Question: Please answer all as no questions remain! Thumbs up! The market risk premium is 8% and the risk-free rate is 1,3%. The beta of the

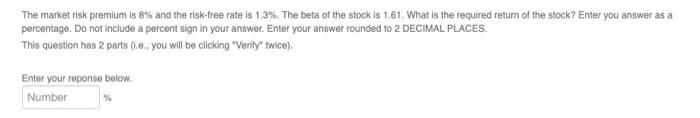

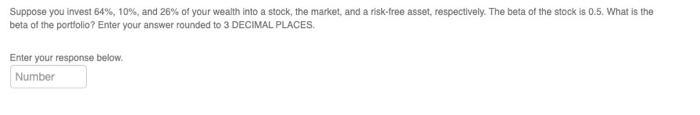

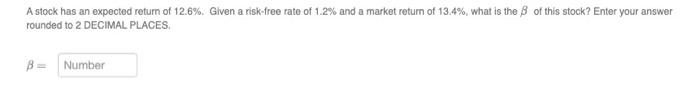

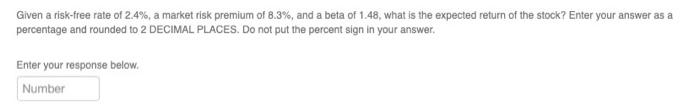

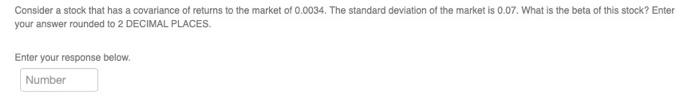

The market risk premium is 8% and the risk-free rate is 1,3%. The beta of the stock is 1.61. What is the required return of the stock? Enter you answer as a percentage. Do not include a percent sign in your answer. Enter your answer rounded 10 2 DECIMAL PLACES. This question has 2 parts (le, you will be clicking "Verity twice). Enter your reponse below. Number 96 Suppose you invest 84%, 10%, and 26% of your wealth into a stock, the market, and a risk-free asset, respectively. The beta of the stock is 0.5. What is the beta of the portfolio? Enter your answer rounded to 3 DECIMAL PLACES Enter your response below. Number A stock has an expected return of 12.6%. Given a risk-free rate of 1.2% and a market return of 13.4%, what is the 8 of this stock? Enter your answer rounded to 2 DECIMAL PLACES Number Given a risk-free rate of 2.4%, a market risk premium of 8.3%, and a beta of 1.48, what is the expected return of the stock? Enter your answer as a percentage and rounded to 2 DECIMAL PLACES. Do not put the percent sign in your answer. Enter your response below. Number Consider a stock that has a covariance of returns to the market of 0.0034. The standard deviation of the market is 0.07. What is the beta of this stock? Enter your answer rounded to 2 DECIMAL PLACES Enter your response below. Number

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts