Question: please answer all correctly for thumbs up thanks Jazz World Inc. is considering a project that has the following cash flow and WACC data. What

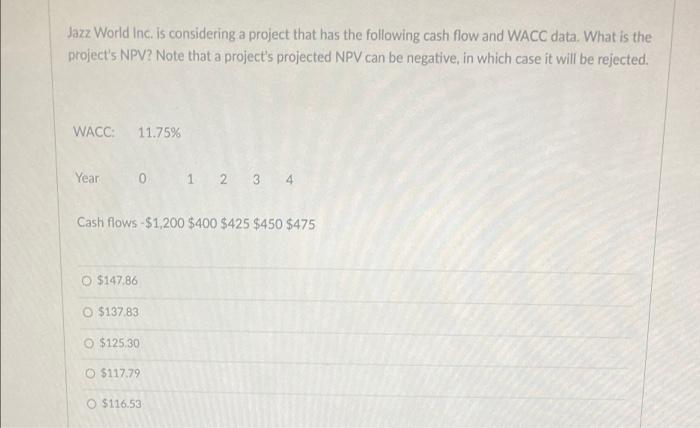

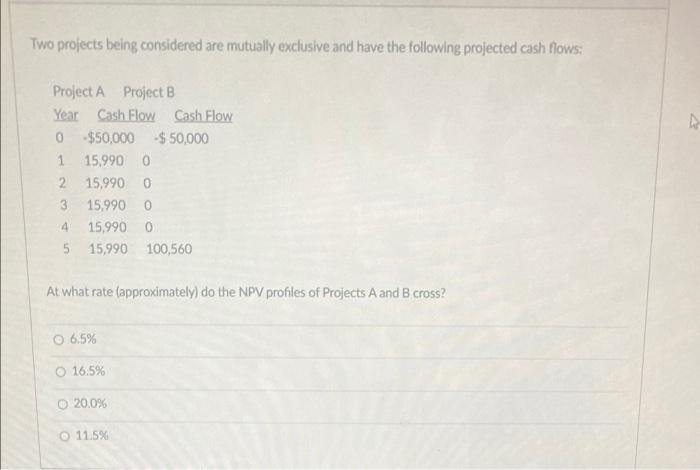

Jazz World Inc. is considering a project that has the following cash flow and WACC data. What is the project's NPV? Note that a project's projected NPV can be negative, in which case it will be rejected. WACC: 11.75% Year 0 1 2 3 4 Cash flows $1,200 $400 $425 $450 $475 $147.86 $137.83 $125,30 $117.79 $116.53 Two projects being considered are mutually exclusive and have the following projected cash flows: Project A Project B Year Cash Flow Cash Flow 0 $50,000 $ 50,000 15,990 0 2 15,990 0 3 15.990 0 4 15,990 0 5 15,990 100,560 At what rate (approximately) do the NPV profiles of Projects A and B cross? 6.5% 16.5% O 20.0% 11.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts