Question: Please answer all boxes with 0's and red x's next to them, and go by the 2019 tax rate schedules which i shared above please.

Please answer all boxes with 0's and red x's next to them, and go by the 2019 tax rate schedules which i shared above please.

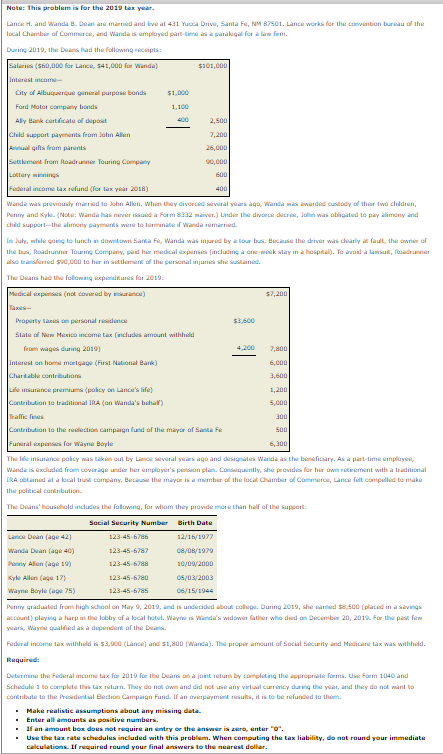

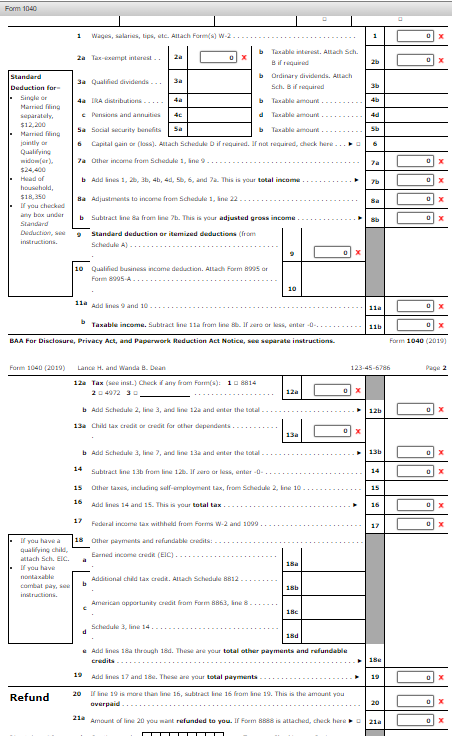

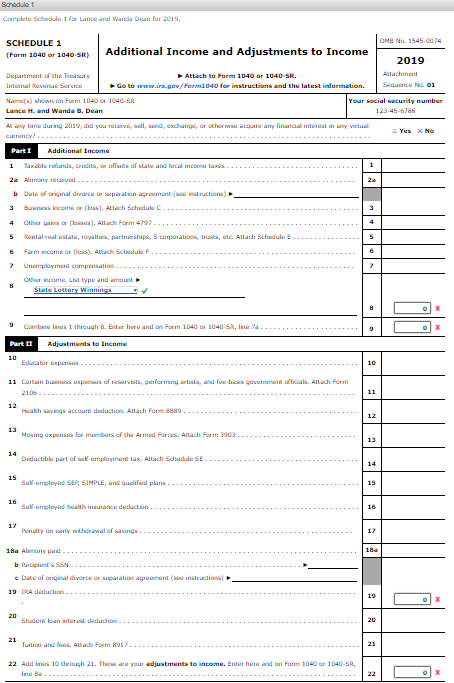

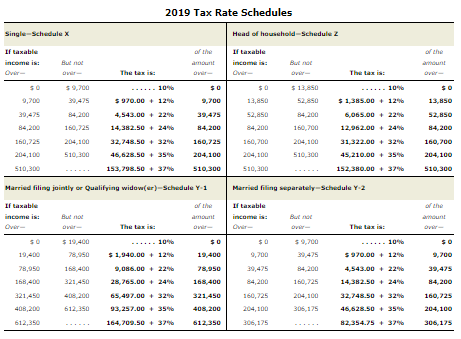

Note: This problem is for the 2019 tax year. Lance Hand Wanda B. Dean are married and live al 431 Yucca Drive, Santa Fe, NM 87501. Lance works for the convention bureau of the local Chamber of Commerce, and Wanda is employed part-time a paralegal for allem During 2019, the Dead had the following recept: Salaries ($60,000 for Lance, 541,000 for Wanda) $101,000 Interest income City of Albuquerque general purpose bonds $1.000 Ford Motor Company bonds 1,100 Ally Bank caricate of dupout 2,500 Child Support pants from John Allen 7,200 al gifts from parents 26,000 Settle from Road Touring Company 90,000 Lory wings 6001 Federal income tax refund (for tax year 2018) 400 Wanda was previously maradt John Allen. When they divorced several years ago, Wanda is awarded custody of their two children, Panny and Kyle. (Note: Wanda has ever issued a form 8322 miver. Under the dividere, Job was obligated to pay alimely and child Support the alimenty payments were to Linate if Wanda remarried. In July, while going to lunch in den Santa Fe, Wanda was injured by a tour bus. Because the driver was clearly at fault, the owner of the bus, Roadrurier Touring Company, paid he medical experts including a new lay in a hospital). To avoid a lawsuit, Roadrunner also transferred $20,000 to her in settlement of the personal injuries she sustained. The Deans had the following expenditures for 2019 Medical expenses (nettvered by its) $7,200 Tax Property tax on personal residence $3,600 State of New Mexico income tax (includes amount withheld from wages during 2019) 4,200 7,800 Interest on home moulage (First National Bank) 6,000 Charitable contribution 3,600 Life insurance premium (policy on Lance's life) Contribution to traditional IRA (on Wanda's behalf) Tallines 300 Contribution to the reaction campaign fund of the mayor of Santa Fe 500 Funeral experies for Wayne Boyle The life insurance policy was taken out by Laivalyas ago and designates Wanda as the beneficiary. As a part-time employee Wanda is excluded from coverage under her employer's pension plan. Coquently, she provides for her woment with a traditional TRA obtained at a local trail company. Because the mayor is a member of the local Chamber of Commerce, Lance at compelled to make the political contribution The Deans' hosthold includes the following for whom they provide more than half of the support: Social Security Number Birth Date Lance Dean (age 42) 123-45-6786 12/16/1077 Wanda Dean (age 40) 123.45-6787 08/08/1070 Pily Allen (age 19 123.45-6788 10/09/2000 Kyle Allen (age 17) 123.45-6780 OS/03/2003 Wayne Boyle (age 75) 123.45-6785 06/15/1944 Panny graduated from high school on May 2, 2019, and is undecided about college. During 2019, she wanted $8.500 (placed in a savings account) playing a harp in the lobby of a local hotel. Wayne is Wanda's widower father who died on December 20, 2019. For the past few years, Wayne Galled as a dipendent of the Dead Federal income tax withheld is $3,900 (Lance) and 51,800 (Wanda). The proper amount of Social Security and Medicare lax was withheld. Required: Dutermine the Federal income tax for 2019 for the Dean on a joint return by completing the appropriate forms. Use Form 1040 and Schedule to complete this tax return. They do not own and did not use any virtual currency during the year, and they do not want to contribute to the Presidential Bedtion Campaign Fund. If an payment results, it is to be refunded to the Make realistic assumptions about any missing data. . Enter all amounts as positive numbers. . If an amount box does not require an entry or the answer is zero, enter "o". . Use the tax rate schedules included with this problem. When computing the tax liability, do not round your immediate calculations. If required round your final answers to the nearest dollar. 1,200 5.000 6,300 Form 1040 1 Wage salaris, lips, etc. Allach Form) W-2. 1 2a Tax-exemplinterest.. 2a 0 Taxable in Altach Sch. Bil required Ordinary dividends. Altach Sch. Bifrequired b 3a Qualified dividends... 3a 4a TRA dibutions..... Taxation 4b Standard Deduction for Single or Married fing separately $12.200 Married fling Pensions and annu 4c Taxable amount Sb Sa Social Security benefits Taxable amount 6 Capital gain (less). Allach Schedule D if required. If not required, chick here 7a Other income from Schedule 1, line.. Qualifying widower), Ta 0 7b O Add lines 1, 2, 3, 46, 4, 5, 6, and 72. This is your total income Be Adjustments to income from Schedule 1, line 22 0 X Header hold $16.50 If you checked ay box under Standard Lotualian, instructions 0 Subtract linea from line 7h. This is your adjusted gross income Standard deduction or itemized deductions (from Sched A) 10 Qualified business income deduction. Altach Form 8995 or Form8995- 10 110 Add 9 and 10 11a b Taxable income. Subtract line 11a from line. If ro or kiss, enter-O-.. 116 0 X BAA For Disclosure, Privacy Act, and Paperwork Reduction Act Notice, se separate instructions. Form 1040 (2019) Form 1040 (2019) 123.45-6785 Page 2 12a Land and Wanda B. Den 122 Tax (soins.) Check any from Fam(s): 1. 814 24972 30 Add Schedule 2, line 3, and line 122 and enter the total 132 Child tax credit de credit for other dependents 12 13b 0 14 D X 15 16 0 17 0 Add Schedule 3, line 7, and line 13 and enter the total 14 Subtract bine sa from 12 rorless, enter- 15 Others, including sd-mployment tax, from Schedule 2. ine 10 16 Add lines 14 and 15. This is your total tax 17 Federal income tax withheld from Form W-2 and 1099 18 Other payments and refundable credits: qualifying child allach Sch. EIC. Earned income credit (EIC)... 18a If you have naxable Additional child lax credit. Allah Schedule 8812 al pl. E 18 indructions. American opportunity credit from Form 8863, line 8. 18 Schedule 3. line 14.. Add lines 18a through 18d. There are your total other payments and refundable Credits 18 19 Addnes 17 and 18. There your total payments 19 Refund 20 20 If line 19 is more than line 16, subtract line 16 from line 19. This is the amount you overpaid 212 Amount of line 20 you want refunded to you. If Form BBS is attached, chick here 21a Schedule 1 Complete Schedule 1 for Lance and Wanda Dean for 2019. SCHEDULE 1 OMB No 1545-0074 (Form 1040 or 1040 SR) Additional Income and Adjustments to Income 2019 Department of the Treasury Attach to Form 1040 or 1040-SR. Allachment Intemal ve Service Go to www.irs.gov/Form1040 for instructions and the latest information. Sequence No. 01 Name() shown on Form 1040 or 1040-SR Your social security number Lance H. and Wanda B. Dean 123.45-6786 Alany time during 2019, did you receive, sel, sad, exchange, or other acquire any financial interest in any virtual Yes No Currency?... Part I Additional Income 1 Taxable refunds, Credits, or offsets of state and local inclus 2e Alimonly received 2 b Dale of original dire separation agreement ( struction) 3 Become foss). Allach Schedule Our (sas). Alth Form 4797 5 Rental real estate, royalti partnerships, corporation, truits, etc. Allach Schedule 6 Farm income or less). Altach Schedule F 7 Unemployment compensation Other income Lil type and amount B State Lottery Winnings 1 4 5 6 2 B 9 Combine lines through & Enter here and on Form 1040 1040-SR, linea Part 1 Adjustments to Income 10 Education 10 11 Certain business depends of reservas, performing artists, and fee-basis geven official. Altach Form 2106 11 12 Health Savings account deduction Allach Form 889. 12 13 Moving exp for members of the Armed Forces. Allah Form 3003 13 14 Deductible part of womployment la Altach Schedule SE.. 14 15 Self-employed SE, SIMPLE, and qualified plants. 15 16 Self-employed health insurance deduction 16 17 Punally on early withdrawal of wings 1 18 18a Alimony paid. b Recipes SSN Date of original divorce or separation agreement (sane instruction) 19 DRA deduction 19 20 Student loan interesa deduction 20 21 Tuition and foc. Allah Form 8917 21 22 Add line 10 through 21. These are your adjustments to income. Enter here and on Form 1040 or 1040-SR, na Ba 22 of the 13,BSO 52,850 84,200 2019 Tax Rate Schedules Single-Schedulex Head of household - Schedule z If taxable of the If taxable income is: Bulo! But noe The taxis The tax is: $ 9,700 10% $0 SO $ 13,850 .... 10% 9,700 39,475 $ 970.00 + 12% 2,700 13,850 52,850 $ 1,385.00+ 12 39,475 4,543.00 - 22 39,475 52,850 84 200 6,065.00 229 84,200 160,725 14,382.50 24% 84,200 84,200 150,700 12,962.00 + 24% 150,725 204,100 32,748.50 + 32% 160,725 160,200 204,100 31,322.00 + 32% 204,100 510,300 46,625.50 + 35% 204,100 204,100 510,300 45,210.00 + 35% $10,300 153,798.50 +374 510,300 510,200 152,380.00 + 37% Married filing jointly or Qualifying widow(er)-Schedule Y-1 Married filling separately Schedule Y-2 If taxable If taxable income is: Bule amount income is: But not Over The tax is: The tax is: 50 $ 19,400 10% $0 $0 $ 9,700 10% 19,400 $ 1.940.00 + 12% 19,400 9,700 39,475 5 970.00 + 12% 78,950 168,400 9,086.00 229 78,950 39,475 84200 4,543.00 + 22 158,400 321,450 28,765.00 + 24% 168,400 84,200 160,725 14,382.50 + 24% 221,450 468,200 65,497.00 + 329 321,450 160,725 204,100 32,748.50 + 32% 408,200 612,350 93,257.00 + 35% 408,200 204,100 305,175 46,628.50 + 35% 612,350 164,709.50 + 37% 612,350 306,125 82,354.75 + 37% 160,700 204,100 510,300 of the 9,700 39,475 84,200 160,725 204,100 306,175

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts