Question: PLEASE ANSWER ALL 7 QUESTIONS, I DO NOT NEED EXPLANATIONS JUST ANSWERS. THANK YOU 1. A company wants to save $750,000 to buy some new

PLEASE ANSWER ALL 7 QUESTIONS, I DO NOT NEED EXPLANATIONS JUST ANSWERS. THANK YOU

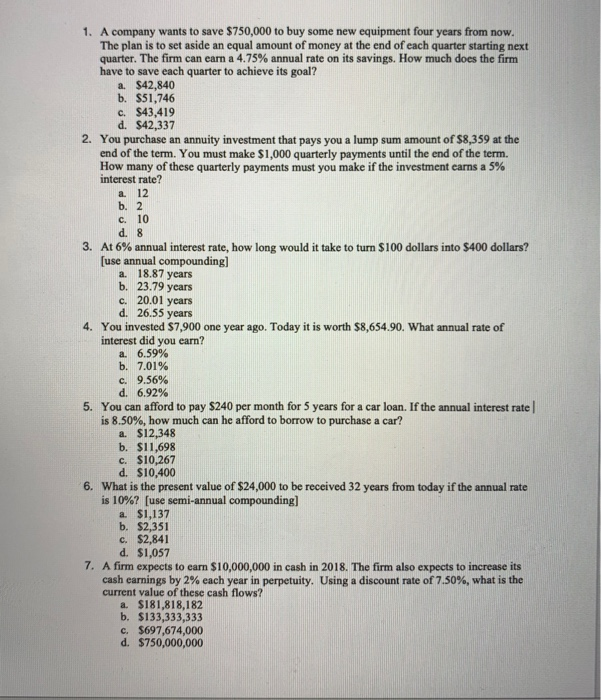

1. A company wants to save $750,000 to buy some new equipment four years from now. The plan is to set aside an equal amount of money at the end of each quarter starting next quarter. The firm can earn a 4.75% annual rate on its savings. How much does the firm have to save each quarter to achieve its goal? a. $42,840 b. $51,746 c. $43,419 d. $42,337 2. You purchase an annuity investment that pays you a lump sum amount of $8,359 at the end of the term. You must make $1,000 quarterly payments until the end of the term. How many of these quarterly payments must you make if the investment earns a 5% interest rate? a. 12 b. 2 c. 10 d. 8 3. At 6% annual interest rate, how long would it take to turn $100 dollars into $400 dollars? use annual compounding] a. 18.87 years b. 23.79 years c. 20.01 years d. 26.55 years 4. You invested $7,900 one year ago. Today it is worth $8,654.90. What annual rate of interest did you earn? 6.59% 7.01% 9.56% 6.92% b. . d. 5. You can afford to pay $240 per month for 5 years for a car loan. If the annual interest rate | is 8.50%, how much can he afford to borrow to purchase a car? a. $12,348 b. $11,698 c. $10,267 d. $10,400 6. What is the present value of $24,000 to be received 32 years from today if the annual rate is 10%? [use semi-annual compounding] a. $1,137 b. $2,351 c. $2,841 d. $1,057 7. A firm expects to earn $10,000,000 in cash in 2018. The firm also expects to increase its Using a discount rate of 7.50%, what is the cash earnings by 2% each year in perpetuity. current value of these cash flows? a. $181,818,182 b. $133,333,333 c. $697,674,000 d. $750,000,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts