Question: Please answer all below. take your time Required Information [The following information applies to the questions displayed below] Renee operates a proptletorship selling collectibles over

![information applies to the questions displayed below] Renee operates a proptletorship selling](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66e2f56540584_98866e2f564cbad6.jpg)

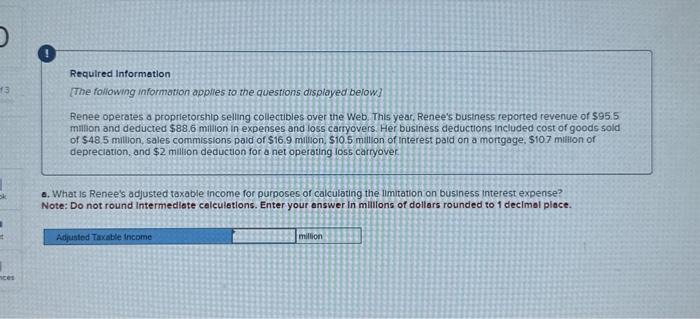

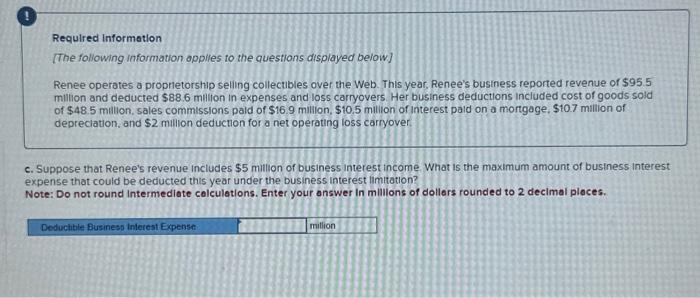

Required Information [The following information applies to the questions displayed below] Renee operates a proptletorship selling collectibles over the Web. This year, Renee's business reported revenue of $95.5. milion and deducted $88.6 milion in expenses and loss cartyovers. Her business deductions included cost of goods sold of $48.5 million, sales commissions pald of $16.9 mition. $10.5 million of interest patd on a mortgage, $107 miltion of depreciation, and $2 million deduction for a net operating loss carryover Q. What is Renee's adjusted taxable income for purposes of calculating the limitation on business interest expense? Note: Do not round intermediate celculetions. Enter your enswer in millions of dollors rounded to 1 decimal place. Required information The foliowing information applies to the questions displayed below] Renee operates a proprietorship seling collectibles over the Web. This year, Renee's business reported revenue of $95.5 million and deducted $88.6 million in expenses and loss carryovers. Her business deductions included cost of goods soid. of $48.5 mition, sales commissions pald of $16.9 mition, $10.5 mition of interest paid on a mortgage, $107 milion of depreciation, and $2 million deduction for a net operating loss carryover. Required: b-1. What is the moximum amount of business interest expense thot Renee can deduct this year? b-2. How is the disallowed interest expense (ff any) treated? Interest disallowed would be: Complete this question by entering your answers in the tabs below. What is the maximum amount of business interest expense that Renee can deduct this year? What is the maximum amount of business interest expense that Reree can deduct this yearl Note: Do not round intermediate calculations. Enter your answer in millions of dollars rounded to 2 decimal places. Required Information [The following information opplies to the questions displayed below] Renee operates a proprietorship seling collectibles over the Web. This year. Renee's business reported revenue or $95.5 miltion and deducted $88.6 milition in expenses and loss carryovers. Her business deductions included cost of goods sold of $48.5 million, sales commissions pald of $16.9 million, $10.5 milition of interest paid on a mortgage, $10.7 million of depreciation, and $2 million deduction for a net operating loss carryover. c. Suppose that Renee's revenue includes $5 million of business interest income. What is the maximum amount of business interest expense that could be deducted this year under the business interest limitation? Note: Do not round Intermedlate colculations. Enter your onswer in mililons of dollers rounded to 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

To solve these questions well start by calculating the adjusted taxable income ATI and then determine the limitations on business interest expense a A... View full answer

Get step-by-step solutions from verified subject matter experts