Question: Please Answer all 5 questions 2. What is the current beta on MME's common stock? Do not round intermediate calculations. Round your answer to four

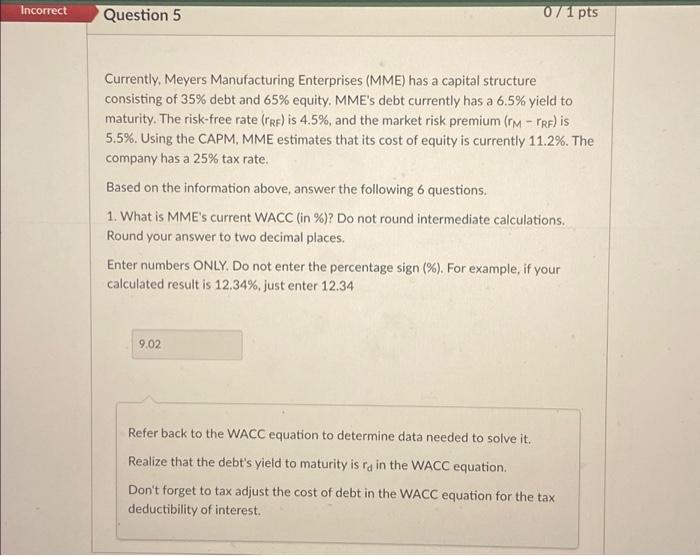

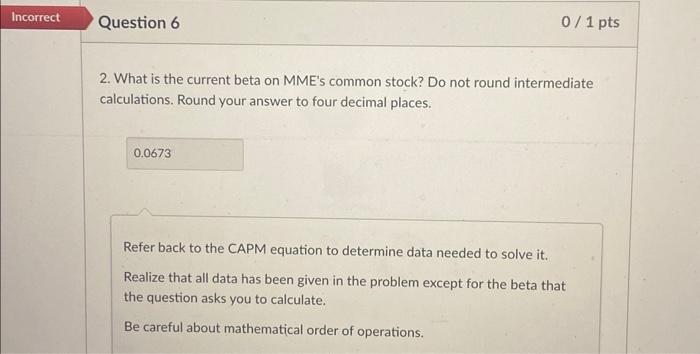

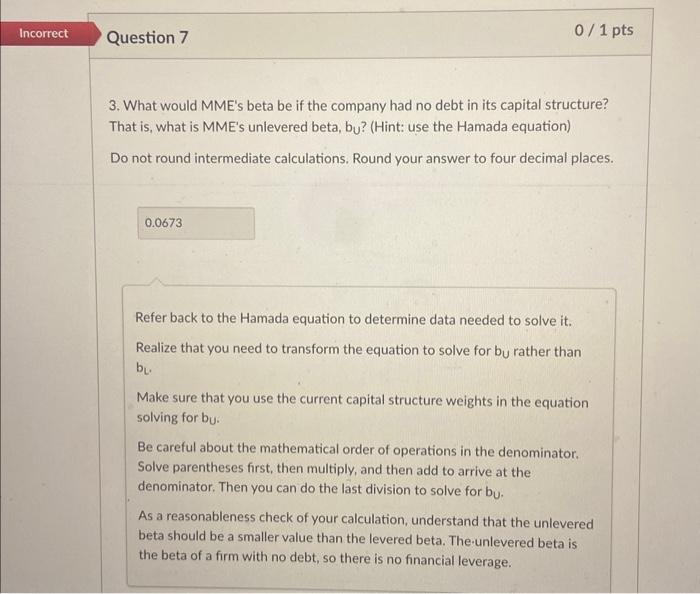

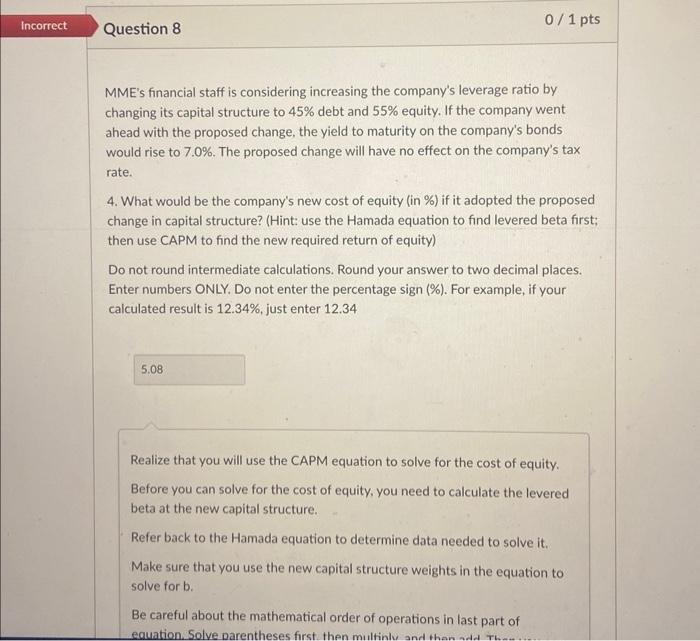

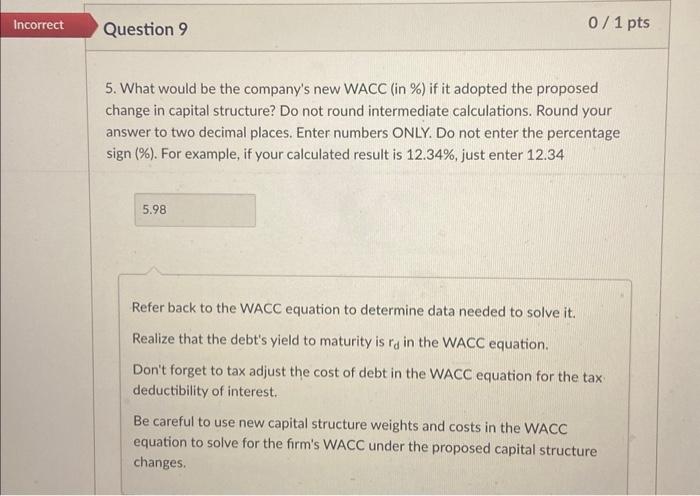

2. What is the current beta on MME's common stock? Do not round intermediate calculations. Round your answer to four decimal places. Refer back to the CAPM equation to determine data needed to solve it. Realize that all data has been given in the problem except for the beta that the question asks you to calculate. Be careful about mathematical order of operations. 5. What would be the company's new WACC (in \%) if it adopted the proposed change in capital structure? Do not round intermediate calculations. Round your answer to two decimal places. Enter numbers ONLY. Do not enter the percentage sign (\%). For example, if your calculated result is 12.34%, just enter 12.34 Refer back to the WACC equation to determine data needed to solve it. Realize that the debt's yield to maturity is rd in the WACC equation. Don't forget to tax adjust the cost of debt in the WACC equation for the tax deductibility of interest. Be careful to use new capital structure weights and costs in the WACC equation to solve for the firm's WACC under the proposed capital structure changes. 3. What would MME's beta be if the company had no debt in its capital structure? That is, what is MME's unlevered beta, bu? (Hint: use the Hamada equation) Do not round intermediate calculations. Round your answer to four decimal places. Refer back to the Hamada equation to determine data needed to solve it. Realize that you need to transform the equation to solve for bu rather than b. Make sure that you use the current capital structure weights in the equation solving for bu. Be careful about the mathematical order of operations in the denominator. Solve parentheses first, then multiply, and then add to arrive at the denominator. Then you can do the last division to solve for bu. As a reasonableness check of your calculation, understand that the unlevered beta should be a smaller value than the levered beta. The-unlevered beta is the beta of a firm with no debt, so there is no financial leverage. Currently, Meyers Manufacturing Enterprises (MME) has a capital structure consisting of 35% debt and 65% equity. MME's debt currently has a 6.5% yield to maturity. The risk-free rate (rRF) is 4.5%, and the market risk premium (rMrRF) is 5.5%. Using the CAPM, MME estimates that its cost of equity is currently 11.2%. The company has a 25% tax rate. Based on the information above, answer the following 6 questions. 1. What is MME's current WACC (in \%)? Do not round intermediate calculations. Round your answer to two decimal places. Enter numbers ONLY. Do not enter the percentage sign (\%). For example, if your calculated result is 12.34%, just enter 12.34 Refer back to the WACC equation to determine data needed to solve it. Realize that the debt's yield to maturity is rd in the WACC equation. Don't forget to tax adjust the cost of debt in the WACC equation for the tax deductibility of interest. MME's financial staff is considering increasing the company's leverage ratio by changing its capital structure to 45% debt and 55% equity. If the company went ahead with the proposed change, the yield to maturity on the company's bonds would rise to 7.0%. The proposed change will have no effect on the company's tax rate. 4. What would be the company's new cost of equity (in \%) if it adopted the proposed change in capital structure? (Hint: use the Hamada equation to find levered beta first: then use CAPM to find the new required return of equity) Do not round intermediate calculations. Round your answer to two decimal places. Enter numbers ONLY. Do not enter the percentage sign (\%). For example, if your calculated result is 12.34%, just enter 12.34 Realize that you will use the CAPM equation to solve for the cost of equity. Before you can solve for the cost of equity, you need to calculate the levered beta at the new capital structure. Refer back to the Hamada equation to determine data needed to solve it. Make sure that you use the new capital structure weights in the equation to solve for b. Be careful about the mathematical order of operations in last part of

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts