Question: please answer all 5 questions and show your work. Extra Credit (10 total points) semiannual bond that sells for Calculate the cost of debt for

please answer all 5 questions and show your work.

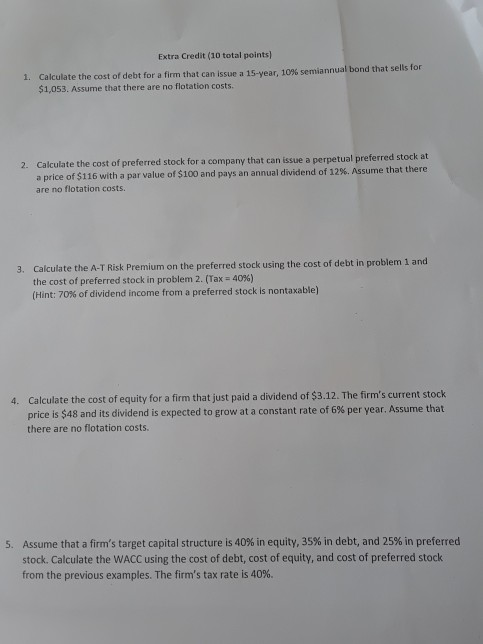

Extra Credit (10 total points) semiannual bond that sells for Calculate the cost of debt for a firm that can issue a 15-year, 10% $1,053. Assume that there are no flotation costs. I. Calculate the cost of preferred stock for a company that can issue a perpetual preferred stock at a price of $116 with a par value of $100 and pays an annual dividend of 12%. Assume that there 2. are no flotation costs. Calculate the A-T Risk Premium on the preferred stock using the cost of debt in problem 1 and the cost of preferred stock in problem 2, (Tac 40%) (Hint: 70% of dividend income from a preferred stock is nontaxable) 3. Calculate the cost of equity for a firm that just paid a dividend of $3.12. The firm's current stock price is $48 and its dividend is expected to grow at a constant rate of 6% per year. Assume that 4. there are no flotation costs. Assume that a firm's target capital structure is 40% in equity, 35% in debt, and 25% in preferred stock. Calculate the WACC using the cost of debt, cost of equity, and cost of preferred stock from the previous examples. The firm's tax rate is 40%. 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts