Question: please answer all 4, thank you A bond has five years to maturity, a $1,000 face value, and a 6.5% coupon rate with annual coupons.

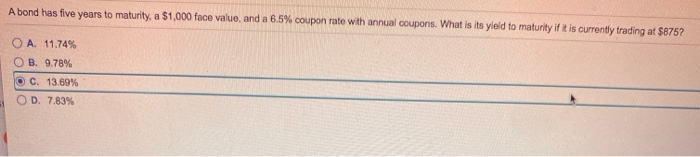

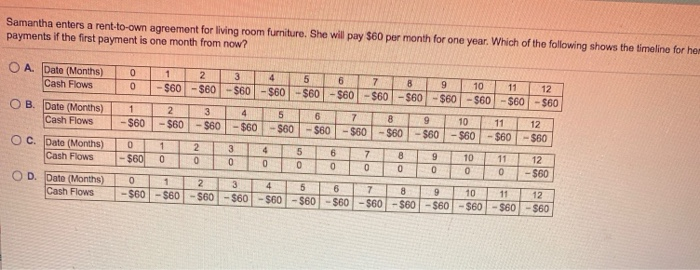

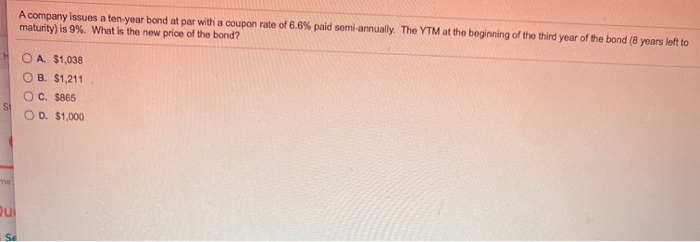

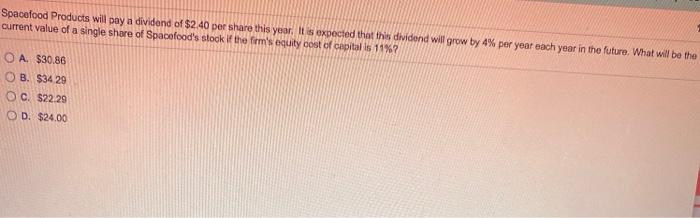

A bond has five years to maturity, a $1,000 face value, and a 6.5% coupon rate with annual coupons. What is its yield to maturity if it is currently trading at $875? O A 11.74% OB. 9.78% OC 13.69% OD. 7.83% Samantha enters a rent-to-own agreement for living room furniture. She will pay $60 per month for one year. Which of the following shows the timeline for her payments if the first payment is one month from now? O A. Data (Months) Cash Flows O B . Date (Months) Cash Flows OC. Date (Months) Cash Flows OD. Date (Months) Cash Flows 0 1 2 3 4 5 6 7 8 9 10 11 12 0 -560 - $60 - $60-560 -560 - $60-$60-560 - $60 - $60-560-560 1 2 3 4 5 6 7 8 9 10 11 12 - $60 - $60 - $60 - $60 -560 - $60 - $60 - 560 -560 - $60 - $60 -560 0 1 2 3 4 5 6 7 8 9 10 11 12 - $600OOOOOOOOOO-560 0 1 2 3 4 -560-560-560-560-560 5 6 -560-560 7 8 9 10 11 12 - $60-560 - $60 - $60 - $60-560 A company issues a ten year bond at par with a coupon rate of 6.6% paid semi-annually. The YTM at the beginning of the third year of the bond (8 years left to maturity) is 9%. What is the new price of the bond? O A $1,038 O B. $1,211 OC. $865 OD. $1,000 lu Spacefood Products will pay a dividend of $2.40 per share this year. It is expected that this dividend will grow by 4% per year each year in the future. What will be the urrent value of a single shore of Spacefood's stock if the firm's equity cost of capital is 11%? O A. $30.86 O B. $34 29 OC. $22.29 OD. $24.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts