Question: please answer all and give all steps. I will give u an upvote if the answer is accurate! Thankyou and enjoy~ Question 3 (a) A

please answer all and give all steps. I will give u an upvote if the answer is accurate! Thankyou and enjoy~

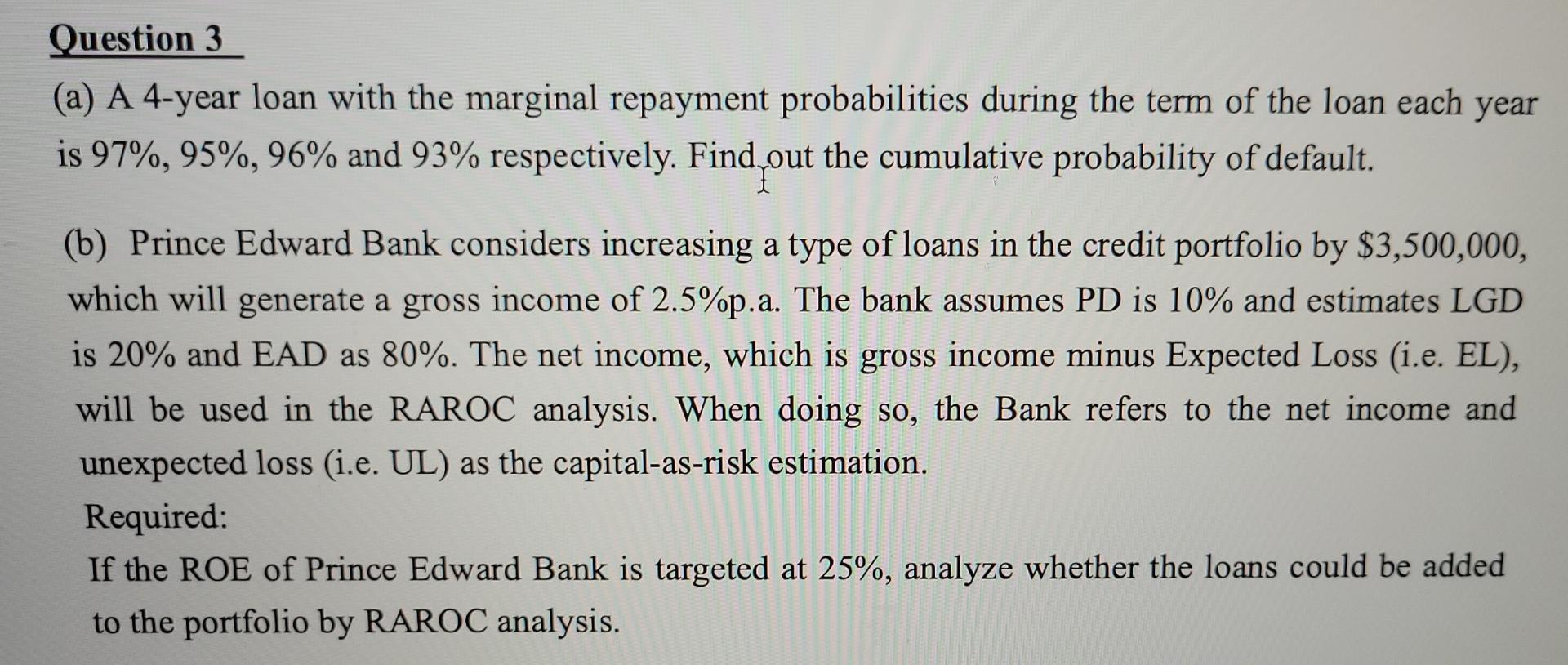

Question 3 (a) A 4-year loan with the marginal repayment probabilities during the term of the loan each year is 97%, 95%,96% and 93% respectively. Find out the cumulative probability of default. (b) Prince Edward Bank considers increasing a type of loans in the credit portfolio by $3,500,000, which will generate a gross income of 2.5%p.a. The bank assumes PD is 10% and estimates LGD is 20% and EAD as 80%. The net income, which is gross income minus Expected Loss (i.e. EL), will be used in the RAROC analysis. When doing so, the Bank refers to the net income and unexpected loss (i.e. UL) as the capital-as-risk estimation. Required: If the ROE of Prince Edward Bank is targeted at 25%, analyze whether the loans could be added to the portfolio by RAROC analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts