Question: Please answer all as no more monthly question left! Thumbs up!! Consider a stock that will have price of $46.96 one year from now and

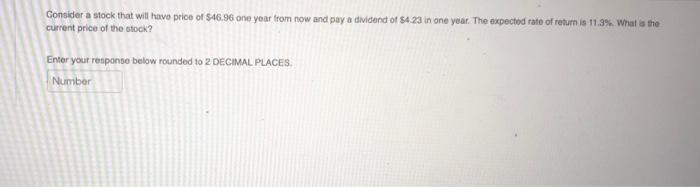

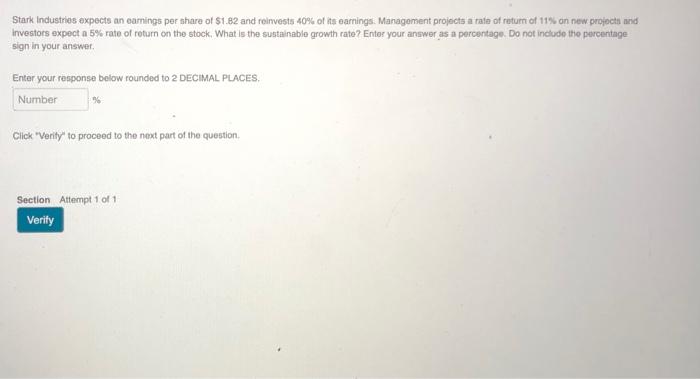

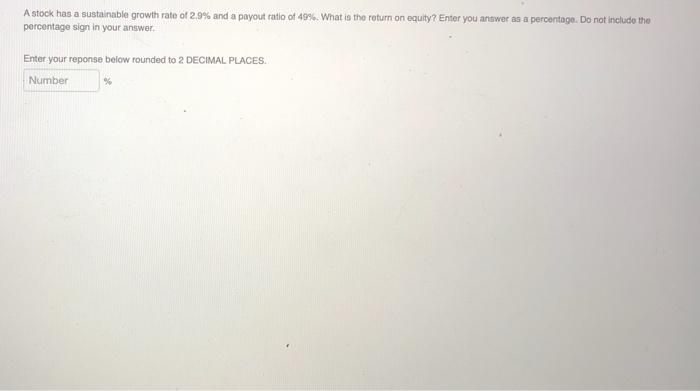

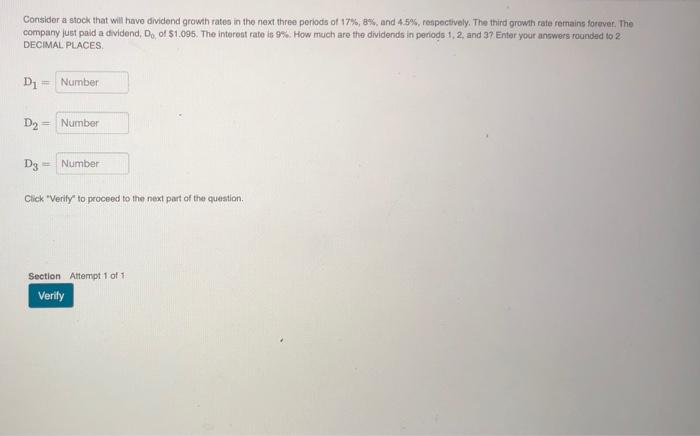

Consider a stock that will have price of $46.96 one year from now and pay a dividend of 84.23 in one year. The expected rate of return is 11.3% What is the current price of the stock? Enter your response below rounded to 2 DECIMAL PLACES Number Stark Industries expects an earnings per share of $1.82 and reinvests 40% of its earnings. Management projects a rate of ratum of 11% on new projects and Investors expect a 5% rate of return on the stock. What is the sustainable growth rato? Enter your answer as a percentage. Do not include the percentage sign in your answer Enter your response below rounded to 2 DECIMAL PLACES, Number Click "Verity" to proceed to the next part of the question, Section Attempt 1 of 1 Verity Astock has a sustainable growth rate of 2.9% and a payout ratio of 49%. What is the return on equity? Enter you answer as a percentage. Do not include the percentage sign in your answer Enter your reponse below rounded to 2 DECIMAL PLACES Number Consider a stock that will have dividend growth rates in the next three periods of 17%, 8%, and 4.5%, respectively. The third growth rate remains forever. The company just paid a dividend, D. of $1.095. The interest rate is 9% How much are the dividends in periods 1, 2 and 37 Enter your answers rounded to 2 DECIMAL PLACES Di Number D2 Number DE Number Click "Verity to proceed to the next part of the question. Section Attempt 1 of 1 Verity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts