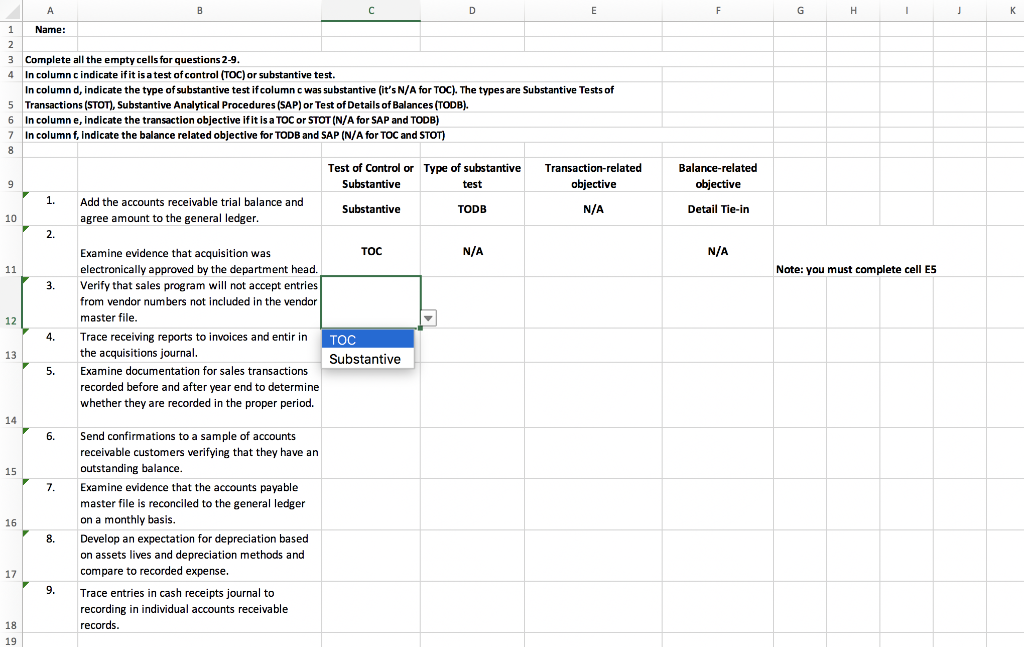

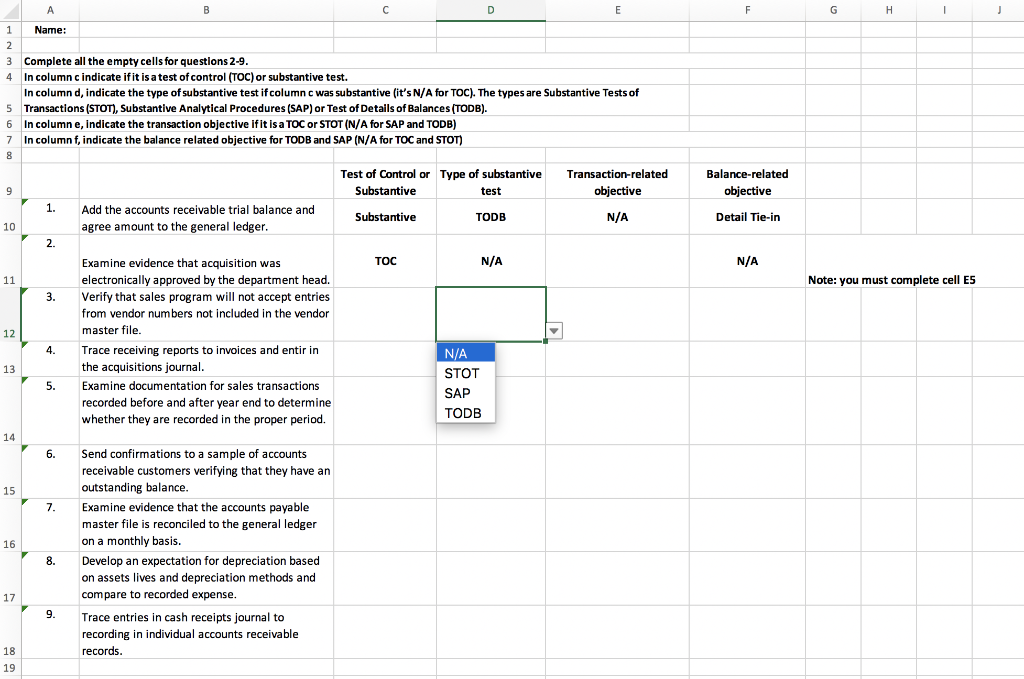

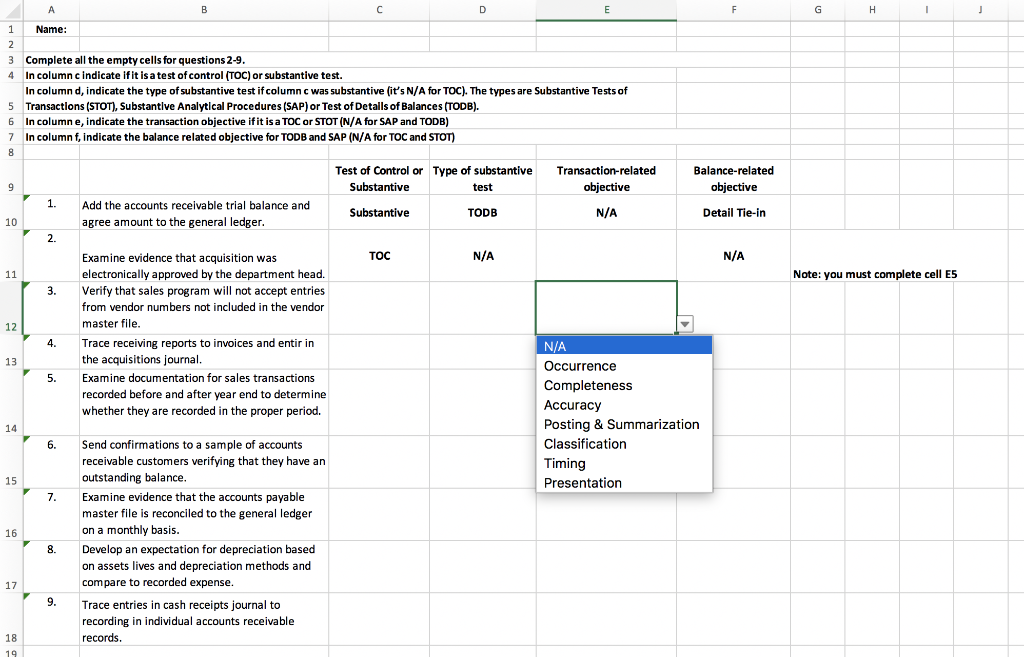

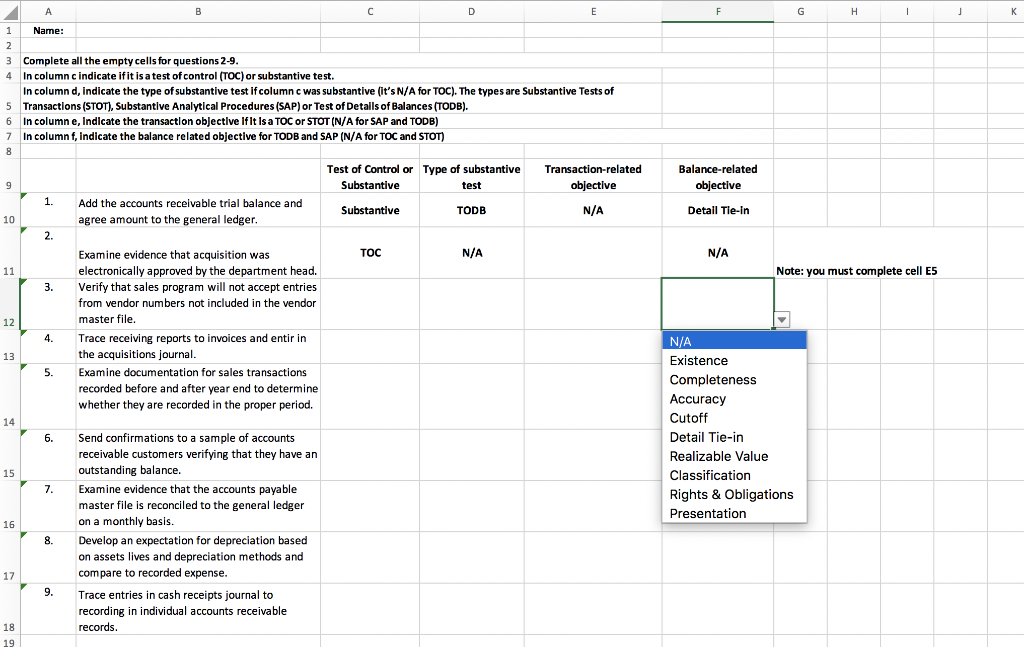

Question: Please answer all available drop down menus for questions 1-9. A B D E F G H 1 j K Balance-related objective Detail Tie-in N/A

Please answer all available drop down menus for questions 1-9.

A B D E F G H 1 j K Balance-related objective Detail Tie-in N/A Note: you must complete cell ES : 1 Name: 2 3 Complete all the empty cells for questions 2-9. 4 In column c indicate if it is a test of control (TOC) or substantive test. In columnd, indicate the type of substantive test if column c was substantive (it's N/A for TOC). The types are Substantive Tests of 5 Transactions (STOT), Substantive Analytical Procedures (SAP) or Test of Details of Balances (TODB). 6 In column e, indicate the transaction objective if it is a TOC or STOT (N/A for SAP and TODB) 7 In column f, indicate the balance related objective for TODB and SAP (N/A for TOC and STOT) 8 Test of Control or Type of substantive Transaction-related 9 Substantive test objective 1. Add the accounts receivable trial balance and Substantive TODB N/A 10 agree amount to the general ledger. 2. Examine evidence that acquisition was TOC N/A 11 electronically approved by the department head. 3. Verify that sales program will not accept entries from vendor numbers not included in the vendor 12 master file. 4. Trace receiving reports to invoices and entir in TOC 13 the acquisitions journal. Substantive 5. Examine documentation for sales transactions recorded before and after year end to determine whether they are recorded in the proper period. 14 6. Send confirmations to a sample of accounts receivable customers verifying that they have an 15 outstanding balance. 7. Examine evidence that the accounts payable master file is reconciled to the general ledger 16 on a monthly basis. 8. Develop an expectation for depreciation based on assets lives and depreciation methods and 17 compare to recorded expense. 9. Trace entries in cash receipts journal to recording in individual accounts receivable 18 records. 19 B D E F G H Balance-related objective = Detail Tie-in N/A Note: you must complete cell E5 1 Name: 2 2 Complete all the empty cells for questions 2-9. 4 In column c indicate ifit is a test of control (TOC) or substantive test. In columnd, indicate the type of substantive test if column c was substantive (it's N/A for TOC). The types are Substantive Tests of 5 Transactions (STOT), Substantive Analytical Procedures (SAP) or Test of Details of Balances (TODB). 6 In column e, indicate the transaction objective if it is a TOC or STOT (N/A for SAP and TODB) 7 In column f, indicate the balance related objective for TODB and SAP (N/A for TOC and STOT) 8 8 Test of Control or Type of substantive Transaction-related 9 Substantive test objective 1. Add the accounts receivable trial balance and Substantive TODB N/A 10 agree amount to the general ledger. 2. Examine evidence that acquisition was TOC N/A 11 electronically approved by the department head. 3. Verify that sales program will not accept entries from vendor numbers not included in the vendor 12 master file. 4. Trace receiving reports to invoices and entir in N/A 13 the acquisitions journal. STOT 5. Examine documentation for sales transactions SAP recorded before and after year end to determine TODB whether they are recorded in the proper period. 14 6. Send confirmations to a sample of accounts receivable customers verifying that they have an 15 outstanding balance. . 7. Examine evidence that the accounts payable master file is reconciled to the general ledger 16 on a monthly basis. 8. Develop an expectation for depreciation based on assets lives and depreciation methods and 17 compare to recorded expense. 9. Trace entries in cash receipts journal to recording in individual accounts receivable 18 records. 19 A B D E F G H 1 j 9 10 Note: you must complete cell E5 1 Name: 2 3 Complete all the empty cells for questions 2-9. 4 In column c indicate if it is a test of control (TOC) or substantive test. In column d, indicate the type of substantive test if column c was substantive (it's N/A for TOC). The types are Substantive Tests of 5 Transactions (STOT), Substantive Analytical Procedures (SAP) or Test of Details of Balances (TODB). 6 In columne, indicate the transaction objective if it is a TOC or STOT (N/A for SAP and TODB) 7 In column f, indicate the balance related objective for TODB and SAP (N/A for TOC and STOT) 8 Test of Control or Type of substantive Transaction-related Balance-related Substantive test objective objective 1. Add the accounts receivable trial balance and Substantive TODB N/A Detail Tie-in agree amount to the general ledger. 2. Examine evidence that acquisition was TOC N/A N/A 11 electronically approved by the department head. 3. Verify that sales program will not accept entries from vendor numbers not included in the vendor 12 master file. 4. Trace receiving reports to invoices and entir in N/A 13 the acquisitions journal. Occurrence 5. Examine documentation for sales transactions Completeness recorded before and after year end to determine whether they are recorded in the proper period. Accuracy 14 Posting & Summarization 6. Send confirmations to a sample of accounts Classification receivable customers verifying that they have an Timing 15 outstanding balance. Presentation 7. Examine evidence that the accounts payable master file is reconciled to the general ledger 16 on a monthly basis. 8. Develop an expectation for depreciation based on assets lives and depreciation methods and 17 compare to recorded expense. 9. Trace entries in cash receipts journal to recording in individual accounts receivable 18 records. 19 A B D E F G H 1 j K Balance-related objective Detail Tie-in N/A Note: you must complete cell E5 master file. 1 Name: 2 2 3 Complete all the empty cells for questions 2-9. 4 In column c indicate if it is a test of control (TOC) or substantive test. In column d, indicate the type of substantive test if column c was substantive (it's N/A for TOC). The types are Substantive Tests of Transactions (STOT), Substantive Analytical Procedures (SAP) or Test of Details of Balances (TODB). 6 in column e, indicate the transaction objective if it is a TOC or STOT (N/A for SAP and TODB) 7 In column f, indicate the balance related objective for TODB and SAP (N/A for TOC and STOT) 8 Test of Control or Type of substantive Transaction-related 9 Substantive test objective 1. Add the accounts receivable trial balance and Substantive TODB N/A / 10 agree amount to the general ledger, 2. Examine evidence that acquisition was TOC N/A 11 electronically approved by the department head. 3. Verify that sales program will not accept entries from vendor numbers not included in the vendor 12 4. Trace receiving reports to invoices and entir in 13 the acquisitions journal. 5. Examine documentation for sales transactions recorded before and after year end to determine whether they are recorded in the proper period. 14 6. Send confirmations to a sample of accounts receivable customers verifying that they have an 15 outstanding balance. 7. Examine evidence that the accounts payable master file is reconciled to the general ledger 16 on a monthly basis. 8. Develop an expectation for depreciation based on assets lives and depreciation methods and 17 compare to recorded expense. 9. Trace entries in cash receipts journal to recording in individual accounts receivable 18 records. 19 N/A Existence Completeness Accuracy Cutoff Detail Tie-in Realizable Value Classification Rights & Obligations Presentation A B D E F G H 1 j K Balance-related objective Detail Tie-in N/A Note: you must complete cell ES : 1 Name: 2 3 Complete all the empty cells for questions 2-9. 4 In column c indicate if it is a test of control (TOC) or substantive test. In columnd, indicate the type of substantive test if column c was substantive (it's N/A for TOC). The types are Substantive Tests of 5 Transactions (STOT), Substantive Analytical Procedures (SAP) or Test of Details of Balances (TODB). 6 In column e, indicate the transaction objective if it is a TOC or STOT (N/A for SAP and TODB) 7 In column f, indicate the balance related objective for TODB and SAP (N/A for TOC and STOT) 8 Test of Control or Type of substantive Transaction-related 9 Substantive test objective 1. Add the accounts receivable trial balance and Substantive TODB N/A 10 agree amount to the general ledger. 2. Examine evidence that acquisition was TOC N/A 11 electronically approved by the department head. 3. Verify that sales program will not accept entries from vendor numbers not included in the vendor 12 master file. 4. Trace receiving reports to invoices and entir in TOC 13 the acquisitions journal. Substantive 5. Examine documentation for sales transactions recorded before and after year end to determine whether they are recorded in the proper period. 14 6. Send confirmations to a sample of accounts receivable customers verifying that they have an 15 outstanding balance. 7. Examine evidence that the accounts payable master file is reconciled to the general ledger 16 on a monthly basis. 8. Develop an expectation for depreciation based on assets lives and depreciation methods and 17 compare to recorded expense. 9. Trace entries in cash receipts journal to recording in individual accounts receivable 18 records. 19 B D E F G H Balance-related objective = Detail Tie-in N/A Note: you must complete cell E5 1 Name: 2 2 Complete all the empty cells for questions 2-9. 4 In column c indicate ifit is a test of control (TOC) or substantive test. In columnd, indicate the type of substantive test if column c was substantive (it's N/A for TOC). The types are Substantive Tests of 5 Transactions (STOT), Substantive Analytical Procedures (SAP) or Test of Details of Balances (TODB). 6 In column e, indicate the transaction objective if it is a TOC or STOT (N/A for SAP and TODB) 7 In column f, indicate the balance related objective for TODB and SAP (N/A for TOC and STOT) 8 8 Test of Control or Type of substantive Transaction-related 9 Substantive test objective 1. Add the accounts receivable trial balance and Substantive TODB N/A 10 agree amount to the general ledger. 2. Examine evidence that acquisition was TOC N/A 11 electronically approved by the department head. 3. Verify that sales program will not accept entries from vendor numbers not included in the vendor 12 master file. 4. Trace receiving reports to invoices and entir in N/A 13 the acquisitions journal. STOT 5. Examine documentation for sales transactions SAP recorded before and after year end to determine TODB whether they are recorded in the proper period. 14 6. Send confirmations to a sample of accounts receivable customers verifying that they have an 15 outstanding balance. . 7. Examine evidence that the accounts payable master file is reconciled to the general ledger 16 on a monthly basis. 8. Develop an expectation for depreciation based on assets lives and depreciation methods and 17 compare to recorded expense. 9. Trace entries in cash receipts journal to recording in individual accounts receivable 18 records. 19 A B D E F G H 1 j 9 10 Note: you must complete cell E5 1 Name: 2 3 Complete all the empty cells for questions 2-9. 4 In column c indicate if it is a test of control (TOC) or substantive test. In column d, indicate the type of substantive test if column c was substantive (it's N/A for TOC). The types are Substantive Tests of 5 Transactions (STOT), Substantive Analytical Procedures (SAP) or Test of Details of Balances (TODB). 6 In columne, indicate the transaction objective if it is a TOC or STOT (N/A for SAP and TODB) 7 In column f, indicate the balance related objective for TODB and SAP (N/A for TOC and STOT) 8 Test of Control or Type of substantive Transaction-related Balance-related Substantive test objective objective 1. Add the accounts receivable trial balance and Substantive TODB N/A Detail Tie-in agree amount to the general ledger. 2. Examine evidence that acquisition was TOC N/A N/A 11 electronically approved by the department head. 3. Verify that sales program will not accept entries from vendor numbers not included in the vendor 12 master file. 4. Trace receiving reports to invoices and entir in N/A 13 the acquisitions journal. Occurrence 5. Examine documentation for sales transactions Completeness recorded before and after year end to determine whether they are recorded in the proper period. Accuracy 14 Posting & Summarization 6. Send confirmations to a sample of accounts Classification receivable customers verifying that they have an Timing 15 outstanding balance. Presentation 7. Examine evidence that the accounts payable master file is reconciled to the general ledger 16 on a monthly basis. 8. Develop an expectation for depreciation based on assets lives and depreciation methods and 17 compare to recorded expense. 9. Trace entries in cash receipts journal to recording in individual accounts receivable 18 records. 19 A B D E F G H 1 j K Balance-related objective Detail Tie-in N/A Note: you must complete cell E5 master file. 1 Name: 2 2 3 Complete all the empty cells for questions 2-9. 4 In column c indicate if it is a test of control (TOC) or substantive test. In column d, indicate the type of substantive test if column c was substantive (it's N/A for TOC). The types are Substantive Tests of Transactions (STOT), Substantive Analytical Procedures (SAP) or Test of Details of Balances (TODB). 6 in column e, indicate the transaction objective if it is a TOC or STOT (N/A for SAP and TODB) 7 In column f, indicate the balance related objective for TODB and SAP (N/A for TOC and STOT) 8 Test of Control or Type of substantive Transaction-related 9 Substantive test objective 1. Add the accounts receivable trial balance and Substantive TODB N/A / 10 agree amount to the general ledger, 2. Examine evidence that acquisition was TOC N/A 11 electronically approved by the department head. 3. Verify that sales program will not accept entries from vendor numbers not included in the vendor 12 4. Trace receiving reports to invoices and entir in 13 the acquisitions journal. 5. Examine documentation for sales transactions recorded before and after year end to determine whether they are recorded in the proper period. 14 6. Send confirmations to a sample of accounts receivable customers verifying that they have an 15 outstanding balance. 7. Examine evidence that the accounts payable master file is reconciled to the general ledger 16 on a monthly basis. 8. Develop an expectation for depreciation based on assets lives and depreciation methods and 17 compare to recorded expense. 9. Trace entries in cash receipts journal to recording in individual accounts receivable 18 records. 19 N/A Existence Completeness Accuracy Cutoff Detail Tie-in Realizable Value Classification Rights & Obligations Presentation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts