Question: please answer all 6. You are given the following information about a European call option on Stock XYZ. Use the Black-Scholes model to determine the

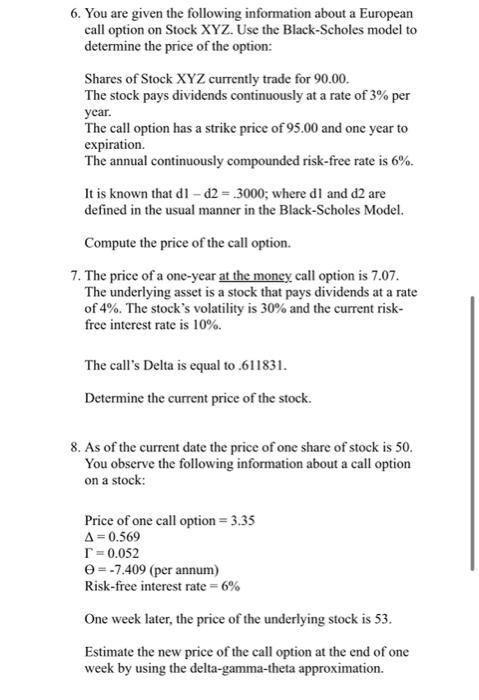

6. You are given the following information about a European call option on Stock XYZ. Use the Black-Scholes model to determine the price of the option: Shares of Stock XYZ currently trade for 90.00 . The stock pays dividends continuously at a rate of 3% per year. The call option has a strike price of 95.00 and one year to expiration. The annual continuously compounded risk-free rate is 6%. It is known that d1d2=.3000; where d1 and d2 are defined in the usual manner in the Black-Scholes Model. Compute the price of the call option. 7. The price of a one-year at the money call option is 7.07 . The underlying asset is a stock that pays dividends at a rate of 4%. The stock's volatility is 30% and the current riskfree interest rate is 10%. The call's Delta is equal to .611831 . Determine the current price of the stock. 8. As of the current date the price of one share of stock is 50 . You observe the following information about a call option on a stock: Price of one call option =3.35 =0.569=0.052=7.409(perannum) Risk-free interest rate =6% One week later, the price of the underlying stock is 53 . Estimate the new price of the call option at the end of one week by using the delta-gamma-theta approximation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts