Question: please answer all asap. will give thumbs up. A piece of equipment is purchased at an acquisition price of $142,000 and is estimated to last

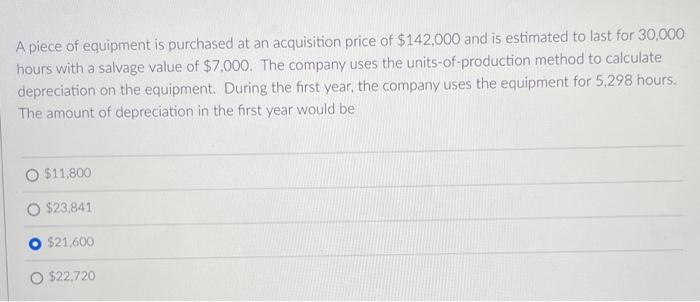

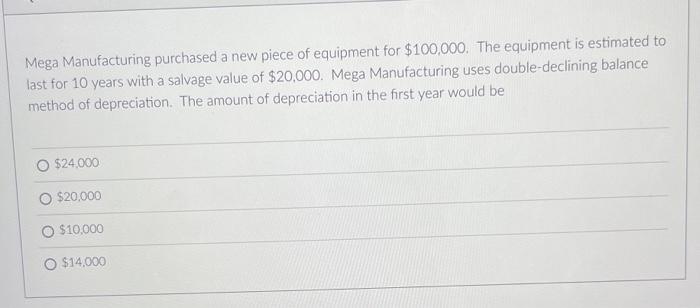

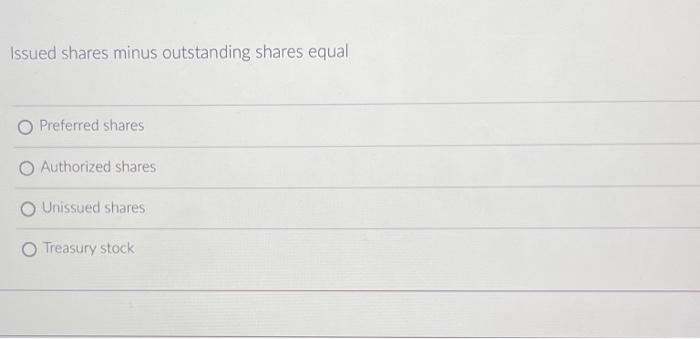

A piece of equipment is purchased at an acquisition price of $142,000 and is estimated to last for 30,000 hours with a salvage value of $7,000. The company uses the units-of-production method to calculate depreciation on the equipment. During the first year, the company uses the equipment for 5,298 hours. The amount of depreciation in the first year would be $11.800 $23,841 $21,600 $22,720 Mega Manufacturing purchased a new piece of equipment for $100,000. The equipment is estimated to last for 10 years with a salvage value of $20,000. Mega Manufacturing uses double-declining balance method of depreciation. The amount of depreciation in the first year would be O $24,000 O $20,000 O $10,000 O $14,000 Issued shares minus outstanding shares equal Preferred shares Authorized shares Unissued shares O Treasury stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts