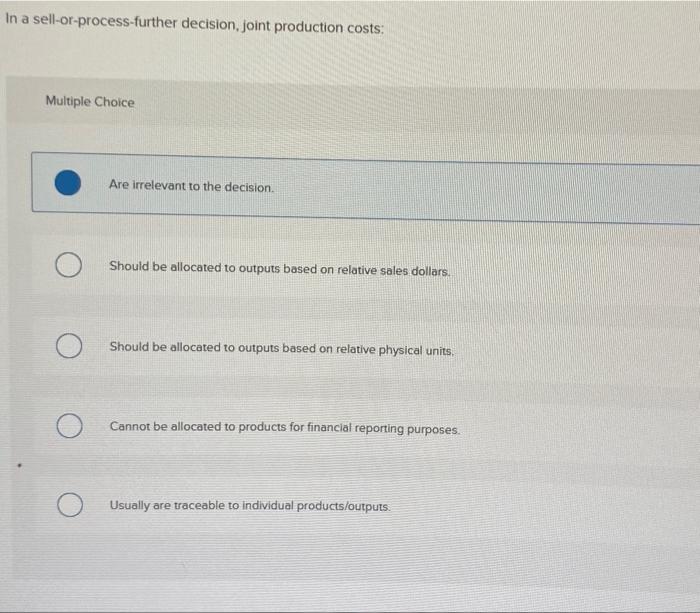

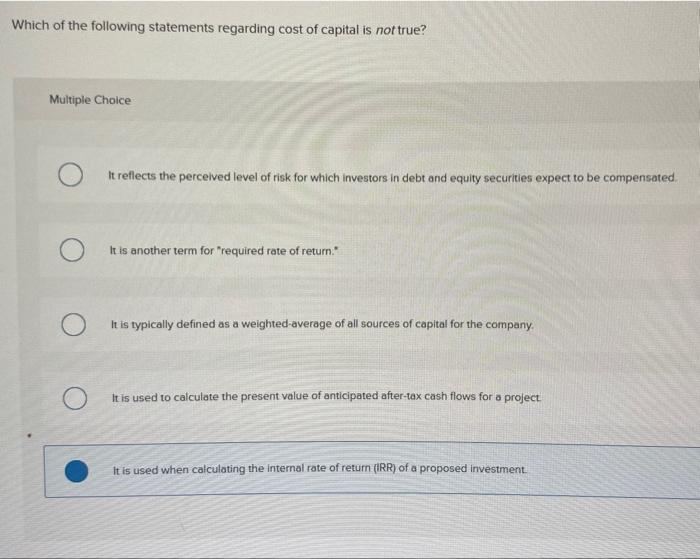

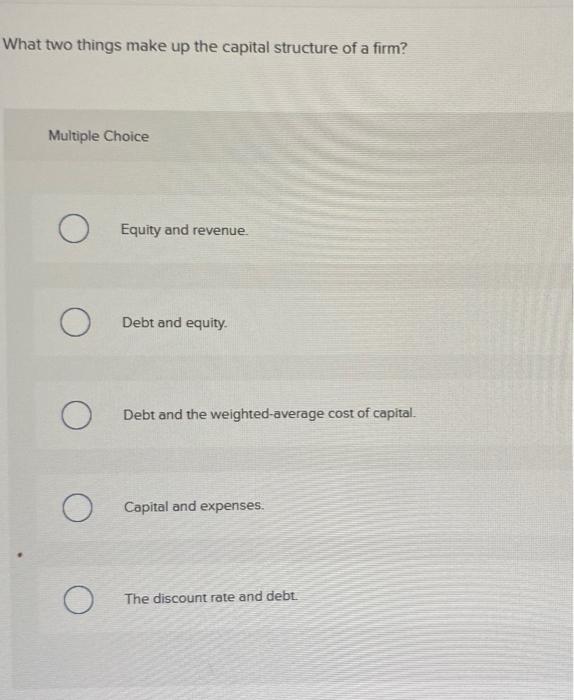

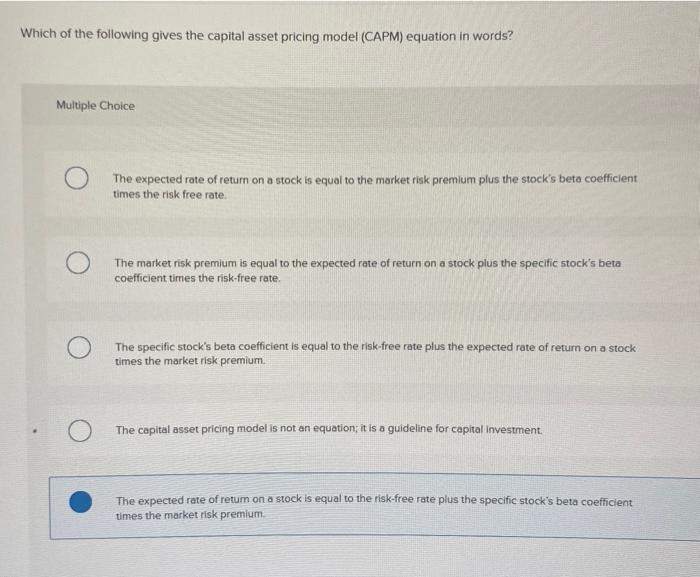

In a sell-or-process-further decision, joint production costs: Multiple Choice Are irrelevant to the decision. Should be allocated to outputs based on relative sales dollars. Should be allocated to outputs based on relative physical units. Cannot be allocated to products for financial reporting purposes Usually are traceable to individual products/outputs. Which of the following statements regarding cost of capital is not true? Multiple Choice It reflects the perceived level of risk for which investors in debt and equity securities expect to be compensated. It is another term for "required rate of return." It is typically defined as a weighted-average of all sources of capital for the company, It is used to calculate the present value of anticipated after-tax cash flows for a project. It is used when calculating the internal rate of retum (iRR) of a proposed investment. What two things make up the capital structure of a firm? Multiple Choice Equity and revenue. Debt and equity. Debt and the weighted-average cost of capital. Capital and expenses. The discount rate and debt. Which of the following gives the capital asset pricing model (CAPM) equation in words? Multiple Choice The expected rate of retum on a stock is equal to the market risk premium plus the stock's beta coefficient times the risk free rate. The market risk premium is equal to the expected rate of return on a stock plus the specific stock's beta coefficient times the risk-free rate. The specific stock's beta coefficient is equal to the risk-free rate plus the expected rate of return on a stock times the market risk premium. The capital asset pricing model is not an equation; it is a guideline for capital investment. The expected rate of retum on a stock is equal to the risk-free rate plus the specific stock's beta coefficient times the market risk premium

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts