Question: Please answer all ASAP. taking exam right now QUESTION 1 Case Analysis: IT'S ALL GREEK TO HER When Sherren Mendoza opened her auto repair shop,

Please answer all ASAP. taking exam right now

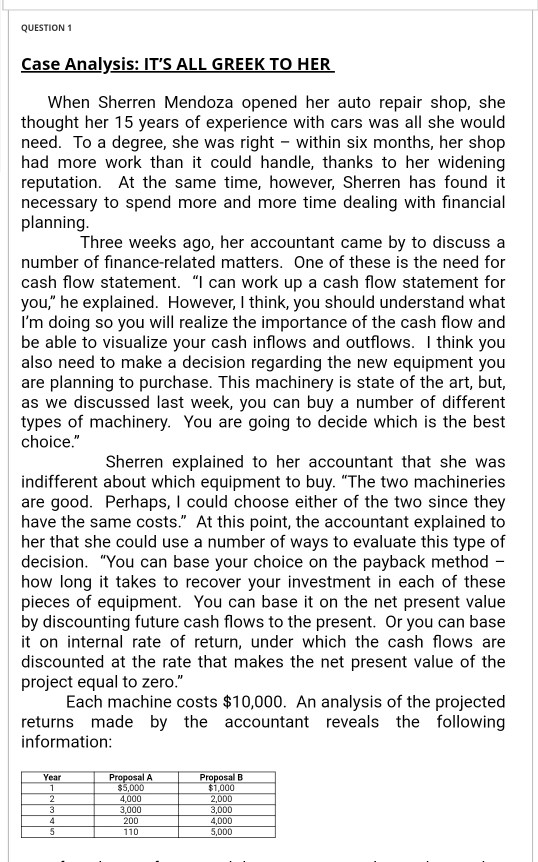

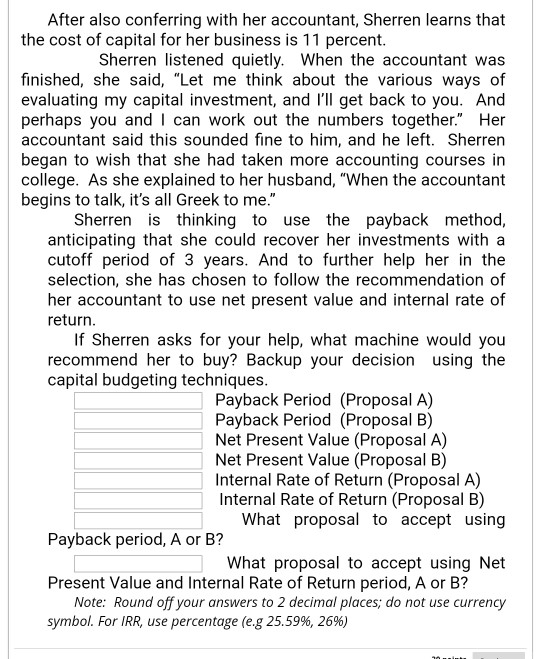

QUESTION 1 Case Analysis: IT'S ALL GREEK TO HER When Sherren Mendoza opened her auto repair shop, she thought her 15 years of experience with cars was all she would need. To a degree, she was right - within six months, her shop had more work than it could handle, thanks to her widening reputation. At the same time, however, Sherren has found it necessary to spend more and more time dealing with financial planning. Three weeks ago, her accountant came by to discuss a number of finance-related matters. One of these is the need for cash flow statement. "I can work up a cash flow statement for you," he explained. However, I think, you should understand what I'm doing so you will realize the importance of the cash flow and be able to visualize your cash inflows and outflows. I think you also need to make a decision regarding the new equipment you are planning to purchase. This machinery is state of the art, but, as we discussed last week, you can buy a number of different types of machinery. You are going to decide which is the best choice." Sherren explained to her accountant that she was indifferent about which equipment to buy. "The two machineries are good. Perhaps, I could choose either of the two since they have the same costs." At this point, the accountant explained to her that she could use a number of ways to evaluate this type of decision. "You can base your choice on the payback method - how long it takes to recover your investment in each of these pieces of equipment. You can base it on the net present value by discounting future cash flows to the present. Or you can base it on internal rate of return, under which the cash flows are discounted at the rate that makes the net present value of the project equal to zero." Each machine costs $10,000. An analysis of the projected returns made by the accountant reveals the following information: Year 1 2 3 4 5 Proposal A $5,000 4,000 3,000 200 110 Proposal B $1,000 2,000 3,000 4,000 5,000 After also conferring with her accountant, Sherren learns that the cost of capital for her business is 11 percent. Sherren listened quietly. When the accountant was finished, she said, "Let me think about the various ways of evaluating my capital investment, and I'll get back to you. And perhaps you and I can work out the numbers together." Her accountant said this sounded fine to him, and he left. Sherren began to wish that she had taken more accounting courses in college. As she explained to her husband, "When the accountant begins to talk, it's all Greek to me." Sherren is thinking to use the payback method, anticipating that she could recover her investments with a cutoff period of 3 years. And to further help her in the selection, she has chosen to follow the recommendation of her accountant to use net present value and internal rate of return. If Sherren asks for your help, what machine would you recommend her to buy? Backup your decision using the capital budgeting techniques. Payback Period (Proposal A) Payback Period (Proposal B) Net Present Value (Proposal A) Net Present Value (Proposal B) Internal Rate of Return (Proposal A) Internal Rate of Return (Proposal B) What proposal to accept using Payback period, A or B? What proposal to accept using Net Present Value and Internal Rate of Return period, A or B? Note: Round off your answers to 2 decimal places; do not use currency symbol. For IRR, use percentage (e.g 25.59%, 26%)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts