Question: PLEASE ANSWER ALL 4 QUESTIONS PLEASEEE!!! MCQ: Legacy Inc. recently issued bonds that mature in 10 years. They have a par value of $1,000 and

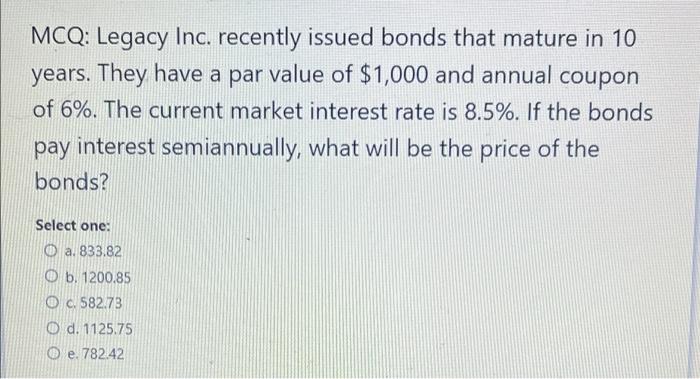

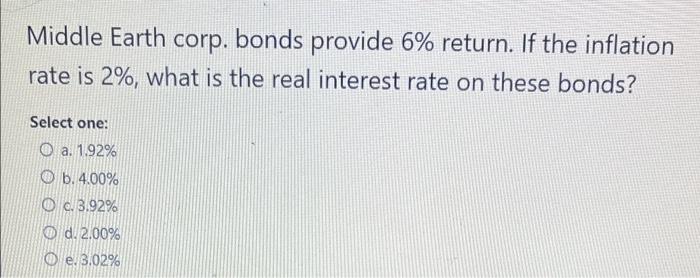

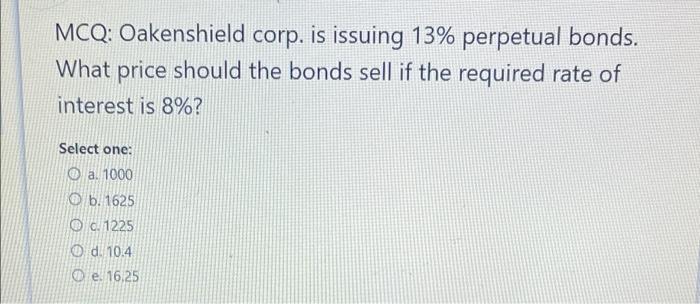

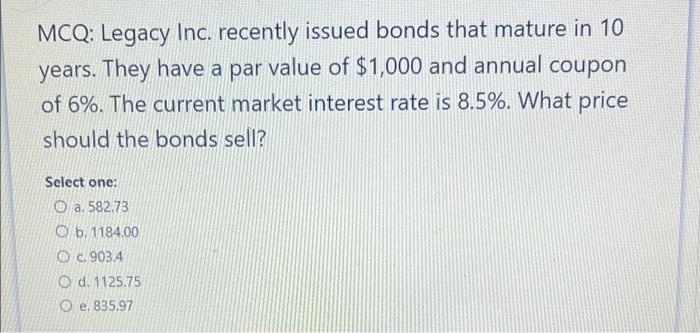

MCQ: Legacy Inc. recently issued bonds that mature in 10 years. They have a par value of $1,000 and annual coupon of 6%. The current market interest rate is 8.5%. If the bonds pay interest semiannually, what will be the price of the bonds? Select one: O a. 833.82 O b. 1200.85 O c. 582.73 O d. 1125.75 O e. 782.42 Middle Earth corp. bonds provide 6% return. If the inflation rate is 2%, what is the real interest rate on these bonds? Select one: O a. 1.92% O b.4.00% O C.3.92% O d. 2.00% O e. 3.02% MCQ: Oakenshield corp. is issuing 13% perpetual bonds. What price should the bonds sell if the required rate of interest is 8%? Select one: O a. 1000 O b. 1625 C. 1225 O d. 10.4 O e. 16.25 MCQ: Legacy Inc. recently issued bonds that mature in 10 years. They have a par value of $1,000 and annual coupon of 6%. The current market interest rate is 8.5%. What price should the bonds sell? Select one: O a. 582.73 O b. 1184.00 c. 903.4 O d. 1125.75 O e. 835.97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts