Question: please answer all 6. A benefactor proposes to set up an endowment for student scholarship at the Business School. The proposal is to provide scholarship

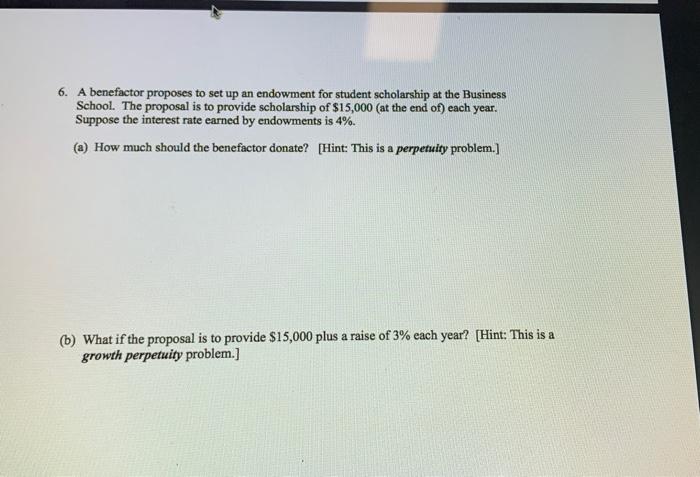

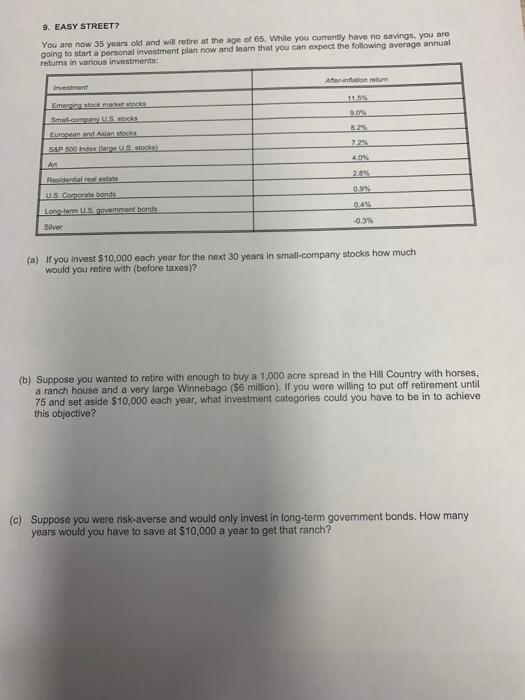

6. A benefactor proposes to set up an endowment for student scholarship at the Business School. The proposal is to provide scholarship of $15,000 (at the end of) each year. Suppose the interest rate earned by endowments is 4%. (a) How much should the benefactor donate? [Hint: This is a perpetuity problem.] (b) What if the proposal is to provide $15,000 plus a raise of 3% each year? [Hint: This is a growth perpetuity problem.] 9. EASY STREET? You are now 35 years old and will retire at the age of 65. While you currently have no savings, you are going to start a personal investment plan now and learn that you can expect the following average annual retums in various investments: Investment Emerging stock market stocks Smal-company US stocks European and Asian stocks S&P 500 Index (large US stocks) Art Residential real estate U.S. Corporate bonds Long-term US govemment bonds Silver After inflation return 11.5% 8.2% 7.2% 4.0% -0.3% (a) If you invest $10,000 each year for the next 30 years in small-company stocks how much would you retire with (before taxes)? (b) Suppose you wanted to retire with enough to buy a 1,000 acre spread in the Hill Country with horses, a ranch house and a very large Winnebago ($6 million). If you were willing to put off retirement until 75 and set aside $10,000 each year, what investment categories could you have to be in to achieve this objective? (c) Suppose you were risk-averse and would only invest in long-term government bonds. How many years would you have to save at $10,000 a year to get that ranch

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts