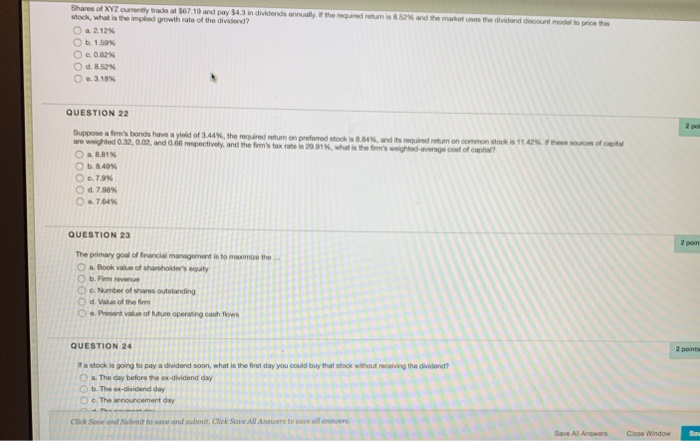

Question: PLEASE ANSWER ALL and the matures the dividend discount model to see this Shares of XYZ currently trace a $67.19 and pay $4.3 in dividends

and the matures the dividend discount model to see this Shares of XYZ currently trace a $67.19 and pay $4.3 in dividends annually the required tumis 8.52 stock, what is the implied growth rate of the dividend? a. 2.12% b. 1.50% 0.62% O d. 8.52% 03.18% QUESTION 22 the and round on common sockis 11.02h w a verage cost of capital? UOS Suppose a firm's bonds have a yield of 3.44%, the more return on preferred to are weighted 0.32 0.09, and 0.60 rompectively, and the firm's tax rates 29.01. what a 8.81% b. 8.49% O 0.79% O d. 7.90% 0 .7.64% QUESTION 23 2 poin The primary goal of financial management is to maxim a Book value of shareholder's equity b. Pirm revenue O e Number of shares outstanding d. Value of the fimm Oo. Present value of future operating cash flow QUESTION 24 Fa stock is going to pay a dividend soon, what is the first a. The day before the ex-dividend day b. The dividend day c. The councement day Click Save and submit to save and submit. Click Save Al Close Window Sas

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts