Question: please answer all. Case 2 (50 marks) Suppose a private bank client has US$1,000,000 to investment. Advise the client on a derivatives strategy that take

please answer all.

please answer all.

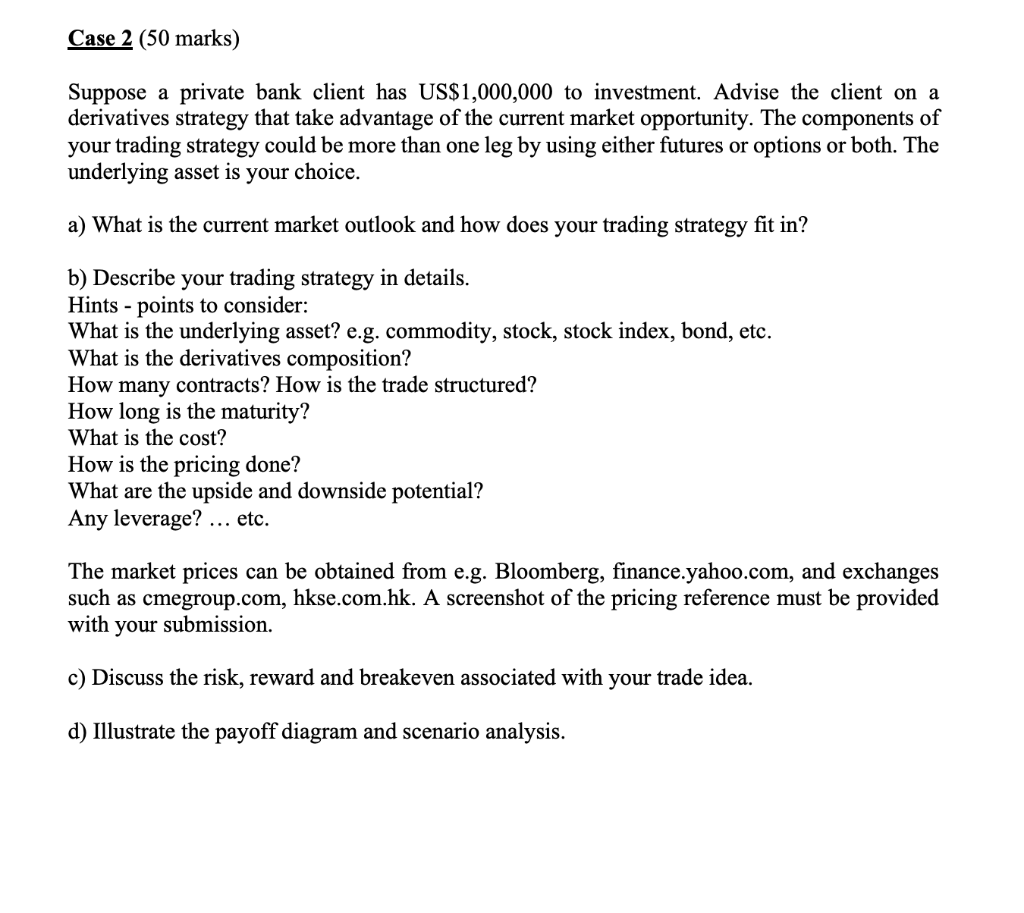

Case 2 (50 marks) Suppose a private bank client has US$1,000,000 to investment. Advise the client on a derivatives strategy that take advantage of the current market opportunity. The components of your trading strategy could be more than one leg by using either futures or options or both. The underlying asset is your choice. a) What is the current market outlook and how does your trading strategy fit in? b) Describe your trading strategy in details. Hints - points to consider: What is the underlying asset? e.g. commodity, stock, stock index, bond, etc. What is the derivatives composition? How many contracts? How is the trade structured? How long is the maturity? What is the cost? How is the pricing done? What are the upside and downside potential? Any leverage? ... etc. The market prices can be obtained from e.g. Bloomberg, finance.yahoo.com, and exchanges such as cmegroup.com, hkse.com.hk. A screenshot of the pricing reference must be provided with your submission. c) Discuss the risk, reward and breakeven associated with your trade idea. d) Illustrate the payoff diagram and scenario analysis. Case 2 (50 marks) Suppose a private bank client has US$1,000,000 to investment. Advise the client on a derivatives strategy that take advantage of the current market opportunity. The components of your trading strategy could be more than one leg by using either futures or options or both. The underlying asset is your choice. a) What is the current market outlook and how does your trading strategy fit in? b) Describe your trading strategy in details. Hints - points to consider: What is the underlying asset? e.g. commodity, stock, stock index, bond, etc. What is the derivatives composition? How many contracts? How is the trade structured? How long is the maturity? What is the cost? How is the pricing done? What are the upside and downside potential? Any leverage? ... etc. The market prices can be obtained from e.g. Bloomberg, finance.yahoo.com, and exchanges such as cmegroup.com, hkse.com.hk. A screenshot of the pricing reference must be provided with your submission. c) Discuss the risk, reward and breakeven associated with your trade idea. d) Illustrate the payoff diagram and scenario analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts