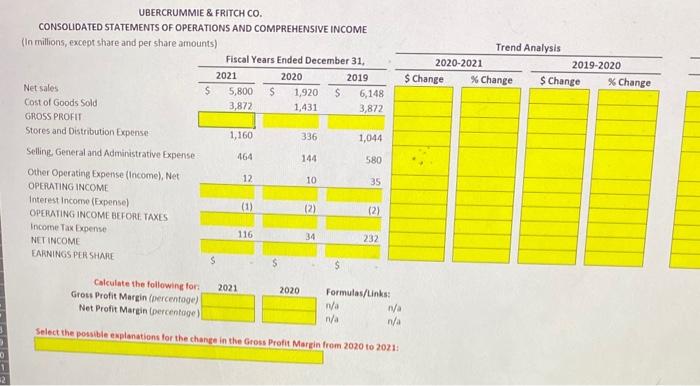

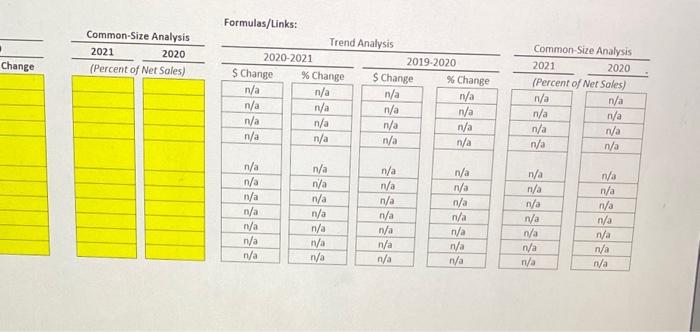

Question: please answer all cells in yellow. the first two pictures are the income statement. it wouldnt all fit into one pic without beinf blurry. second

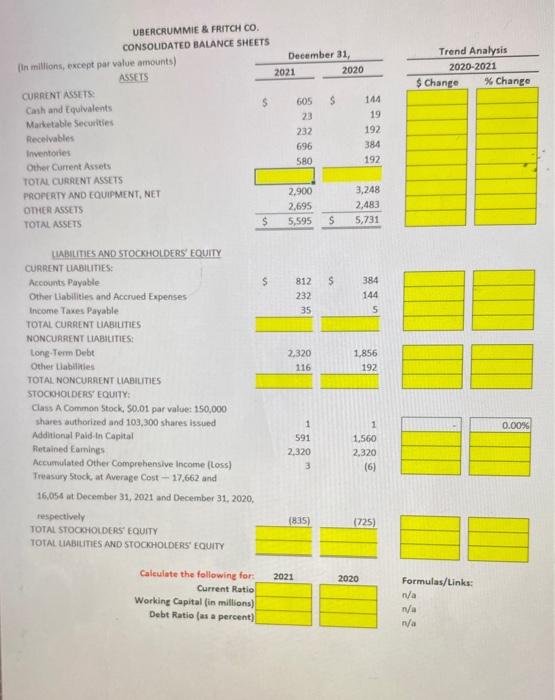

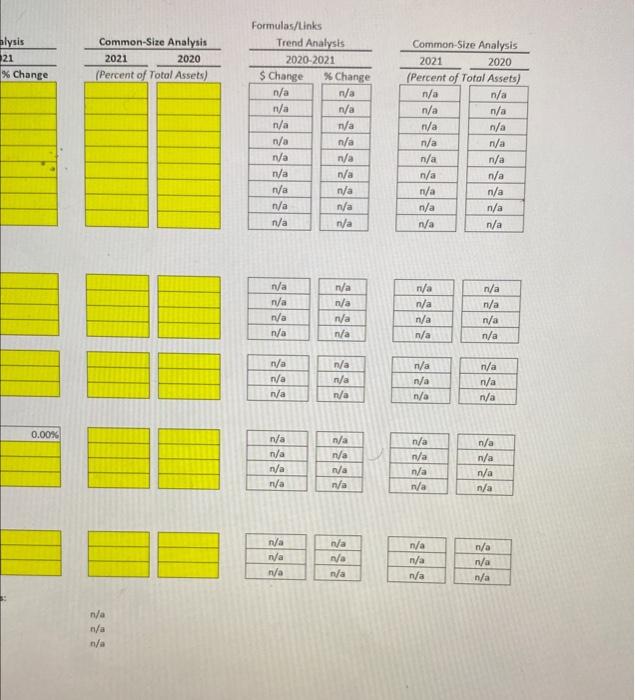

UBERCRUMMIE \& FRITCH CO. CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (In millions, exceot share and per share amounts) Select the possible explanations for the change in the Gross Profit Margin from 2020 to 2021: Frirmalae ft take. UBERCRUMMIE \& FRITCH CO. UABMITIES AND STOCKHOLDERS EQUITY CURRENT UABULINES: Accounts Payable Other tiabilities and Accrued Expenses Income Taxes Payable TOTAL CURRENT UABUIUES NONCUARENT LABIUTIES: tone-Tem Debt Other Llabilities TOTAL NONCURRENT LABILTIES STOCHHOLDERS' EQUITY: Class A Common Stock, 50.01 par value: 150,000 shares authorized and 103,300 shares issued Additional Paids in Capital flotained Eamines Accumulated Other Comprehensive income (loss) Treasury Stock, at Average Cost 17,662 and 16,054 at December 31, 2021 and December 31, 2020, Caleulate the following for: 2021 Current Ratio Working Capital (in millions) Debt Ratio (as a persent) \begin{tabular}{|l|l} \multicolumn{1}{|c|}{2020} & Formulas/Links: \\ n/a \\ N/a \\ n/a \end{tabular} Formulas/Links \begin{tabular}{l} \hline Common-5 \\ \hline 2021 \\ \hline( Percent of \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|l||l|} \hlinen/a & n/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|l|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|l|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hline n/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|l|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} n/an/an/a UBERCRUMMIE \& FRITCH CO. CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (In millions, exceot share and per share amounts) Select the possible explanations for the change in the Gross Profit Margin from 2020 to 2021: Frirmalae ft take. UBERCRUMMIE \& FRITCH CO. UABMITIES AND STOCKHOLDERS EQUITY CURRENT UABULINES: Accounts Payable Other tiabilities and Accrued Expenses Income Taxes Payable TOTAL CURRENT UABUIUES NONCUARENT LABIUTIES: tone-Tem Debt Other Llabilities TOTAL NONCURRENT LABILTIES STOCHHOLDERS' EQUITY: Class A Common Stock, 50.01 par value: 150,000 shares authorized and 103,300 shares issued Additional Paids in Capital flotained Eamines Accumulated Other Comprehensive income (loss) Treasury Stock, at Average Cost 17,662 and 16,054 at December 31, 2021 and December 31, 2020, Caleulate the following for: 2021 Current Ratio Working Capital (in millions) Debt Ratio (as a persent) \begin{tabular}{|l|l} \multicolumn{1}{|c|}{2020} & Formulas/Links: \\ n/a \\ N/a \\ n/a \end{tabular} Formulas/Links \begin{tabular}{l} \hline Common-5 \\ \hline 2021 \\ \hline( Percent of \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|l||l|} \hlinen/a & n/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|l|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|l|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hline n/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|l|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} \begin{tabular}{|c|} \hlinen/a \\ \hlinen/a \\ \hlinen/a \\ \hline \end{tabular} n/an/an/a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts