Question: Please answer all aliswer for the question. Each ques 1. The Walthers Company has a semi-annual coupol onth market rate of interest will have a)

Please answer all

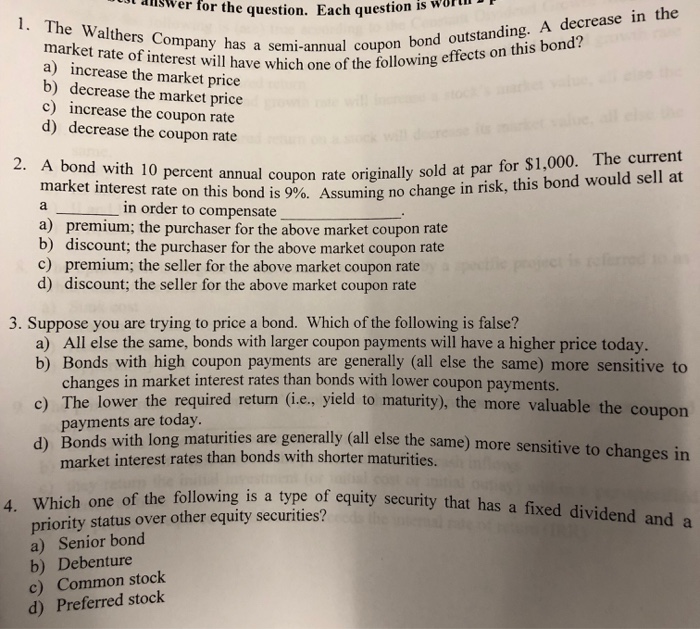

Please answer all aliswer for the question. Each ques 1. The Walthers Company has a semi-annual coupol onth market rate of interest will have a) increase the market price b) decrease the market price a semi-annual coupon bond outstanding. A decrease in the the follo ) decrease th market price e which one of the following effects on this bond? c) increase the coupon rate d) decrease the coupon rate 2. A bond with 10 percent annual coupon rate origina e current uld sell at market interest rate on this bond is 9%. Assuming no change in risk, this bond wo a in order to compensate a) premium; the purchaser for the above market coupon rate b) discount; the purchaser for the above market coupon rate c) premium; the seller for the above market coupon rate d) discount; the seller for the above market coupon rate 3. Suppose you are trying to price a bond. Which of the following is false? a) All else the same, bonds with larger coupon payments will have a higher price today b) Bonds with high coupon payments are generally (all else the same) more sensitive to changes in market interest rates than bonds with lower coupon payments. payments are today market interest rates than bonds with shorter maturities. the required return (i.e., yield to maturity), the more valuable the coupon maturities are generally (all else the same) more sensitive to changes in d) Bonds with long of the following is a type of equity security that has a fixed dividend and a 4. Which one priority status over other equity securities? a) Senior bond b) Debenture c) Common stock d) Preferred stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts