Question: PLEASE ANSWER ALL BOXES FOR THUMBS UP! smaller boxes say add/less Bramble Entertainment Corporation prepared a master budget for the month of November that was

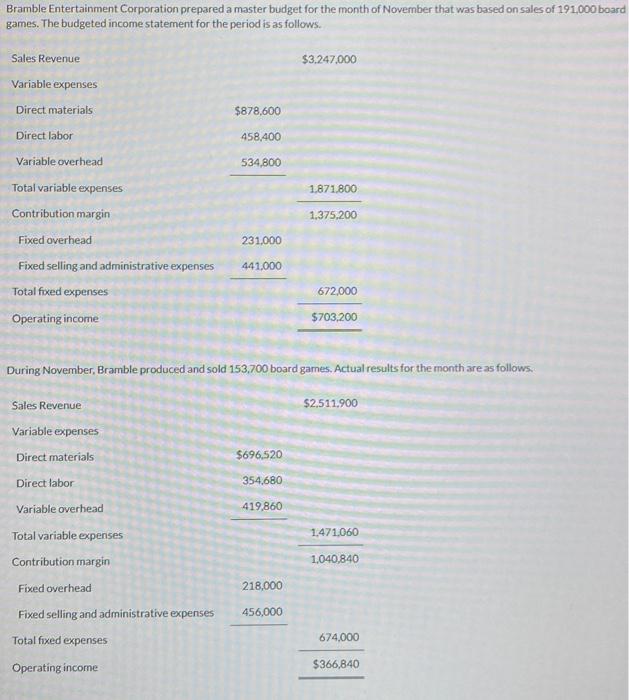

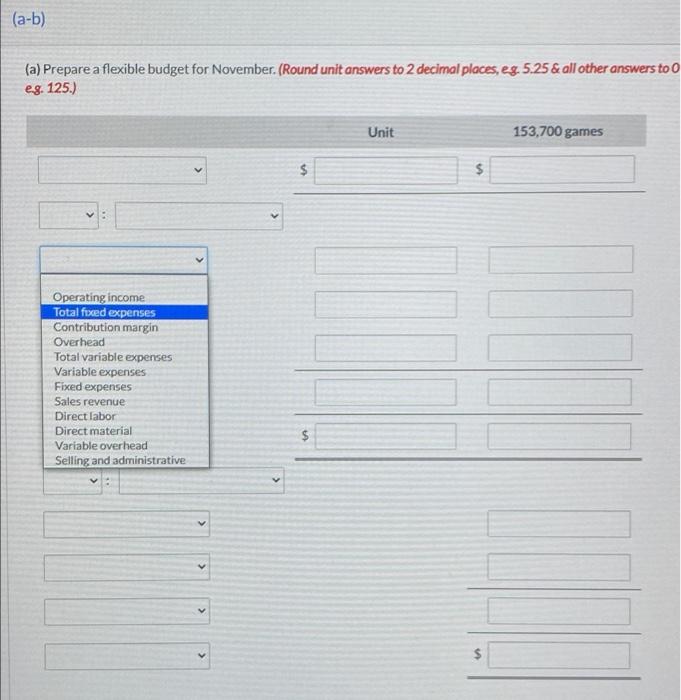

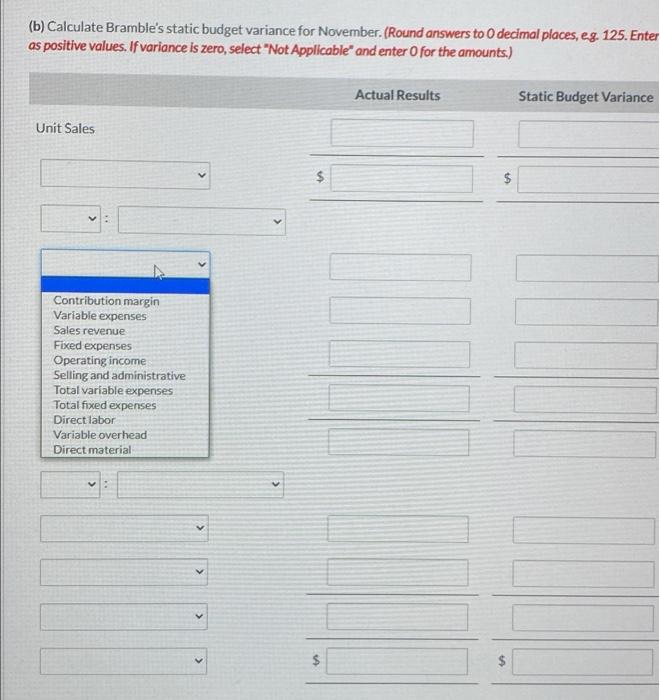

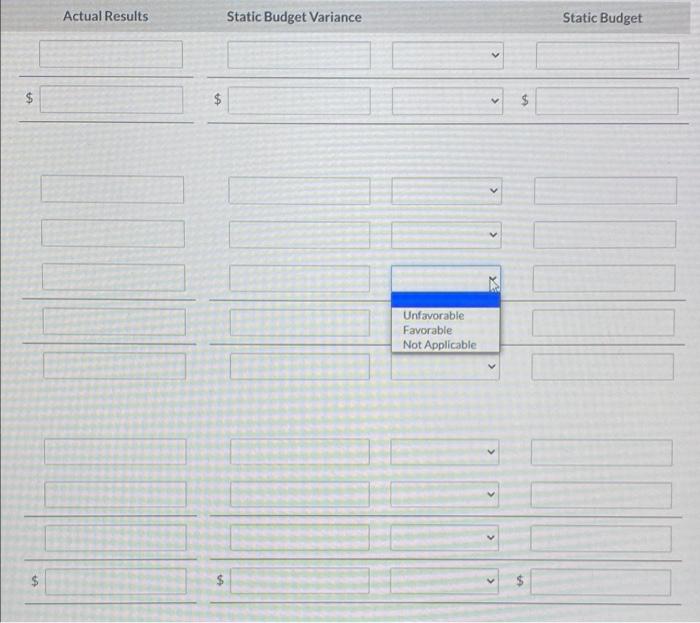

Bramble Entertainment Corporation prepared a master budget for the month of November that was based on sales of 191,000 board games. The budgeted income statement for the period is as follows. Sales Revenue $3,247,000 Variable expenses Direct materials $878,600 Direct labor 458,400 Variable overhead 534,800 Total variable expenses 1,871,800 Contribution margin 1.375,200 Fixed overhead 231,000 Fixed selling and administrative expenses 441,000 Total fixed expenses 672,000 Operating income $703,200 During November, Bramble produced and sold 153,700 board games. Actual results for the month are as follows. Sales Revenue $2,511.900 Variable expenses Direct materials $696,520 Direct labor 354,680 Variable overhead 419,860 Total variable expenses 1,471,060 Contribution margin 1,040,840 Fixed overhead 218,000 Fixed selling and administrative expenses 456,000 Total fixed expenses 674,000 Operating income $366,840 (a-b) (a) Prepare a flexible budget for November. (Round unit answers to 2 decimal places, eg. 5.25 & all other answers to 0 eg. 125.) Unit 153,700 games $ Operating income Total fixed expenses Contribution margin Overhead Total variable expenses Variable expenses Fixed expenses Sales revenue Direct labor Direct material $ Variable overhead Selling and administrative $ S TI (b) Calculate Bramble's static budget variance for November. (Round answers to 0 decimal places, eg. 125. Enter as positive values. If variance is zero, select "Not Applicable" and enter O for the amounts.) Actual Results Static Budget Variance Unit Sales V: Contribution margin Variable expenses Sales revenue Fixed expenses Operating income Selling and administrative Total variable expenses Total fixed expenses Direct labor Variable overhead Direct material v V V $ $ NI $ S $ Actual Results $4 Static Budget Variance Unfavorable Favorable Not Applicable > X $ Static Budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts